Cody Kiss & Tell: Stocks, emotions and momentum

Here is the transcript to this week’s Live Q&A chat. Join me next Wednesday at 2pm EST at http://tradingwithcody.com/chat or send me an email with your question at support@tradingwithcody.com.

Howdy folks. Let’s hit it. Whatcha got?

Q. Cody, if you had to pick one tech stock to start a new position in leaving Apple, Google out what would it be? Thanks!

A. If you’re looking for a long-term investment, maybe FB. But I always suggest diversifying across several stocks, not buying just one. Google is up huge and Apple’s down over the last year, but for years that action was opposite, as Apple went up huge and Google stagnated. Owning several stocks is very important.

Thanks Cody! I own FB and many more tech stocks and I have some more room to add. I may put some more in FB then.

Q. Cody – Do all of these scandals now hitting at once move up the time line on a short term bubble burst?

A. What scandals? Is there more scandal right now than usual with the Republican/Democrat Regime and its endless corruption?

That’s true….

Q. Hey Cody, as you can imagine, it’s extremely frustrating to see all the gains in the DOW over the last few months and my tech heavy portfolio just keeps on slipping….what gives?

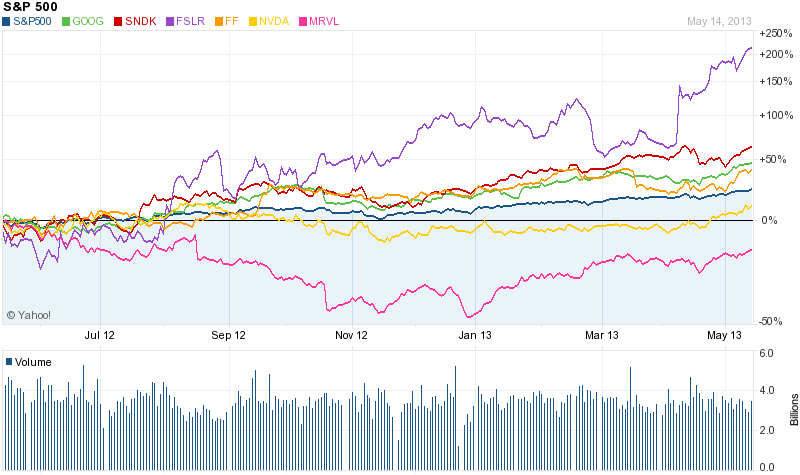

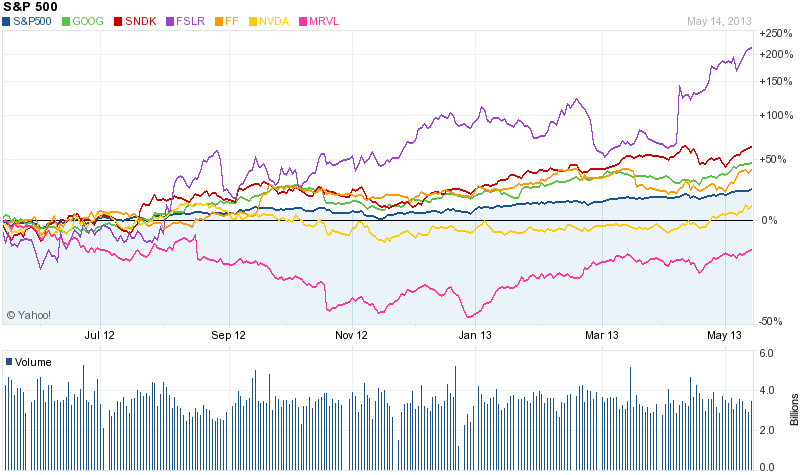

A. Hmm, we’ve had our problems with Apple but overall, I would think your year would be going pretty well. Here’s a chart of some of our positions vs. the S&P 500 and you’ll see we’ve had a lot of stocks (tech and otherwise) outperforming the indices, no?

Q. Cody. What are your thoughts on companies in the housing market? For instance William Lyon Homes. IPO coming tomorrow. Thanks

A. I called a long-term bottom in crashed real estate markets back in 2011. I wouldn’t want to own any RE-dependent company though. I’d rather buy some more land at hugely discounted prices and sit on it for my grandkids.

