Cody Kiss & Tell: Recognizing Imbalances, Gold Strategies and A Market of Stocks

Here is the transcript to this week’s Live Q&A chat. Join me next Wednesday at 2pm EST at http://tradingwithcody.com/chat or send me an email with your question at support@tradingwithcody.com.

Howdy folks. Where you been Alistair?

Q Hi Cody, how do you measure the imbalance in the broader market? Any particular indicator that you are looking for?

A. Great question. I think finding and recognizing those imbalances requires paying attention to everything we pay attention to every day here at TradingWithCody.com. It’s a totality kind of thing — valuations, charts, policies, actions by real-live-players, etc.

Q. Hi Cody, I certainly appreciate the cautious tone about the market. I think we are in an unchartered water here. I like what you said about staying flexible. Yes, the market had a huge run from March 2009 low. But on the flip side, it actually just climbed out of a hole. Do you see reverse to mean or even overshoot to the upside?

A. I think you can see both. The reversion to the mean would happen here near-term to bring the charts back towards their X-moving day trend lines, but I do think the Fed-QE-ZIRP bubble is still inflating in the stock market. Risk/reward in investing in that bubble isn’t as good now in mid-2013 as it was in 2009.

Thanks. Wish I invested more in 2009.

A. Don’t have any regrets in your trading/investing. Take the lessons you learned from this past cycle and the ongoing one and be ready to apply them impassionately the next time the markets crash, and they will crash again at some point in your lifetime. Ride the cycles as best you can and keep with trusted resources and analysis like TradingWithCody.com. 🙂

Q. Cody what stock is going to be the best performer of 2nd half of 2013–educated guess?

A. Ooh, that’s a toughie. Feet to fire, I’ll narrow it down to these: INTC, FB, ZNGA with JNPR, XONE and GDX probably up there too.

Q. Cody, I’m actively scaling into your recommendations but if they keep going up is there a trigger to go ahead and buy that next tranche rather than waiting for a pullback to make that may not come?

A. Yes, if two weeks go by and you haven’t gotten a chance to scale into more, then buy a 1/5 position or so to keep the building going.

Q. Hi Cody, it’s always a challenge to balance your general market advice with specific stock advice. General advice currently seems to be to trim a little because of the new highs being reached and the general feeling of complacency that seems to prevail about the markets here. You stated last week that you would hold JNPR through yesterday’s ER; what is your expectation now for JNPR – near term and longer term? Is it still buyable here? Stock or options?

A. The reason that it seems challenging to balance my general market advice with my specific stock advice is because I too think we are at a challenging place in the markets and that is reflected in my writings. It’s important to remember that even as the Fed and the TBTF banks have destroyed any semblance of market pricing and valuations in general, that it is a market of stocks, not just a “stock market”. In the end our job is still to find the biggest revolutionary secular trends in the marketplace and to find the best risk/reward stocks in the market based on those trends. JNPR is a classic example. I am indeed worried about the markets now that we are so far up in the last few years and so many stocks are looking outright bubbled and the string-pushing by the Fed has lost all credibility, but I also know that AT&T, Verizon and Orange and Deutsche Telekom and all the carriers around the world have to build up their networks with the types of routers that Juniper sells. So I stick with JNPR for now despite my broader cautiousness. I think JNPR could run sorta like CIEN did after its report a few weeks ago and that $25 is more likely than $20 on the next stop. But as always, I suggest starting off with a 1/3 or so position and then slowly scale into more over the next few weeks til you have a full position. Options are always risky, but if JNPR can run to $25 there’s profits to be had on some JNPR calls. Timing could be off when you use options though, so BE CAREFUL if you do.

Thanks Cody, I really appreciate your market sense. I know it’s more art than science and having some idea of a goal makes it easier to trade.

I use my broader market as a general guideline for my overall stock market exposure in the portfolios. When I am wildly bullish, as I was in 2002 and again in 2010, I’ll go so far as to get into the investment-management/guidance business to ride the rally train. When I get wildly bearish, as I was in 2000 and 2007 and as I will be again at some point here in the future if (when) prices go high enough and the imbalances build big enough, I’ll get out of the markets entirely and prepare for the next great buying opportunity. Having that broader perspective can help ride the bigger cycles in the markets and economy.

