I’ve been betting my time, money and reputation on the idea that…

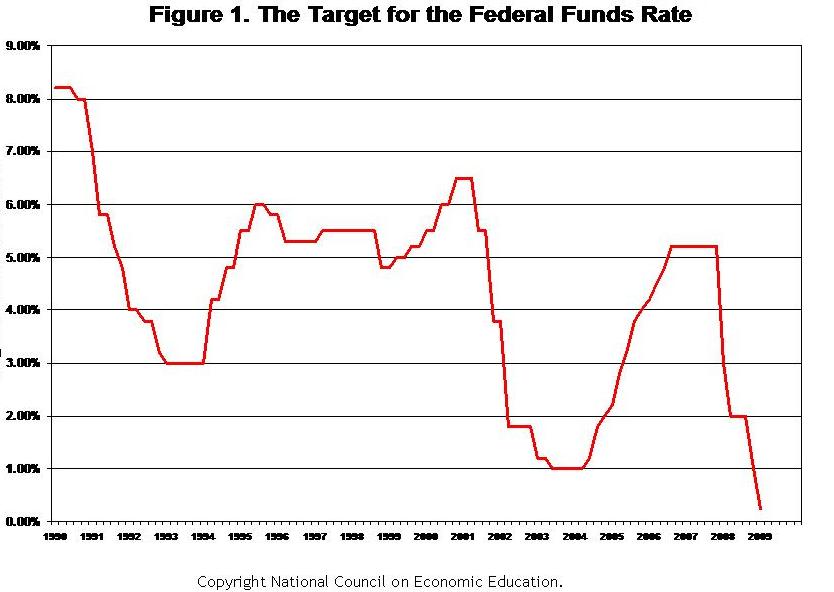

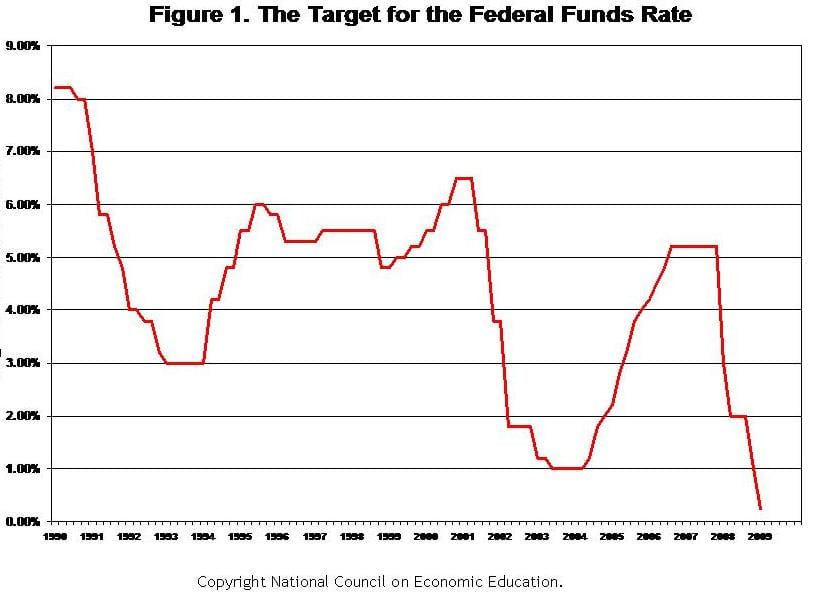

Do you remember how in the mid 1990s how the Fed kept rates at artificially low rates, eventually dropping them all the way to unprecedented levels in the midst of a market boom over stupid concerns about Y2K? Do you remember how that was a large part of what propelled us into a great tech/dot-com/telecom bubble?

Do you remember how the Fed kept rates at artificially low rates, especially starting in 2002 and on through to 2005 or so, eventually taking them to levels yet again unprecedented levels and leaving them there as the stock markets boomed and real estate went wild? Do you remember how that was a large part of what propelled us into a huge real estate and banking bubble?

Long-time readers know that I’ve been betting my time, money and reputation on the idea that we’ve been heading into the greatest bubble ever in large part because. Think about it…You know what I think I’ll be writing in five or ten years?

Most likely it’ll be something like this:

Do you remember how that the Fed kept rates at artificially low rates, especially starting in late 2008 and 2009, eventually dropping them all the way to a truly unprecedented 0% rate and then going on to create trillions in brand new quantitative easing methods, even as the stock market and commodities have been in big-time boom mode? Do you remember how that was a large part of what propelled us into the greatest asset bubble that the world had ever seen?

And then today comes news that Bernanke’s more likely to figure out ways to take the existing unprecedented easy monetary policies and make them yet even more unprecedentedly easy monetary policies. Holy cow.

These Fed idiots are forcing everybody who has any money at all to risk it in desperation for some sort of return. My parents, my old hedge fund partners and even my own money, are desperate for any kind of return on the capital. 0.4% in the money market and 0.2% in the savings account ain’t gonna cut it.

So what happens when the Fed continues to create unprecedented amounts of dollars and forces trillions of dollars of private capital into risky assets like corporate bonds and especially stocks?

You tell me.

I sure think we’re most likely headed into yet another unprecedented asset bubble. And I’m continuing to bet that way, with my aggressive (and nicely profitable!) positions in Riverbed, Apple, Cypress, and even Visteon and other older school assets that are likely to bubble too