Focus on shorting crappy companies

The darkening of the market mood is palpable. Just two months ago stocks were going up in a straight line and everyone was in agreement that the economy was picking up steam. Funny what a difference a big down move can make. Let’s look at some numbers.

In the last month the Dow is -4.03% and the S&P 500 -4.54%:

Year-to-date the broader markets are still up (DJIA +2.35%, S&P 500 4.63%) but what looked like a full-blown rally is verging on correction territory. Here’s what the biggest banks did from the 1st trading day of the year through March 21st, that’s two months ago:

Wells Fargo: +23.4% Bank of America: +76.62% Goldman Sachs: +39.32% Citigroup: +43.67% J.P Morgan Chase: +35.70%

And here’s what they’ve done YTD

Wells Fargo: +13.92% Bank of America: +22.83% Goldman Sachs: +6.71% Citigroup: -0.23% J.P Morgan Chase: -2.23%

That’s just incredible. In 60 days Bank of America is down more than 50%, Goldman is down more than 30%. Citi and JPM have given up so much ground that they’re negative as of the close yesterday. So no wonder the bears are out in full force with headlines like this one from Marketwatch: ‘Expect to see Dow 11,000 before Dow 14,000’.

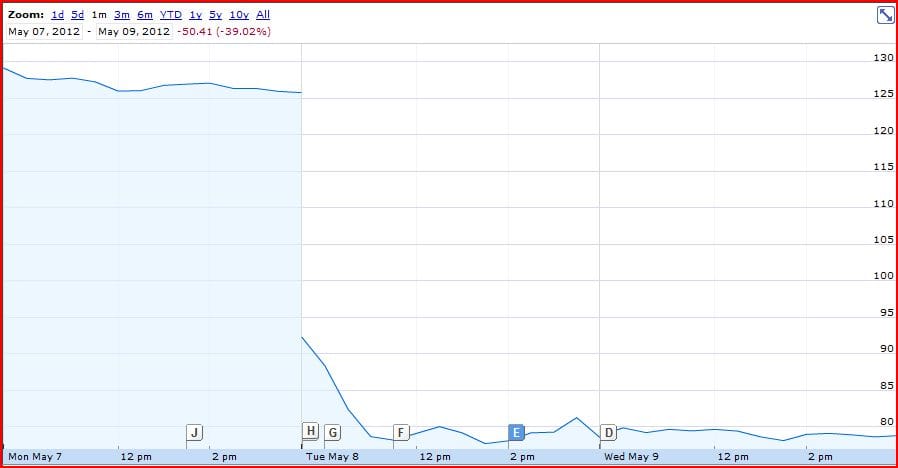

I’ve been beating the drum all this year (and for my whole career) that you need to be long secular tech themes and hedge that with short exposure to frauds and companies that are falling by the wayside (and sometimes as a long-short pair like my Seagate / Western Digital trade). Timing the long side is difficult enough, timing the short side is even more tricky, which is why you should target companies that are fundamentally broken. A great example is in my ebook The Dirty Dozen: 12 Stocks with Fundamentally Broken Business Models. I haven’t talked about this name publicly but I’ve been studying Fossil for some time now and think their business has entered a permanent downturn. From when we published in January through yesterday’s close, Fossil is -21%. But the stock was actually up almost 40% from January through the day before they reported earnings May 8th. And here’s what happened when the Q1 numbers came out:

That’s a monster move that cut the value of the company almost in half and I don’t think their retail footprint is going to improve flagging sales anytime soon (you can read my complete FOSL analysis here). Whether you use my twelve stock picks or not, make sure you’re shorting companies that you’ll feel confident adding to the position, even if it runs against you. Momentum is something but not everything, and if you’re shorting companies just hoping a streak will snap, you’re sure to lose money. It’s better to have both parts, a declining business and an overheated stock. Those of you that caught the big downturn in Green Mountain Coffee know what I’m talking about.

So why short Fossil or be short at all if you want to own Facebook? Because downside exposure can buy you time. It’s easy to start changing your thesis especially when you expected that hot IPO to pop right away andbut it does just the opposite. But if you have some short exposure you’re less likely to get shaken out of your best long ideas. Having shorts in your portfolio helps take care of the timing issue, you can plow the gains from a short back into your long, so that you’re not flatfooted and buying a stock at just one price. Or worse, selling at exactly the wrong moment. Here’s the 1986 Fortune cover featuring Bill Gates and the Microsoft IPO:

If you haven’t read the story I suggest you do so. And while $350M might seem like a quaint amount of money from an IPO (Zuckerberg is worth about as much as Yahoo is), Microsoft was definitely the overheated IPO of its day. And here’s what the stock did in the first six months:

Losing patience and dumping Microsoft because you lost money over 180 days mean you missed out on one of the greatest stocks of all time. So if you want to own Facebook for the long term, have some short exposure, and I’d prefer if you went with specific names rather than just shorting an ETF like the XLF.