And then we will continue to scale into those favorite…

I’ve explained in detail the supposed US budget impasse won’t matter to your portfolio in the long run. I’ve compared the trillions in ongoing explicit corporate welfare and homeowner subsidizations to the tens or hundreds of billions that the Republicans and Democrats want to cut from social services for all citizens and shown you guys why we won’t even remember this supposed budget crisis in six months. But that doesn’t mean it won’t matter to our portfolios in the near-term as the mainstream media and the endlessly misguided pundits they listen to stir up an even bigger media and market frenzy over this distraction.

Indeed, if you look back at some history, you’ll see that the markets often tumble in the weeks that the past supposed “US budget impasses” have caused. Here’s some history of how often the mainstream media tries to panic average citizens into selling their stocks because of “budget impass”:

You remember how badly our economy tanked because of that 1980 budget impasse that the Republicans and Democrats in power at the time convinced the media was really important, right? No? Oh, that’s right, the stock market started a 20 year bull run about that time as the Fed embarked on a long-term below-market-rate stance and the policies out of Washington were incredibly favorable for corporate America.

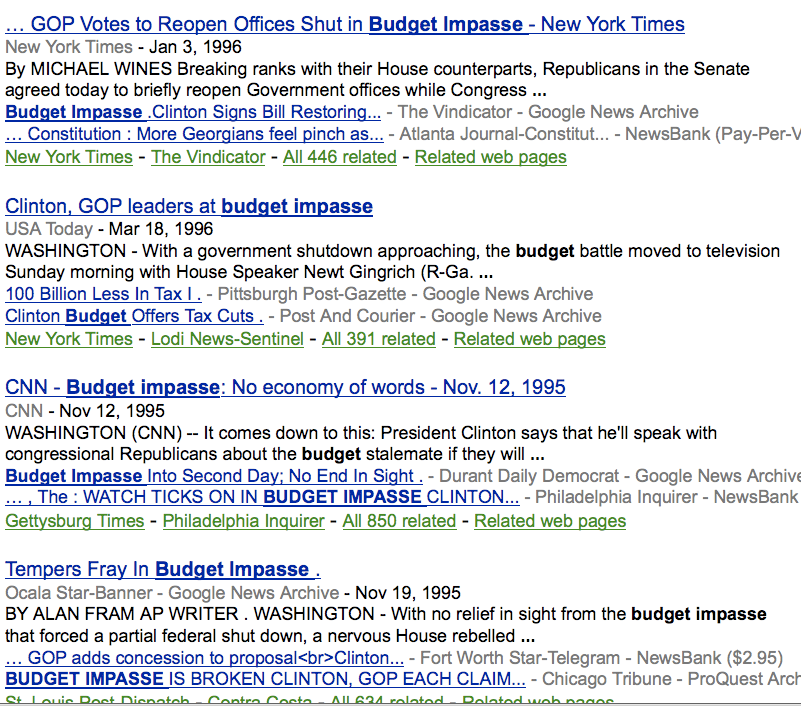

Okay, well, you do remember how badly our economy tanked because of that 1995 budget impasse that the Republicans and Democrats in power at the time convinced the media really important, right? No? Oh, that’s right the stock market went stratospheric as that budget impasse passed and the Federal Reserve kept interest rates way below market levels and the policies out of Washington were incredibly favorable for corporate America. Look at this screenshot of headlines from that time period — don’t they look identical to what you see from these same damn media today:

So look, you have to plan on some more near-term down markets as the weak-handed bulls and mindless dolts decide that the US budget impasse is “too big of a risk” or that the “markets aren’t pricing in the real risk of a US default” or some crap that they say every few years when these fake budget impasses come along.

And given that we are indeed set up for big earnings growth aided by corporate-friendly policies and tax credits, unprecedented lengths of time at unprecedented 0% interest rates, I would suspect that we want to use any and all “budget impasse” weakness as buying opportunities. I wouldn’t rush in right now, but we start putting your toes into some of your favorite longs on a big down day on budget fears like today. And then we will continue to scale into those favorite longs getting increasingly aggressive on the way down if the markets do indeed sell off during the fifteen days of trading action we’ll see between now and the “August 2 deadline” that they say matters so much.

Now’s the time when you have to follow the playbook you set up for yourself. It’s not easy, but doing what isn’t easy is what separates the winners from the losers, no?