And before I go, just 24 hours after you guys read…

The trading day just flew by today, as I was working on these silver and gold and other charts and analysis and getting that information out to you guys. Only the silver trades for me today.

It was N’s over Ss, meaning that the Nasdaq was stronger (in this case, even up on the day) relatively speaking than the S&P500 (which in this case, was down on the day). I’m hard at work on some potential new names both longs and shorts, and you guys will be the first to know if and when I pull any triggers on them.

And before I go, just 24 hours after you guys read the 1 billion iPad over the next five years projection that I wrote for you here on these pages, here’s some buzz about Apple and the incredible potential market for the iPad:

“Goldman Sachs analyst Bill Shope has a report out on Apple this morning that is very bullish,” Jay Yarow reports for The BusinessInsider.

“He met with COO Tim Cook, retail SVP Ron Johnson, and CFO Peter Oppenheimer,” Yarow reports. “Cook said, ‘he sees no reason why the tablet market shouldn’t eclipse the PC market over the next several years,’ according to Shope’s note. By ‘tablet’ we assume Cook means iPads.”

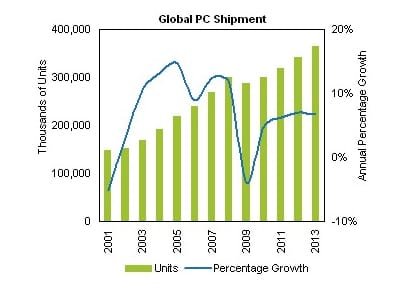

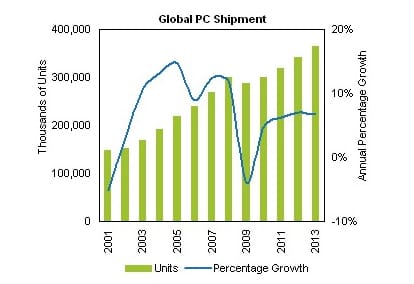

So before we part today, let’s do some reality checks on what seemed just yesterday were some wildly outrageous predictions I made about how Apple could sell a billion iPads over just the next few years. And how many PCs will be sold in a year?

Industry estimates are up near around 400 million PC units being sold in 2011. Assuming no growth in PC sales or even a slight decline in PC sales over the next five years as smartphones and tablets cannibalize some sales, that would mean that Apple’s CFO and COO’s own internal projections are making a mockery out of the measly 250 million tablet marketplace in 2015 that I wrote about yesterday. Even as the big money managers you pay to figure this stuff out for you in your mutual funds and brokerage houses had a hard time fathoming the concept that I introduced in that post yesterday predicting that one billion iPad number and told me so via email and IM last night, one of them was learning that Apple’s own models are indeed projecting some numbers of similar magnitude. Indeed, Apple is apparently figuring on a 400 million or so unit per year tablet marketplace being just a handful of years out.

And as I noted yesterday, it’s not inconceivable that Apple could maintain a 60% or even 70% market share in such a marketplace — meaning that Apple would be moving 300 million tablets a year or more in just five years from now.

Let’s assume that Apple drops the price as it continues to raise the functionality of futures of iPads and that in five years, the average selling price of the iPad is only the $500 that the very cheapest model today costs. 300 million tablets at an average selling price of $500 would be $150 billion in iPad sales in 2015 or so.

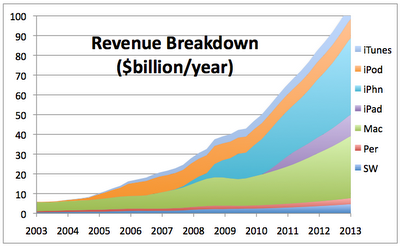

Apple did $5 billion in sales ten years ago, they grew that nearly five-fold to $24 billion in 2007 and they grew that nearly five-fold to $125 billion projected for 2012. No analyst on the street save yours truly, was predicting that kind of growth over the five and ten years out for Apple as I was and as my subscribers have been reading about since I first bought Apple back in 2003. The growth and the various business lines that are driving it is indeed mindblowing:

Certainly, it’s not inconceivable that Apple could at least grow their tablet sales similarly, say up five fold from the twenty or thirty million that analysts are projecting for this year over the next five years and that would get us close to 150 million iPad units for our 2015 models.

Cut the diff between the 300 million unit high end and the 100 low end for 2015 and we’re back to my 200 million annual units that I used in my column yesterday. 200 million iPads at the low end $500 per unit assumption gets us another $100 billion in incremental revenue with continually expanding margins for the iPad alone. Modeling just single digit growth for iPhones, Macs, app sales, content sales and subscriptions, would still get you some huge growth in coming years for this juggernaut tech stock, not to mention the huge earnings leverage in that huge coming growth.

A is for Apple. J is for JustStickWithApple.

Thanks for subscribing and see you back here first thing tomorrow.