After Tuesday’s steep fade into the close…

I posted this last night, but it didn’t go out through the email system, so let’s try this again:

Sheldon: You handled yourself real well, Sonny. A lot of men would’ve choked, and we might have had a death or a multiple death on our hands. But you handled it. I respect that. Now don’t you try to take Sal. We’ll handle him. Just sit tight and you won’t get hurt. [Sheldon turns to walk away] Sonny: Wait a minute… What are you talking about? Sheldon: You just sit quiet. We’ll handle Sal. [Sheldon leaves] Sonny: Do you think I’d sell him out? You f*#@! – Dog Day Afternoon

After yesterday’s steep fade into the close with the markets closing on their lows of the day, it’s not surprising to see the bears and shorts feel emboldened and working the sell orders today. And it’s not surprising to see the weakhanded bulls working their own sell orders today too.

The markets really got the dog days of summer syndrome, eh? There’s that old saying “Sell in May and go away” which is really one of the few sayings on Wall Street that emprically prove out pretty well. That is, June is historically a horrible month for the stock markets and stocks don’t perform as well from June through September as they do the other months of the year.

But that’s not to say that we should be selling and turning bearish now that the markets have already pulled back 8% to 10% from their recent highs. Rather, even if the summer doesn’t take us outright to market highs, we can capture some profits along the way by buying weakness like we did today and yesterday. And as my positions are getting ever closer to being as large as I’m building them to, I’ll likely be a little more aggressive in doing some selling and profit taking next time we rally higher. Which, feet to fire, I do expect we are about to rally back to the recent highs in coming days and weeks and will look to continue buying while we’re down here near DJIA 12k.

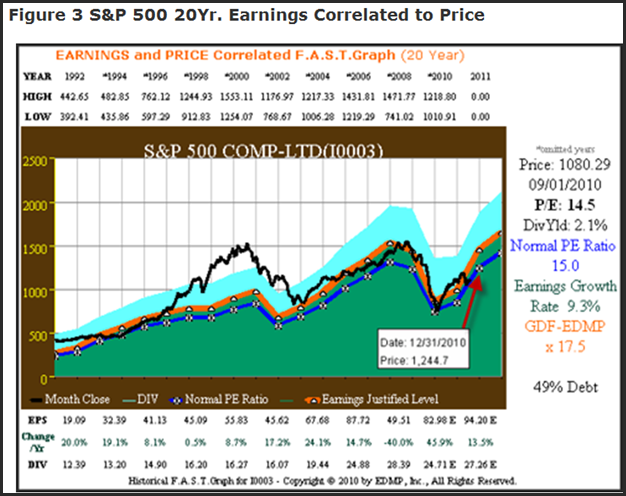

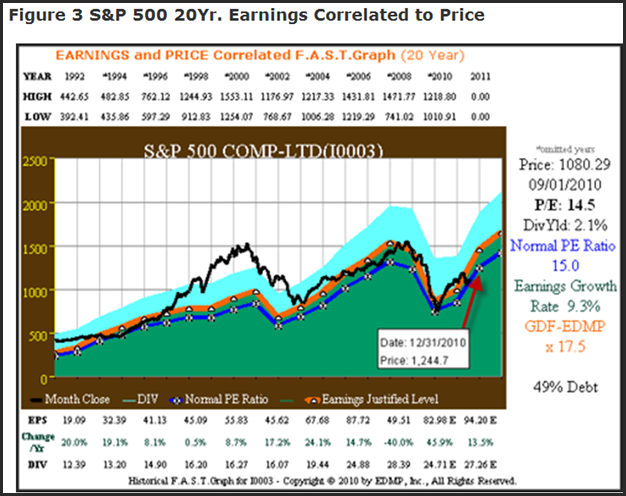

Remember June’s price swings three years ago? Me neither. Here’s some a great chart of the history of the growth of earnings and stock prices for the S&P 500:

See all those intra-year price swings there for the S&P 500, each and every year? 20-50% price swings are typical in given year. Use the swings to your advantage whether you’re a buy-and-hold investor or something more of a trader.

I’ll be doing more buying if we crack lower from here in the near-term too, every couple hundred points lower or so, I’ll be looking to step and buy more aggressively.

The dog days of summer won’t kill our stocks and those selling at these levels are likely to regret sooner rather than later, as the corporate earnings overall continue to accelerate faster than the Street believes they can. Even on Dog Day Afternoons.

Yup. Sal had it right about not selling. Don’t sell your portfolio out now.