Are you ready for water inflation?

We haven’t learned any lessons from the ethanol debacle. Subverting our food supply chain in search of energy is one of the dumbest trades of all time. So when I see headlines like this from the Denver Post, I fret:

Fracking bidders top farmers at water auction

By BRUCE FINLEY The Denver Post

DENVER—Front Range farmers bidding for water to grow crops through the coming hot summer and possible drought face new competition from oil and gas drillers.

At Colorado’s premier auction for unallocated water this spring, companies that provide water for hydraulic fracturing at well sites were top bidders on supplies once claimed exclusively by farmers.

………….

A growing portion of that water now will be pumped thousands of feet underground at well sites to coax out oil and gas. State officials charged with promoting and regulating the energy industry estimated that fracking required about 13,900 acre-feet in 2010. That’s a small share of the total water consumed in Colorado, about 0.08 percent. However, this fast-growing share already exceeds the amount that the ski industry draws from mountain rivers for making artificial snow. Each oil or gas well drilled requires 500,000 to 5 million gallons of water.

A Colorado Oil and Gas Conservation Commission report projected water needs for fracking will increase to 18,700 acre-feet a year by 2015.

So even after pulling down $91.7 billion in profit for 2012 and the Federal Reserve reporting agricultural land prices at all-time highs, farmers are being outbid for the water they absolutely need.

In case you didn’t know there’s a massive energy gold rush underway, some of it only 3.5 hours from New York City. For years, farmers in upstate New York & Pennsylvania knew there was tons of natural gas under their fields in the form of Marcellus Shale. But the boom took off when hydraulic fracturing (or fracking) was perfected and a Penn State report said there was trillions of dollars to be had.

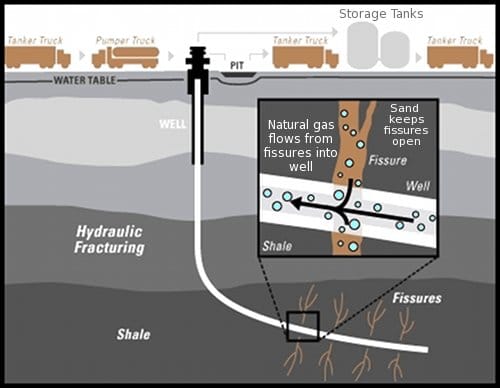

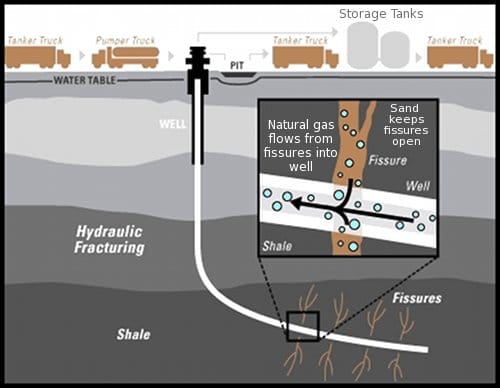

Now I don’t want to get into the politics of fracking, I’ll leave that to politicians like those in Albany who still haven’t decided whether to allow fracking in their state (spoiler alert: they will). What is not in dispute is that fracking uses water. Lots and lots of water. Here’s a schematic of just what it takes to bust the gas out of the rock underground:

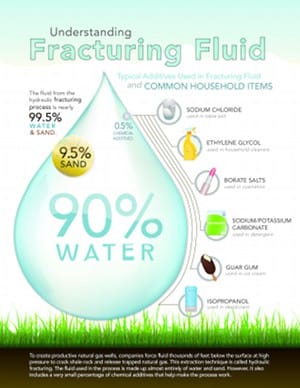

That white pump is full of fracking fluid, a mix of sand and chemicals and water. The natural gas industry has been on the defensive about just what those chemicals are (they’ve claimed it’s a trade secret), so as a defense they like to point out that fracking fluid is mostly just water. Here’s an infographic from a natural gas lobbying group:

See everyone, don’t worry, the sludge is 90% water! And just to be clear, that water isn’t pumped to the site, it’s trucked in over country roads. Here’s a picture my friend took of water trucks lined up near his farm in Pennsylvania:

If Big Gas is ready to admit just how much water they need, we need to be ready to profit from it. Some municipalities are selling companies like Cheasapeake Energy 700,000 gallons of water a day. It takes about 4.5 million gallons to hydraulically frack a natural gas well (or as Chesapeake helpfully tries to minimize, 25 days of water for a golf course), and fracking will absolutely double or triple as a percentage of total water usage in the northeast. You’ve got to get in the mindset that water is about to become a traded and bundled commodity like crude oil. And if you’re looking for bureacrats to keep our water supplies cheap remember that they write brilliant memos saying that entire continents are vastly “underpolluted” and could use a little more dirtying for economic growth.

I bring up ethanol because the ripples of our water usage won’t be evident to everyone till well after the fact. In 2005 the confluence of a court case and an act of Congress made the U.S the largest producer of ethanol. And here’s what happened to corn prices:

The same thing is about to happen to water. And water inflation is way more insidious than food inflation because it will drive up the costs of everything we eat as well.

Governments aren’t going to be on top of this until there is some kind of public outcry, at which point huge percentages of public budgets will spent to make you happy. That’s why I don’t want you to own the water ETFs, they are too heavily weighted to water utilities, and are pretty lazy, uninspired and not necessarily cheap ways to play water scarcity. After looking at PowerShares Water Resources, PowerShares Global Water Portfolio, the Claymore Global S&P Water Index and the First Trust ISE Water Index Fund I’ve concluded that none are good enough for my portfolio, they’re all too lightly traded and manage an anemic amount of assets. Plus I hate the idea of risking money in an ETF when some arcane corporate bylaw could pull the plug if the managers experience too much volatility.

Instead I’ve identified three water stocks for my Revolution Investing readers as long-term plays on water scarcity. These companies are about cleaning and maintaining and managing water, not selling it at regulated rates. You want to bet on everyone freaking out after the fact and spending heavily, not a marginal rise in water prices. I added one of these names to the Revolution Portfolio this week and will be talking about it more in the coming months. So no matter what you do, please add some kind of water hedge to your portfolio, this isn’t a doomsday scenario, this is inflation that is already baked in to the system. And I’d much rather you be a water bug than a gold bug.