And the main catalyst today is the jobs number…

The broader markets are down nearly 2% across the board, but the bigger technical story is really the breadth — more than 5 negative stocks for every 1 positive stock today. The selling is broad, in other words.

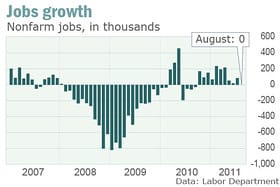

And the main catalyst today is the jobs number:

More green lines above 0 and fewer green lines below it are what we are looking for as a national economy. You guys see that there are green lines trying to build momentum above the 0 line, but that today’s jobs number, coming in at 0 itself has a lot of pundits thinking it’s due to go negative hard again. I don’t think so, as I think the trend is indeed still to the growth side, despite our government’s having basically socialized our entire financial sector in the last two or three years under both parties. That socialization of our capital allocation resources is likely to make our capital even more badly allocated over time, but for the very near term, I wouldn’t be surprised to see some job growth kick back in before the year end. The economy is bad, but corporate America is more profitable than its even been, and those two trends are likely to converge, making the economy better and creating at least some job growth above the 0 line.

I might do a little bit of nibbling on some of the beaten down names today, including maybe a little more Riverbed. But no rush, as usual.