Q. For those of us not ready to arm up and protect our physical gold stash, It seems to me that Sprott Physical Gold Trust (PHYS) might be a better/safer choice than GLD: 1) PHYS is a closed end fund so it’s tax treatment is better. 2) Gold is kept in and audited by the Canadian Mint. 3) Often trades at premium to physical gold vs. GLDs discount. 4) I’ve never met a Canadian that I didn’t like…Am I missing something?

A. Given the reasons you laid out, I do agree that PHYS is relatively safer than GLD as far as paper gold promises go. I’m less confident though that if the global paper gold promise market collapses (when, that is, not if) that you’ll be able to get your hands on all your gold when you want it from across the border. I’d still rather buy physical gold and silver coins and put some in a safe deposit, some buried in your backyard, some in a safe, and some at your most-trusted loved one’s nearby home. Just sayin’, if things go really bad, PHYS and GLD are both not nearly as “safe” as any of the above.

Q. Hi: That last question raised it in a specific way; let me generalize it. (You may have answered this by the time you get to me): following your advice, I pared down then unloaded all (not that much, trust me) of my GDX calls for a nice 2X+ gain. But if (a) I (actually, YOU) feel there’s soon to be another upside run for gold and (b) I’m not quite yet ready to buy the actual stuff . . . where’s the best way to go? Back into GDX (and if so, how far out a call?) The previous suggestion of PHYS? GLD? I believe in the future of gold — advice, please?

A. Okay, let’s try answering it this way – If having your own giant vault in a hidden valley on your own section of land with three different kinds of locks and safes inside of each other and booby traps all around the perimeter to hold buckets full of US Mint Gold and Silver Eagle is a 99 out of a 100 scale, then: GDX for the next six months is probably a 68 and for the next two-five years is a 75. PHYS for the next six months and for the next two-five years is a 75 and for the long-run over the next couple decades is a 55. And GLD is a 62 for the next six months, a 55 for the next two-five years and it’s a 12 for the next couple decades.

Q. Seriously, though: options for either GDX or PHYS — or a straight-out purchase? (I know the risk of options.) How far out if options? At least your theoretical 6 months?

A. I can’t tell you which is right for you, the options or the straight ETF purchase. If you do options, I’d go out to January or Feb of next year and I’d probably do 3x as many into the GDX as into the PHYS.

Thanks.

Q. Hi Cody, how do you think about TOL and KBH at this level, or any other home builder stock. Thank you.

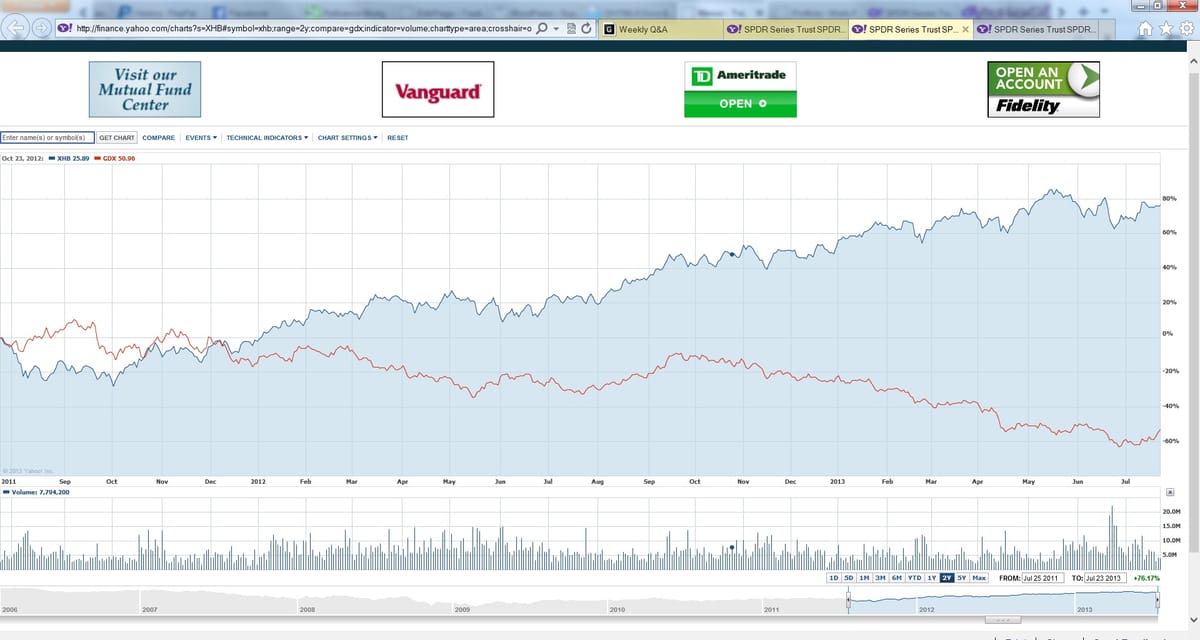

A. Wanna see two disparate sectors in the market going exactly the opposite direction? Gold miners vs homebuilders over the last two years:

Historically those two industries haven’t been inversely correlated but wow, that chart is something eh? I’d rather own GDX than any homebuilder right now.

Q. Hi Cody, what an amazing correlation, regardless whether they really correlate or not. What you are saying is that the home builder sector has overshoot and gold miners is due for a comeback eventually?

A. Yes, I think the homebuilders have overshot to the upside as they are still horribly leveraged and are run by people who load up at the top and have to sell at the bottom or (get bailed out). I think GDX has overshot to the downside and any stabilization of gold much less a rally in gold itself with be reflected in the GDX with high beta especially for the next few months.

Q. Is AAPL call options a buy now? If so, what strike price and timeline? Thanks!

A. Apple’s such a tough call for the near-term as its just had no legs for so long and there are probably still a bunch of weak-minded shareholders out there who bought in the $500s and $600s who still want to unload near their cost-basis. I do the pop today off a relatively blah quarterly report for AAPL last night is indicative of a continued building of support above the $400 level. Maybe the best play on AAPL given that analysis is to short some out-of-the-money puts dated 30, 60, 90 days ahead.

Q. Cody what does Apple have to do to break 500?

A. To break $500 on the upside with all these weakminded shareholders still wanting to unload if and when AAPL ever gets back up near $500, it’ll take Steve Jobs coming back from the grave. Or at least some hint that the new guy Cook has a clue. Okay, in actuality, it’ll take at least one new Revolutionary product like an iWatch or an iTV or an iShirt or an iDashboard deal with Toyota and Ford or something along those lines to bring in enough new buyers to swamp those weakhanded shareholders.

Q. Also, what is your take on TSM with the upcoming deal with Apple? Thanks.

A. I don’t like TSM for two primary reasons. I don’t like investing overseas in companies I can’t visit or get to know very well. I don’t like to invest in low-margin businesses which TSM’s primary businesses are.

What’s your opinion about FB?

A. I like FB a lot at this valuation and I think over the next two years the company could really grow revenues per subscriber to become a huge cash flow generator.

Q. What are your thoughts on QCOM. Wasn’t this in the portfolio? If so, I can’t remember when/why it was removed.

A. QCOM’s a great company with huge profit margins when revenues grow. I think it’s a great long-term stock but it’s just been in a funk for a long while now. $106 billion valuation ain’t nothing to sneeze at.

Q. And on the interest rate front: I’m doing well with my IEF puts (January ’14). Almost double. Time to pare? Time to add? Another thinking-rates-will-rise way to go? If your answer’s an option, can you give time frame and strike?

A. I’d pare the IEF puts as I did already and just let the rest ride for now. If rates spike we’ll get some nice gains and if they crash again, we can reload.

Q. What’s your opinion on BBRY, never a favorite of yours or mine, and seemingly (now, for sure) headed for the cellar. Sure seems like the time to buy some puts. If their phones essentially fail, even their server biz can’t help — at least to the tune of more than just a few dollars per share. Agree? And please suggest strike dates and prices. Thanks.

A. I recommended buying puts/shorting BBBY back when it was — above $100. Again at $50 or so. And recently again on its spike to the mid-teens. I do think it’s a doomed company as I’ve been saying for years now but I don’t think there’s easy money to be made on the downside now that the stock is down some 90% plus from where I first started shorting it.

Maybe a BK play someday!

Q. Your comments about DDD? Thanks!

A. I like XONE, SSYS and then DDD in that order for the 3-D printing revolution.

Okay folks, that’s another wrap. Great stuff! Please spread the word about TradingWithCody.com to help us get new subscribers and help others become better investors and traders. Also remember that I give TradingWithCody.com to all active service members and police officers as I know the sacrifices they make for us are not repaid by the bankers, brokers and business advisors they have access to today. Thanks again.