Everything you need to know about the Fiscal Crisis

First things first — don’t forget this week’s Live Q&A Chat at 2pm EST at TradingWithCody.com/chat. If you can’t make it live, just email me your question at support@tradingwithcody.com and we’ll include in the published transcript.

Let’s talk about the so-called “Fiscal Cliff”. First off, the only people who will be hurt if we were to actually go off the fiscal cliff is middle class and working class and unemployed and welfare-dependent citizens in the US. Corporations and banks will still have all their major subsidies, tax credits, loopholes and targeted tax tricks in 2013 whether they pass some resolution before the Fiscal Cliff deadline or not.

To be clear about one thing up front here, the Fiscal Cliff and the so-called “negotiations” about the Fiscal Cliff are about anything BUT the deficit and the nation’s debt problems. Obama and Boehner and the Republican Democrat Regime can pretend that they have suddenly grown concerned about our nation’s deficit and debt as they debate a difference of a few hundred billion dollars over the next ten years. From Reuters:

“Much of the dispute between Republicans and Democrats centers on the amount of new revenues that would have to be raised to help shrink annual budget deficits that have been hovering around $1 trillion.

Obama has proposed about $1.4 trillion in new revenues over 10 years, while Boehner has offered around $800 billion. In both cases it was unclear how that would be achieved specifically.”

That sounds like a lot of money and like it could be meaningful to attacking the debt. And suppposedly, BOTH sides are working on that whole national debt and deficit issue with close to $1 trillion proposals, right? Over ten years, we’d be talking about $100 billion a year in savings and new revenues for the Republican Democrat Regime! Woo hoo.

Or not.

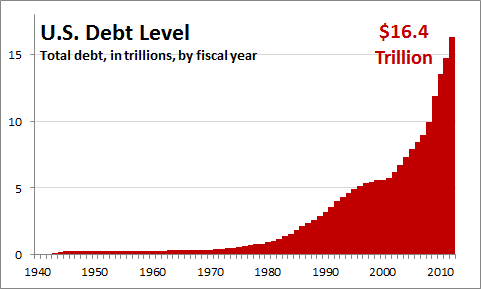

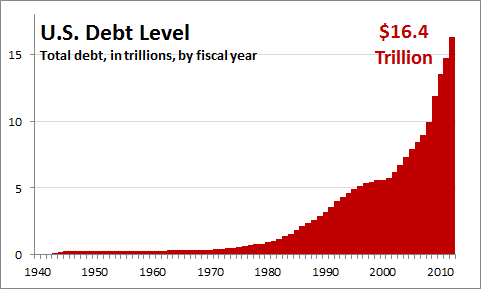

Here’s a picture of the US debt:

From the end of World War II til the explicit endorsement from both the Republican and Democrat parties of corporatocracy started shamelessly helping every major corporation and really, really rich person in the country and abroad avoid paying taxes at the same rates that small businesses, and working class people do, our Federal Debt was held pretty steady.

Then we started an unprecendented move to cut taxes without cutting social services and corporate welfare programs already in place along with Greenspan’s endless (and still ongoing) shoveling of money with ever lower rates for big banks, real estate market manipulation, bubble blowing and welfare for global banks anywhere, and the deficit exploded and the debt followed suit, blowing up from about $2.5 trillion where it had been since the early 1950s til the early 1980s when it tripled in just twenty years to $7.5 trillion or so when the Republican/Democrat Regime celebrated a “new economy” (read: a tech and real estate bubble of epic proportions) and declared they’d be running a SURPLUS for the foreseeable future.

That’s $5 trillion in twenty years from the early 1980s to the year 2000. Then that whole tech/dot-com/telecom bubble popped and what were Obama and Hilary Clinton and Gore and Bush and all the very same people now pretending that they care about the “Fiscal Cliff and Debt Crisis!” doing back then? They all got together and started a new round of wars and real estate welfare programs and historically low rates for the global banking syndicate and more targeted tax tricks for giant corporations like accelerated depreciation, a few hundred dollars of free welfare money stimulus checks for almost everybody (remember that?!), and other so-called “stimuli”.

And guess what the debt did? It went from from $7.5 trillion to $10 trillion in seven years. That’s about $400 billion per year, for those of you keeping score at home. Recall above that Democrats and Republicans are supposedly fighting over about $100 billion per year or so in total cuts, meaning that the actual differences in their proposals total tens of billions of dollars a year.

And finally, we get to the Greatest Transfer of Wealth in the History of Civilization, also known as the endless bailouts, bank sector lawlessness, and endless quantitative easing (which simply means that the Fed is buying nearly worthless mortgage securities and derivatives from the biggest banks in the world for whatever the banks say those assets are worth. It’s stimulus, they say!) that are the new normal of the Post-2008 Credit Crisis and Real Estate Crash.

What did the debt do over the last few years while Obama, Boehner, Pelosi, Reid, and Cantor were running things? The national debt is now at $16.5 trillion. That means it went up $6.5 trillion over the last four years. That’s a run rate of more than $1.6 trillion per year. That’s more than 10x per year what Obama and Boehner say they’re now worried about. That means the Republican/Democrat Regime has SPENT MORE EACH AND EVERY YEAR for THE LAST FOUR YEARS in targeted tax tricks, subsidies and other corporate welfare programs for the biggest banks THAN THE TOTALITY OF EITHER PARTY’S CURRENT $0.8-$1.4 TRILLION NEGOTIATIONS.

The fiscal cliff doesn’t matter to the national debt or the deficit or to the giant corporations that we invest in or to the richest people in the world. In coming years, I fully expect that I’ll personally and that my small businesses will be paying higher taxes in one form or another with higher inflation and state and local taxes continuing to skyrocket for everybody but giant business. Because I don’t have nor do I want a lobbyist out there begging for targeted breaks.

Finally, to really drive this point home — do you know how much the loopholes, subsidies, and targeted tax tricks for the 5,000 largest businesses in this country costs us in the deficit each year? More than $1.5 trilion. And end to lending money to banks at 0% and borrowing it from them at 2% along with a simple scaling tax rate on all income and/or purchases and/or assets in this country would instantly eliminate the entire deficit, would enable an immediate surplus and paying back of the existing debt, and full funding of a non-insurance-based universal health-care system.

I’ve said from the beginning when the idiot mainstream media started biting on this minute “Fiscal Cliff” nonsense that we should buy panics over it when it dominates the headlines and sell euphoria when a supposed resolution is dominating the headlines. That’s still the playbook.

No trades for me today. Steady as she goes.