Going long on the cloud

Just when I thought I was out, they pull me back in.

I was really hoping Greece would have been all wrapped up with it’s fraudulent bond-exchange by now, but a couple creditors, who crazily enough insist on getting paid back, have been given till March 23 to comply-or-die. But no matter, we keep it moving here in the U.S. of A.

Two new trades for our Revolution Portfolio today. As you’ve no doubt noticed I’ve been freeing up cash and closing old positions so that we can better take advantage of the global trends we actually care about. So today I’m putting on a new long and a new short. Both are integral parts of their respective industries, but while one relies on the virtuous cycle of growth, the other is a parasite leeching dollars out of the economy.

First, the good, adding Level 3 LVLT +0.04% , to the mix, as a long. Sales are booming and after buying out Global Crossing I think the company, despite its debt load, has finally turned a corner.

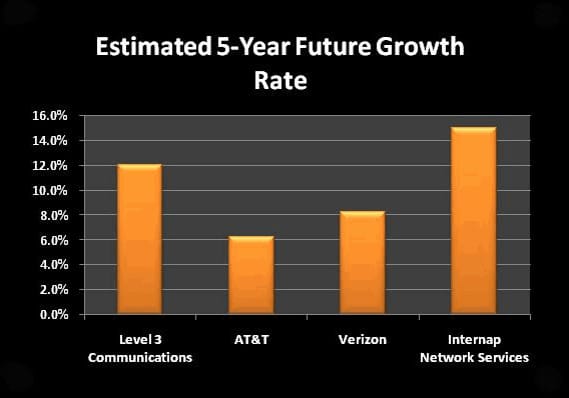

Take a look at this slide from Standard & Poor’s on LVLT’s projected earnings growth, which are multiples of the phone networks they underlie:

Source: S&P Capital IQ; estimates for EPS growth.

LVLT is dumping peripheral businesses and returning to the focus it always should have had. Just last month it sold its coal mining subsidiary. No that’s not a typo, Level 3, since its inception, owned a coal business that dealt primarily with public utilities. I’m happy to see liabilities associated with infrastructure of the past be lessened so they can work on the infrastructure of the present.

Like I said I’ve said many times before I want to be long the critical infrastructure of the Cloud & App revolutions. And there isn’t much more integral to the world economy than Level 3. Their assets rise to the level of national security infrastructure. I fully expect a Google or Apple or Microsoft to spend some of the billions of cash they have sitting around the world and take this thing onto their balance sheet. All three of the names I just mentioned are in a battle with each other to build out cloud services and it wouldn’t surprise me if LVLT becomes the center of a bidding war.

And now to the bad, namely MBIA MBI +5.41% , which I’m initiating a short in.

MBIA was traditionally known as a monoline insurer, a capital arbitrager that took it’s Triple-A rating and lent it out to municipalities that were (unfairly) considered credit risks. But they really got inventive when they started insuring mortgages.

MBIA is up 20% in the last six months on hopes that a lawsuit against Bank of America will pay big dividends for losses it experienced from Countrywide. But the stock has recently cracked and looks like its quite broken and MBIA, nor anyone else. is about to litigate their way to prosperity. And especially not against a TBTF, government protected, money center behemoth like Bank of America. I expect much of this legislation will get pushed aside or settled, and not in MBIA’s favor.

One of the most damning (because it’s so bumbling) parts of the of Q4 earnings call come from CFO C. Edward Chaplin. Reading the transcript , it’s not clear whether the company is putting on a brave face or really doesn’t know what is going on. Since the CEO refers to his lieutenant as Chuck on the call, so will I:

Chuck: “Another way to think about our risk reduction is to view the pattern of expected future losses, quantified as statutory loss reserves … Our capital position is adequate in our view, even though liquidity has declined in 2011 as I will discuss in a few more minutes.”

Chuck: “Starting with our results under U.S. GAAP Accounting, for which there is no slide , we had a net loss for the fourth quarter of $626 million compared to net income of $451 million in 2010’s fourth quarter. For the full year 2011, the net loss was $1.3 billion versus income of $53 million in 2010.”

Chuck: “I would like to attribute the movements to our risk reduction efforts, but that’s hard to say, because CDS price changes and, therefore, our GAAP results have in the past been quite disconnected from fundamentals in our business. “

Chuck: “When you consider our cumulative commutation experience up until the fourth quarter of 2011, we’ve commuted about $37 billion of exposure for gross payments of about $2.2 billion, which was about $100 million under the cumulative loss reserve. At this point, we’ve commuted $61 billion of exposure, and the total cost is about $400 million over the cumulative loss reserve. While significant in dollar terms, that difference is less than $0.01 on the par amount. Every commutation is its own story and the structures and economics of each deal result from a combination of potential future volatility, counter-party motivation and timing.”

So MBIA spent it’s money to lose money because it’s better than losing more money later? And they have the gall to say to shareholders “It’s OK guys, I know $400 million seems like a lot of money to you, but it’s really not that much when you think about it.”

And the best things I may have ever seen on an earnings call:

Chuck: “Now moving away from the income statement, I’d like to make some comments about liquidity and capital, for which I have no slides.”

Really, no one managed to make any slides on liquidity for a company that is completely at the whim of global financial markets, funding long-term positions on an overnight basis?

After talking the liquidity book of each of MBIA’s subsidiaries Chuck concludes:

“So bottom line, the firm has used some of its liquidity flexibility to retire potentially volatile liabilities and has a lower risk profile as a result. The combination of the lower potential volatility and the near-term prospects for clearing significant litigation from our agenda are significant positives that will help us get to more stable operations in the future.”

What this really means is that MBIA has drained away it’s liquidity and not solved the larger problem of a liability book that can explode at a moments notice. Don’t be fooled, the company is sitting on a powder keg of losses, skimming out some of the risk has been incredibly expensive and is a good indication of just how impossible it will be to unwind these toxic positions. We’ve seen again and again how borrowing short and lending long works as a business model, so I feel good shorting MBIA and waiting for any little interest rate hiccup.