Thanks man.

Q. Hi Cody, with the innovation of Google now, do you think Apple’s closed ecosystem in some way stop them from moving forward as well? Here is a link that talks about the Google Now and why Apple user cannot take advantage of it. It is frustrating to see Apple lost its love from investors. Do you still believe in Apple?

A. I’m as frustrated as you guys are about the lack of innovation or even just excitement in Cupertino where Apple is located. You saw my detailed notes yesterday about how the openness of Android plus the cheapness of new Android products is really starting to pinch Apple’s ability to harness outside innovation. Here’s another great explanation of why Apple’s stagnating here and Google’s booming, from the best music analyst out there, Bob Lefsetz. I think Apple can trade at 10x next year’s earnings, as I’ve been saying, which would put it at $800 plus when you include the cash on the balance sheet. That doesn’t mean it will happen tomorrow though. Could be a year before the stock really gets its mojo back. Then again, what if Apple suddenly comes out with some really cool new product categories and shocks the world with their sudden rollout? The good news is that most everybody thinks AAPL is done as an investment here. The bad news is that it can take a while for that perception to change without a serious catalyst.

Q. Hello Cody, Are you a new buyer of apple here down at 425 after the 40 pt decline?

A. No, not yet. Patience with the AAPL for now.

Q. Thanks Cody. Any advice on the Jan 2015 330 and 400 Call? I also own some Jan 2015 900 Call.

A. Not much to add to my prior AAPL trading set up analysis. That $900 target seems outrageous right now though, doesn’t it? The next time (if there is one, that is) it seems like $900 target is a foregone conclusion, will be the time to trim down a bunch, that much is for sure.

Q. What do you think of Apple’s complete dump by “Hedge-fund legend Julian Robertson”? I have a sizable holding in Apple, what’s my best play now? Thank you!

A. When a hedge fund dumps a position it can be for a million different reasons besides they lost faith in the stock. His biggest investor might have demanded it. He might be facing some huge redemptions and needs to raise cash. He might be turning totally bearish and trying to catch a top in the markets. See my earlier commentary on my AAPL analysis as to what do to now.

Q. I want more Google! 🙂

A. Mark this time and GOOG’s price down right now and look back in a week and in a month and in a year. I can almost guarantee when my subscribers are clamoring for MORE Google stock even after it’s now more than doubled from just a few quarters’ ago prices, that GOOG is getting crowded on the long side. In fact, I’d be a trimmer of Google, which is my largest stock holding, right now rather than a buyer. “Mike: May 15, 2013 – 2:37 pm I want more Google! ”

Q. Do you feel that CIEN and JNPR are long term plays? I.e. is it worthwhile waiting 6 months to see if they turn a profit?

A. If the carriers around the world follow through on this increased investment in the network cycle that we’re seeing develop right now, Juniper and Ciena could double. Will need the cycle to play out well though.

Q. Do you have any thoughts on RFMD? Is it a good long term hold or short term buy and sell?

A. RFMD is a good company but it’s balance sheet isn’t great and they sell lower-margin, commoditized chips as their main business. All that said, if the company can deliver on next year’s 50+ cents per share earnings, the stock will likely be closer to $10 than $5.

Thanks Cody. Love hearing your insight.

Q. Fundamentals aside, is TSLA a good swing trade, after the post-earnings breakout on high volume and the next day’s follow through? There is talk of it going to $100 per share soon.

A. I’ve never known a momentum swing trader who didn’t get crushed several times throughout their career and had to completely rebuild. I know some rich swing traders, but I know a lot more swing traders who are out of the business entirely.

Q. Would you consider shorting MS or TSLA anytime soon?

A. Yes, but I’d be careful to slowly scale in on pops and I’d be aggressive about trading around the TSLA for sure. We are in a growing stock market bubble and Tesla is a go to play for the momentum lovers.

Q. Good afternoon, Cody! I wasn’t quite clear on the basis of your recommendation re Barnes & Noble (BKS) the other day. You said there have been Nook-sale-to-MSFT rumors before, followed by a run-up that led to a good sell/short opportunity. Here we are again. Are you saying it’s again a good short opportunity (hovering at 20) (a) because you don’t think the Nook sale will happen or (b) even IF it happens? And what would you recommend now – short, or more radical like a put? (Assuming one were willing to take the incumbent risks of a put – lose all your $, etc.)

