In depth analysis: Google, Android and one hundred billion buckaroos

With the Olympics ending and the British taxpayer seemingly O.K. with a $40 billion bill for adults playing games, I’m sure more attention is about to shift to back to the south of Europe. Not for me though, I already know that the Troika will dole out the $35 billion in aid its been holding back from Greece any day now. Forget the international intrigue, let’s go domestic with Fusion-IO FIO.

It was a terrific quarter for FIO and the market rewarded it by pushing the stock up almost 30% in five days. I hope (and know from the emails) that lots of you were buying the stock in the high-teens over the last couple months. Like I’ve been prediciting, Apple AAPL has become a major customer, alongside Facebook FB. And the good news doesn’t stop there. From the earnings call:

Turning to our customers. We had 8 end-user customers in the fiscal Q4 that placed orders in excess of $1 million. 5 of these were repeat buyers from among 40 customers who’ve purchased $1 million or more worth of products from us; 3 were new additions, including a data analytics company, a leading cloud service provider and a large media software company that experienced a 10x, not 10%, that’s 10x performance improvement in its data center by replacing legacy infrastructure with Fusion-io. This again speaks to the significant ROI our customers can realize with our solutions.

That’s fantastic stuff, I love seeing old customers coming back to the table and that big, juicy ROI will keep them coming back. As I mentioned on Marketwatch, I trimmed my position back since I had added more much lower, but I still expect FIO be a core holding for the time being, and a continual buyout target.

Since the iPhone 5 is all but confirmed at this point (its been widely reported in the media but I’ve also been hearing from tech reporter friends who have been asked to hold the date) let’s talk…..Android.

Google GOOG has gone from an Apple AAPL antagonist to the number one shipper of mobile software in three years. Android is now on more than 68% of global smartphones according to IDC, with mighty Apple far behind, according to IDC:

And check out this screengrab from a Google Android event in June:

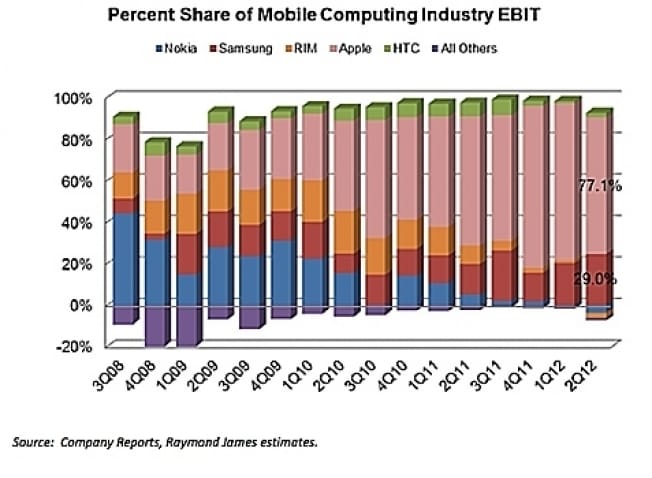

400M people are using Android only three years after that number was practically zero. So if Apple ships a relatively small number of devices compared to all the versions of Android, how has Cupertino stockpiled all that cash? Because the iPhone is 77% of the profits from global mobile sales. Look at this graphic from Raymond James:

Google’s purchase of Motorola and the introduction of an Android phone that it manufactures is a pretty radical move but one that won’t shift the business model. So far Google has just licensed Android to device makers and collected minimal royalties and ad revenue. Going forward they’ll make a flagship phone and work to make it beautiful so that Android is continued to be thought of as a premier OS (and it’s quite possible that if they deliver a great Android phone product or two, Google can get some big margin revenue just like Apple does with the iPhone). And they’ll keep executing the other part of their plan, which is to make as many of the twenty billion people (yes, there will be twenty billion handsets sold in the next decade, up from about 15 billion over the last decade) buying smartphones in the next ten years, Android customers for life. In three years Android has gone from a defensive loss leader to prevent the coming generation of users who are primarily on mobile from abandoning Google’s core search product, to a business that has the potential to do $10 billion in revenue all on its own.

