Apple deja vu

I like to tell the story about how a few years ago, one of the Fast Money Five sent me an email explaining in great detail why Apple was about to collapse. Something to do with the consumer being backed into a corner and a recession imminent, I believe. The more things change, the more they stay the same, huh?

Back on July 1st, when Apple AAPL was about 15% lower, I said that the stock was about to breakout. Here’s my favorite comment I got on that article:

Ben M · Top Commenter

I hate to say it, but you are right (because I have only watched Apple go up). But those pictures you put up of Bill Gates and Steve Ballmer are epic. I (and many other like me) had all forgotten about those huge failings.You’ll have to click through the post see the pictures but Ben M is talking about the all the photographic evidence of Microsoft’s failed tablet initiatives over the years. And I’ve gotten pretty used to the “I hate to say but you’re right” line. I’ve been or at least felt like an outsider on Wall Street for fifteen years now, even when I was running my hedge fund and had my national TV show. So I thought you might enjoy some other commenters on an article I wrote saying Apple AAPL is going to $1000 by 2015, and my thoughts on each of them.

1. Fundamental Analyst

Wow, $1000/sh?!? I have been a long time AAPL fan and investor and am probably as bullish as about anyone out there but this seems a little crazy to me so let’s do some analysis.\

—–

$1000/sh before 2015? That would mean $1000 by 12/31/2014..

Being the largest tech company by all measures at that time, it is hard for me to see how the company could be trading a multiple more than 20 (I think 15 would be more reasonable). But let’s just say AAPL is trading at a PE of 20 and has $100/sh cash. So here is the math: (EPS x 20) + 100 = 1000 implies EPS of $45/sh. EPS of $45/sh would mean AAPL needs to grow it’s earnings at about 33% per year every year for the next 4 years. This was obviously doable 6-8 years ago when AAPL was a fraction of what they are today. But I think keeping up even 20% earnings growth a year at these levels will be a HUGE accomplishment.