A. Well, BKS is already down 15% since I pointed out that short idea. I do think it’ll fall back towards single digits over time, but as always, I could be wrong. Feet to fire, I’d look at buying some six-to-twelve month out slightly-out-of-the-money BKS puts and just use a tiny bit of capital so that I know exactly how much I could lose on the trade. And btw, here’s me recommending the short BKS trade a year ago when the stock did this same thing.

Q. Thanks for the BKS answer. Again, though, if one (that would be me) were convinced that this time the Nook sale WILL happen, would you STILL recommend me taking that short look at it? Or is your thinking that the sale won’t happen. See? — there’s a difference. Are you thinking even the sale won’t chunk up the stock?

A. Good follow up question. No, I don’t think MSFT will do a Nook deal. But if they do give a $1BB to BKS for Nook, that would almost definitely spike the stock to the $30s.

Q. An update, please, on your current thought on BBRY: still think it’s a good short (based on the new phone not helping with a comeback) and — especially — WHEN? It hasn’t quite climbed back up to 17 yet (an earlier guidepost of yours), so — are you still down on it and is it yet time to pull the plug? And a repeated request re your reporting: when you execute an option buy or sell, it would be very informative, i think, for you to post the price of the put or the call — not just of the underlying stock. Last time i asked, you said it was reasonable and asked Bill to look into setting that up — yet it apparently hasn’t happened. Any reason why? I think you can see that the option price would be a good gauge. Will it happen?

A. Would still rather be short than long BBRY for the next six months and would look to build that short anytime it gets close to $17/share. As for the options pricing stuff, I guess we let your request fall through the cracks. I had done it a few times after your request, but I think I forgot the last couple options trades to include that info. Sorry. Will do better for you.

Q. Do you think there is more downside in SLV ?

A. The metals act absolutely wild right now, with the gyrations and emotions packed into every day’s action, it seems. But beneath the veneer of normalcy in the metals markets is steady newsflow like this. “What is not stated is that it was cheaper for South Africa to ship gold all the way from New York to meet their delivery obligations than it was to acquire the bullion from their own region, or the regions where their customers reside, which are presumably in Asia. Couple this with the news we had that bullion shortages in Hong Kong were being met by gold bullion imports from London and Switzerland. Gold is flowing from west to east, and this is precipitated by price distortions in the paper markets of New York and London. The pundits on Bloomberg TV met the comments from Putin about Russia’s desire for a change in the reserve currency with contemptuous laughter and snide derision after the close today. ”

Q. Any opinion on AOL and could it be the next CBS or NBC?

A. I recommended AOL back when it first spun out and was at $20 a share. I don’t think the company will ever be another CBS or NBC unless they go out and roll up a bunch of cable channel or something like Rupert did back thirty years ago with FOX. And there’s just not enough critical mass or growth in the AOL internet stuff where there’s very little barrier to entry in most of their services, that I’m not a fan of AOL at these prices these days.

Q. FMCC and FMNA have been on a tear. I picked up some of them and have been well rewarded. Any thoughts on the future prospects for these two? And I know they represent just about everything that’s wrong with politics these days, just couldn’t help making the trade with the upside they have…

A. Wow, congrats on the gusty trade in those worthless penny stocks. The only reason those stocks even trade any more is because if the government actually took over the last 30% that they don’t own (and that’s the part of the equity that you’re trading), then the Republican/Democrat Regime would have to put those huge liabilities from Fannie Mae’s and Freddie Mac’s balance sheets onto their own balance sheet, which would immediately add a couple trillion dollars or so to the federal deficit. In other words, you’ve been gambling that you’ll be able to sell those two stocks to some “greater fool” at some point (and you’ve been, as you said, WELL REWARDED for taking this risk so far). But the equity in either, both, each company is and forever will be worthless when the chips finally settle.

All rightie folks, that was a great one! Thank you for all the questions and for helping us continue to build the TradingWithCody.com community. We’ve got more traffic these days than ever before and a large part of it is you guys yourselves contributing to the value people receive from this service. Thank you and rock on.