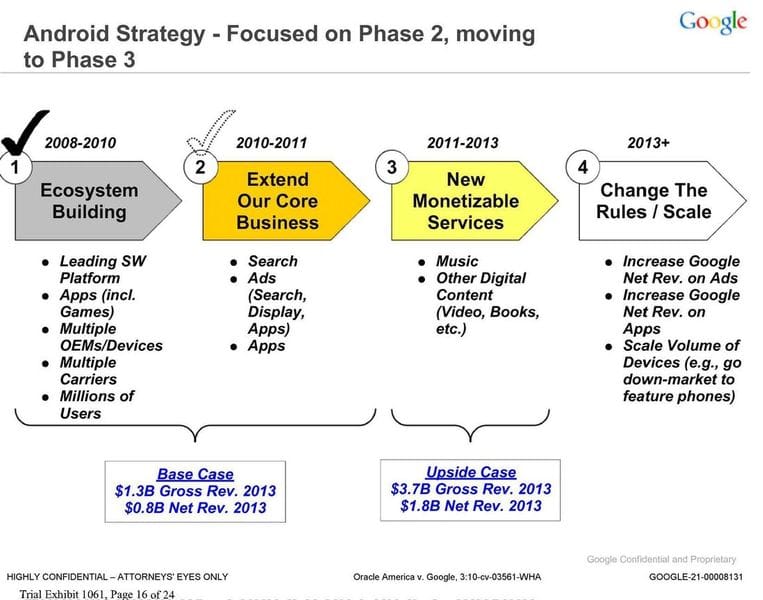

Just how fast Google is getting there is $300 billion question. Android’s revenues have never really been broken out but we have a glimpse into the business thanks to a patent dispute with Oracle. Here are some internal slides that are now public because of the dispute that Andy Rubin, Google’s Android wunderkind, discussed with his lieutenants:

It’s amazing to see how wrong Google was back in 2010, in a good way. They are already double their projection for total number of handsets by the end of 2013. And I’d feel safe saying that they’re going to get to a billion before 2014. And since they were low on the total number of activations, their projection of $280M for 40M handsets was probably low, but let’s use it as a reference. Next up, Android’s ad sales in 2010, also now public:

Not bad but won’t move the meter for a company with $43 billion in annual revenue. Finally, Google’s projections for Android:

Before we go into the numbers let me say that I hate that concept of ‘gross revenue’, which just means sales before rebates and taxes. So that’s a meaningless number, it’s essentially the amount of cash you have to process, not what you have to work with. And with mobile handsets being subject to all kinds of carrier promos and discounts and mail-in rebates and contract renegotiation talks, the net number is the one we care about. Even still, using the previous figure of Google underestimating handset sales by a factor of 10x, let’s halve that (because the music and digital content businesses haven’t taken off) and multiply the net revenue number by five, for about $8 billion in Android revenue.

Even without the same kinds of profits Apple makes from iOS, the sheer scale of Android, and their ability to monetize mobile, means that three years from now Google will conservatively have Android sales of $10-15 billion, or just under half of total revenues today. Going with the low-end of the range of $10 billion and adding that to the current revenue number and keeping the same price/sales for the stock and Google would be about 40-50% higher in 2015 than it is today.

The most exciting thing I see on the horizon isn’t the ad sales that will almost certainly materialize, but the network effects of a billion Android users and the ways Google can leverage that scale. If one billion people are on the same mobile OS and you know where they are precisely and they have a biometric scanner on their phone, do you really need Mastercard and Visa to take their 3% to verify the funds and identity? That’s why Google is working on Google Wallet. If one billion people are constantly sharing their location by virtue of having their phone switched on, could you sell them stuff based on where they are? That’s why Google is working on Google Offers. And if one billion people care more about the device than the network and will pick the service based on who has the cool new Android phone, couldn’t you launch your own data service? That’s Google Fiber. And that’s why Google is working so furiously on Android, not for the $10 billion in ad revenue that it will surely get, but the $100 billion in revenue it can potentially tap into over the next two decades.