Amazon, The Robot King, Or: Amazon AI Services (AAIS)

If you take the advancement of AI, automation, and robotics to its ultimate conclusion, then basically all valuable human effort will be replaced by machines. Therefore, the natural hedge to losing your job to a robot is to own the robot that replaces you.

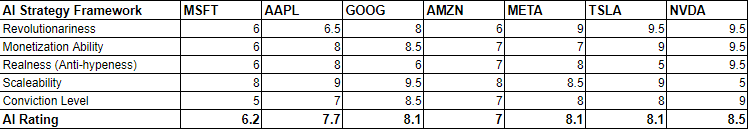

This is Part 5 of a series of articles breaking down and ranking the AI strategies of the Magnificent 7.

“All these services allow you to kind of have variable cost ways of doing things that would have been very expensive to do at large scale. So the goal is to make it easier for people to build web-scale applications without having to worry about all of the kind of nuts and bolts of scaling that make it very difficult to go from your idea to a successful product.” — Jeff Bezos on Amazon Web Services, 2012.

Here’s a thought. Shouldn’t every human want to have a good portion of their capital invested in AI, automation, and robotics? These three technologies necessarily increase the portion of profits that go to capital over labor. Your primary form of generating revenue for yourself is through your labor. However, you may be at risk of losing that income-generating capability to AI and robotics at some point in the future. If you take the advancement of AI, automation, and robotics to its ultimate conclusion, then basically all valuable human effort will be replaced by machines. Therefore, the natural hedge to losing your job to a robot is to own the robot that replaces you.

In this article, we’re talking about the AI strategy of Amazon.com, Inc. (AMZN).

Analyzing Amazon’s AI strategy was the impetus for me writing the above aside because Amazon is one of the largest employers in the US and it is starting to replace some of its millions of workers with robots. The potential to automate its entire logistical network presents Amazon with the unique opportunity to significantly increase margins on one of the largest-revenue businesses in the world. Moreover, Amazon’s cloud business is the largest in the country and Amazon is well positioned to continue to grow its cloud business as the AI Revolution only accelerates the transition to the cloud. While Amazon may not have the “sexiest” AI strategy of the Sexy 6, it certainly has a very real and monetizable one. So let’s break it down.

Before we start, it’s worth noting that Amazon is really two giant businesses in one, and the two businesses are altogether very different. Amazon is both an online retailer and a cloud services provider (CSP). And Amazon is implementing AI into both sides of the business.

A Brief History Of Amazon Web Services (AWS)

“Then a business miracle happened. This never happens. This is like the greatest piece of business luck in the history of business so far as I know. [AWS] faced no like-minded competition for seven years. It’s unbelievable.” Jeff Bezos on the success of AWS.

In 2006, Amazon launched AWS in part because the company was sitting on a lot of compute capacity that was going unused most of the time. Amazon had to build enough data centers and fill them with enough servers to accommodate the surge in traffic that came to Amazon.com on Black Friday and during the holidays. However, during most of the year, a good chunk of those servers would go unused because of the lack of traffic.

Amazon realized that it could monetize this extra compute capacity by essentially renting the servers out to other companies that needed compute power and storage capacity. In doing so, Amazon alleviated a lot of headaches associated with running data centers which is not what companies like Frito-Lay and Caterpillar, for example, want to spend their time doing anyway. Moreover, by offering companies the ability to rent storage and compute rather than pay for it all upfront, thousands of startups were able to get off the ground because it significantly reduced the capital needed to get going.

The AWS model quickly took the IT industry by storm and it wasn’t very long before AWS became a significant profit driver for Amazon. Compared to its low-margin and cyclical retail business, AWS offered Amazon a source of high-margin, recurring revenue from some of the largest organizations on the planet. AWS’s customers include companies like Netflix, Sony, Adobe, Facebook, Johnson & Johnson, 3M, Coca-Cola, Twitter, ESPN, and Reddit, and organizations like the CIA, NASA, Stanford, and the University of California System.