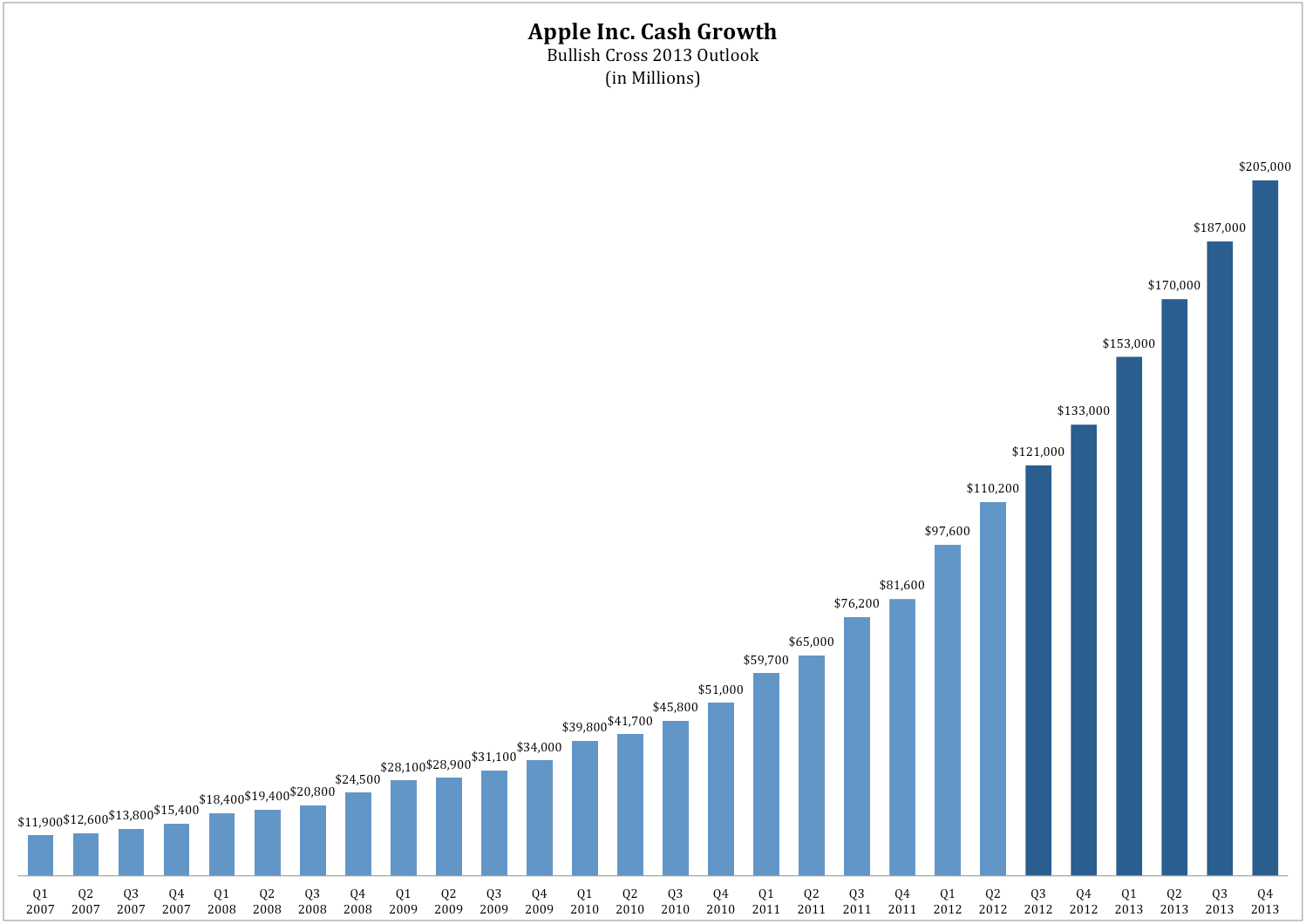

To Fundamental Analyst, I’m happy you’re working the numbers out for yourself instead of relying on others, but Apple’s cash pile is going to get to $200 billion really really quickly. Here’s an excellent chart from BullishCross detailing projections that are very close to my own (lower actually):

That’s $200 billion by the end of next year. Not a bad warchest and a big part of why I think the stock is going to $1000. Apple can effectively buy up the components and the corner the market for whatever it needs to keep making iphones. Don’t be surprised if a company like Broadcom BRCM or Nuance NUAN ends up under Apple’s control and away from rival Google GOOG.

2. Bongo

What an idiot. As good as Apple is, it’s stock price is still heavily dependent on wider market fundamentals, and nobody can tell where they will be in five years. If anything, most signs are pointing to another drop or a period of very slow growth.

