Greece, grease, grise grees, greze. You…

Greece, grease, grise grees, greze. You’re gonna hear a lot about Greece today. Here’s something I wrote on this very topic in Revolution Investing a few months ago, the last time people freaked out about Greece:

http://www.marketwatch.com/story/europe-troubles-again-2010-11-30

Europe troubles. Did you hear about them? Everybody I know on Wall Street is panicking over the fact that Ireland’s government can’t pay back all its loans. But should they be? I’ve been investing and trading for fifteen years and one of the biggest lessons I’ve learned over that time is: Ignore Europe.

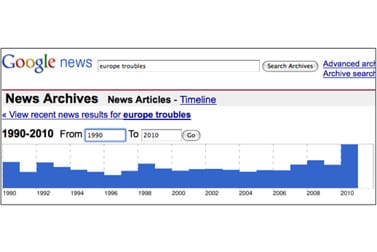

Unless you’re reading this from Dublin or Munich, I wouldn’t worry myself too much with Europe. How many times has the media panicked about “Europe Troubles” in the last 20 years ?

A lot of mainstream media over “Europe Troubles” in the last couple decades, huh? Has it ever made you money to sell when the worries about “Europe Troubles” peaks or when it troughs?

I’ve studied the chart above with stock index charts and we can’t find much correlation at all. But I’d still rather be a seller when the mainstream media’s reporting items such as this, appearing in The Irish Times last week:

Minister and priest say pray for economy

“CO WEXFORD priest has joined a Cabinet minister in calling for prayers for a successful outcome to the economic crisis.

“Minister for Social Protection Éamon Ó Cuív said prayers were needed because ‘not everything is in the control of the Government.’

“He told Highland Radio in Donegal that prayer is “very powerful.”

Let’s step back for more historical perspective, shall we? The markets are up hundreds of thousands of percentage points in the last 150 years even as the media has fretted over “Europe Troubles” every step of the way:

Will people in Ireland buy fewer iPads in 2011 and 2012 because their economy was blown up by their banks? Probably. But will Apple’s earnings still go up in 2011 and 2012 by 20-30% per year? Probably. So even as we’ve got a lot of macro-economic hedges in our Revolution Investing model portfolio, I’m not turning bearish because Ireland’s imploding in front of our eyes.

Let’s talk about this “fix” for Ireland, what they say is a bail out for the Irish government. Really the only people being bailed out are…wait for it…yup, the bankers. Big European, including German banks, along with US banks are getting another explicit multi-hundred billion dollar infusion of welfare to make up for the losses that they’d otherwise have to deal with for having (supposedly) risked their money on Irish bonds. We continue to live through a new system of wealth transference that is several orders of magnitude larger than anything this planet has ever seen.

The banks get more welfare and they’ll probably be able to continue their charade of extend-and-pretend that their not still insolvent with all the worthless loans and stupid investments they made during the bubble years. And they continue to avoid any prosecutions for the fraud they perpetrated on buyers of the mortgage securities they packaged. And now they are trying to avoid any prosecutions for the fraud they’re trying to perpetrate on the homeowners whose mortgages were fraudulently packaged and sold.

You’ll be hearing a lot more about robo-signers at these major banks whose job it was to literally forge signatures — sometimes 10s of thousands each. These robo-signers would sit in their offices and sign documents verifying the information and documentation of those individual mortgages. Only problem was that they often signed off as employees of institutions that they were not employees of. And other times they’d sign someone else’s name entirely — just faking it.

And see, the banks don’t seem to realize that they’re now dealing with individuals who have been defrauded, and not just taxpayers/systems that the banks have been defrauding. And now, they’re in trouble because these individuals aren’t giving up their homes to fraudulent mortgage holders/owners/servicers.

So we stay short the banks. And we stay long growth technology and other Revolution Investments that we constantly seek out.