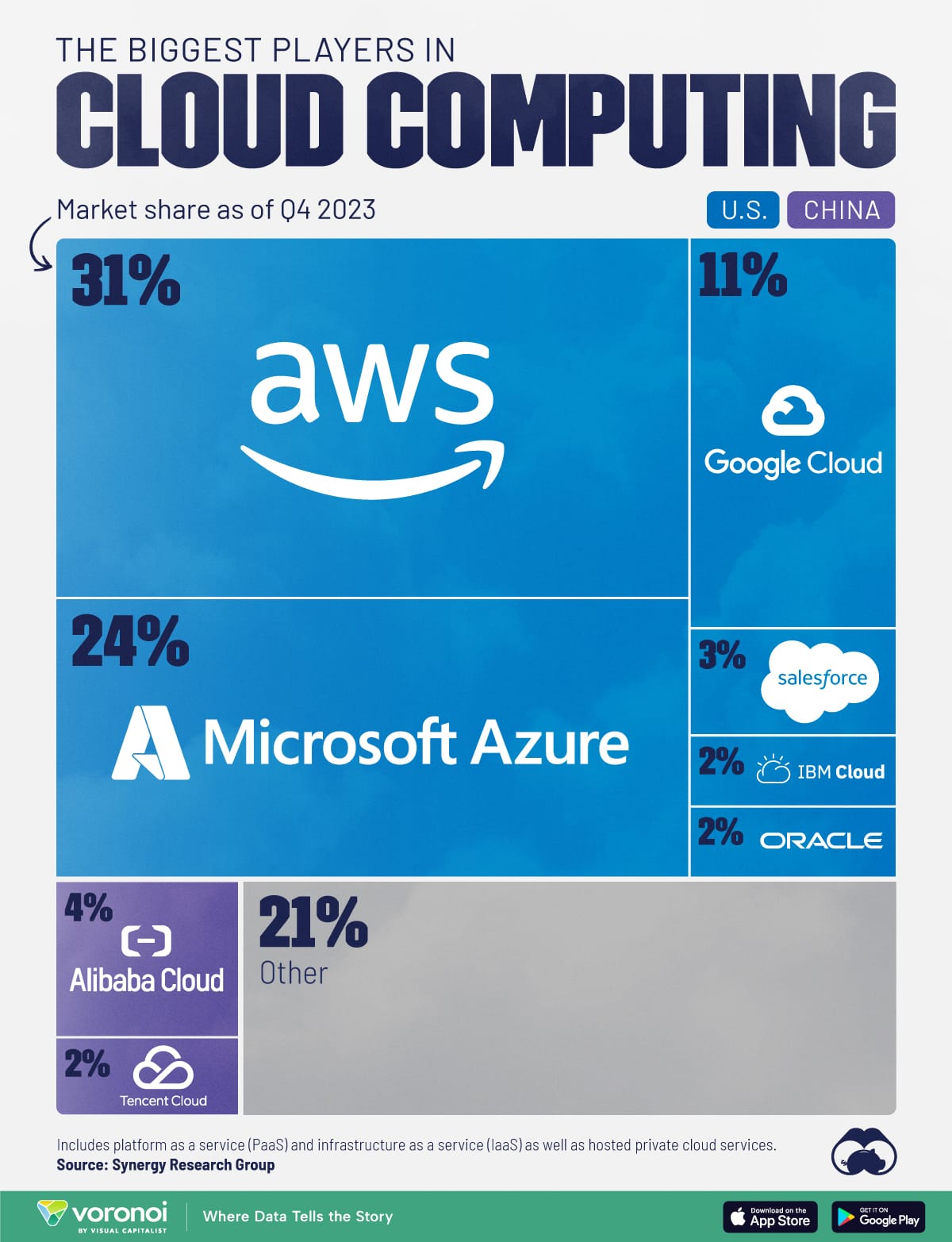

Eventually, the clear benefits offered by cloud computing became obvious, and Google and Microsoft launched their own competing cloud service offerings. However, as Jeff Bezos mentioned in the opening quote, AWS was basically the sole cloud provider for almost seven years before it faced any serious competition. AWS is still the leading cloud company and Amazon maintains a 31% overall market share.

Source: Visual Capitalist.

Amazon’s AI Strategy

Amazon has a unique two-pronged AI strategy. First, it is integrating AI throughout its cloud business (just like Microsoft and Google). Second, unlike nearly all of the other Mag 7 companies, Amazon is already implementing AI and robotics to improve efficiency and productivity in its retail business.

AAIS

First, Amazon is going to spend between $50 and $60 billion this year on capex, and the big bulk of that is going into AI data centers. Like every other kid on the block, Amazon is trying to buy as many NVIDIA chips as it can and it is also equipping its data centers with custom silicon like its Graviton, Inferentia, and Tranium chips (props for the cool names, Amazon). AI is being built into the entire AWS offering, and given this level of spending they should change the name to Amazon AI Services (AAIS).