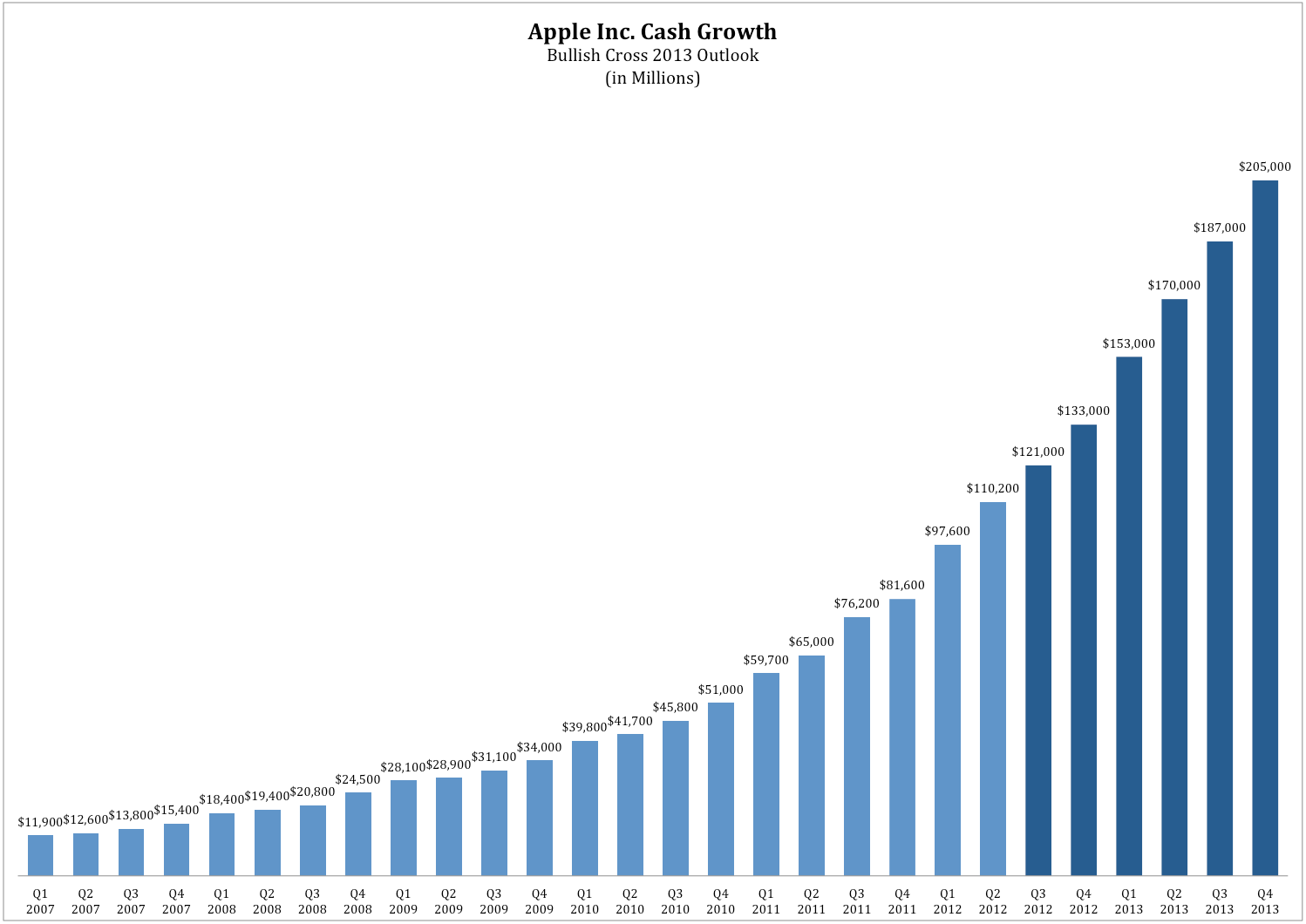

I’ve been called an idiot many times. Something about rubber and glue comes to mind. Let’s take Bongo’s argument that Apple is at the whims of the market. To wit, a five-year chart of Apple vs the S&P 500:

There’s a good lesson here. When you’re buying a stock you’re investing in a business. You’re becoming an owner. And there will always be businesses that thrive even if the world is collapsing. Or going sideways. Now Apple is definitely a once-in-a-lifetime stock, but any company that executes and meaningfully grows earnings will be rewarded in the long-term. Some other examples of companies that have boomed while the market has stayed flat:

Priceline PCLN

Whole Foods WFM

Questcor Pharmaceuticals QCOR

I just named a travel booking website, a premium grocery chain and a pharmecutical that makes a multiple sclerosis drug. Three stocks that couldn’t be more different from each other and Apple and they have all destroyed the market. If you ignore the prognosticators predicting the death of equities (I’m looking at you Allianz AZSEY crony Bill Gross) you’ll do just fine.

3. Skeptical

Having looked at the about me page on Cody’s blog, I’m skeptical to say the least. These days, I don’t know how much weight I give a snot nosed nearly kid hedge fund manager – that personifiers… Good looks + a little hard work + meeting the right people = some degree of success. I don’t think Cody has the ability to make thus irresponsible prediction, it simply has no merit.

Mixed bag , I’m always happy to have strangers call me pretty. Not so thrilled about “snot nosed” but I’ve heard much worse. At least you didn’t call me mullet-head. Now Skeptical didn’t actually say why my prediction has no merit so there isn’t much to dissect. But this is actually my favorite of all the comments and here’s why. Mr. or Mrs. Skeptical is totally right, anyone can put on a good suit, hustle, network, get an expensive haircut, and become a TV expert. You should always be skeptical of anyone who is telling you what to do with your money. Over the years I’ve discovered that many pundits that the financial networks put on the air don’t trade for themselves or any clients, they are professional opinion-havers with zero capital at risk. And those who do have skin the game are often talking up their books. Be wary of anyone offering an opinion about stocks.

I have something to admit before I leave you. The article I pulled these comments from isn’t recent or even from 2011. They’re from 2010, when MacDailyNews quoted my Apple $1000 call from September 2nd of that year. Apple was under $250 back then and the naysayers were making all the same arguments as they are today. I found this article when searching for something else and sent it to my assistant. He didn’t see the date and just assumed it was from this year, even after I told him specifically to read all the comments from that article. It may as well have been from this summer, because I get emails every single day telling me Apple’s growth is about to slow down or the market is about to tank or that I’m a hippie and I should get a haircut. But there’s only 30% left to go before Apple’s price is in the four figure club and I’m still betting it gets there.