In order to justify this massive capex spending, Amazon needs to sell lots of cloud services, and in order to do that, its AWS customers need to see some real cost savings or revenue boosts from AI if this trend is to be sustainable. According to Amazon, its customers are already seeing big benefits from using its AI cloud services. For instance, in the Q1 earnings call the CEO stated that Workday (WDAY) reduced its inference latency by 80% using one of the new AWS AI services known as Sagemaker. Again, we need to start seeing the cost savings flow through to the bottom lines of the customers, not just big tech, for AI to justify the massive spending we’ve seen in the data center.

It’s difficult for us to judge Amazon’s AI capabilities at this point because it does not have a consumer-facing LLM like ChatGPT, CoPilot, Gemini, or Claude. However, given Amazon’s deep experience building some of the best cloud services in the business, we can fairly confidently say that Amazon probably isn’t very far behind Microsoft Azure and Google Cloud.

Perhaps more than anything else, Amazon’s advantage at this point may simply be its scale. AWS is at a $100 billion annual run rate and still growing at 17% per year. Moreover, its customers have been on the platform longer than the customers at any other cloud provider, and thus they probably have way more data on AWS than anywhere else. Having tons of data stored natively on AWS will allow AWS’s customers to train better models more efficiently. Amazon is building lots of tools to help AWS customers leverage their data to make their organizations more efficient, and we don’t think it’s very likely that any AWS customers will start to migrate data to Azure or Google Cloud simply because they have a slightly better AI offering at this point. Moving data from one cloud to another is expensive and time consuming after all.

In sum, we think AI will continue to be a growth driver for AWS, and Amazon is well-positioned to help its massive customer base become more productive and efficient using AI. However, if over time Amazon fails to keep up with the relatively faster rate of AI innovation we are seeing at Microsoft and Google right now, Amazon could start to lose some cloud market share.

Amazon, The Robot King

If it weren’t for robots, Amazon would not be able to offer its amazingly fast fulfillment services at such a large scale like it does now. Amazon operates over 700,000,000 square feet of buildings across its warehouses, data centers, and offices around the world. That works out to over 16,000 acres, or 25 square miles of buildings. Amazon has to process about 10 million orders per day, and it is able to get the right products to the right household within just a few days every time, thanks in large part to robots.

Amazon has been using robots in its business for some time now and AI has the potential to massively increase the rate of robot usage at Amazon. Amazon is currently working on implementing robots across its entire logistics network from sorting, to packaging, to delivery. We know that advanced neural networks have the ability to dramatically improve the functionality and utility of robots by allowing the machines to train themselves, rather than being told what to do by human programmers.

Given the massive scale of Amazon’s retail business, it has a huge incentive to implement automation and robotics to the greatest extent possible. Amazon already has over 750,000 robots in its fulfillment centers, which includes 520,000 mobile robots. Amazon recently introduced its first fully autonomous mobile robot, Proteus, which doesn’t need to be confined to restricted areas and can work alongside humans. Amazon is also building its own delivery drones and is opening up the delivery-by-drone service to a third US city (Mesa, Arizona) later this year.

Source: Amazon.

Further, Amazon has invested in Agility Robotics which makes humanoid robots. Agility’s “Digit” robot is currently undergoing testing at some of Amazon’s facilities:

Source: Amazon.

If Amazon can effectively use AI-powered robots in its logistics business, then it could translate to a massive profit driver for the company. As of December 31, 2023, Amazon had 1,525,000 full and part-time employees (that doesn’t include the thousands of independent contractors who drive trucks, work holidays, etc.), making it the second largest private employer in the US after Walmart (WMT). The average warehouse worker probably costs Amazon around $50,000 per year. That’s over $76 billion in total annual wages and benefits.

In 2023, Amazon’s North America segment generated $15 billion in operating profits on over $350 billion in sales (4% margin). Let’s say that 60% of Amazon’s workforce is on the North American retail side, so that means the annual labor cost is about $45 billion for that segment. If Amazon can reduce labor costs in the US by 10% using robots and AI, then that would be $4.5 in additional profit or a 28% increase in the retail business.

To be clear, it’s going to take time before robots start to seriously displace humans at Amazon, but it’s already happening and one report claims that robots replaced up to 100,000 jobs at Amazon already. But the point is, Amazon has the incentive and the capability to try and automate as much as possible, and it’s already well on its way to doing so.

Conclusion

For these reasons, Amazon gets high points from us for its monetization ability, scalability, and “realness” factors. However, we think Amazon is somewhat behind the others in Revolutionarniess since it isn’t really at the cutting edge with any of its AI or robotics technology, and in many ways is relying on outside startups to power its innovation (like Microsoft). However, we have high conviction in the management team’s ability to execute and Amazon has an incredible track record of strong growth and innovation at scale, so it comes in with a solid 7 out of 10, placing in 6th place in our AI Strategy Framework.