I’ve just added to my puts and short in the…

Let’s update our stance, remind you of our positioning and talk about what I expect next for our silver and gold positions.

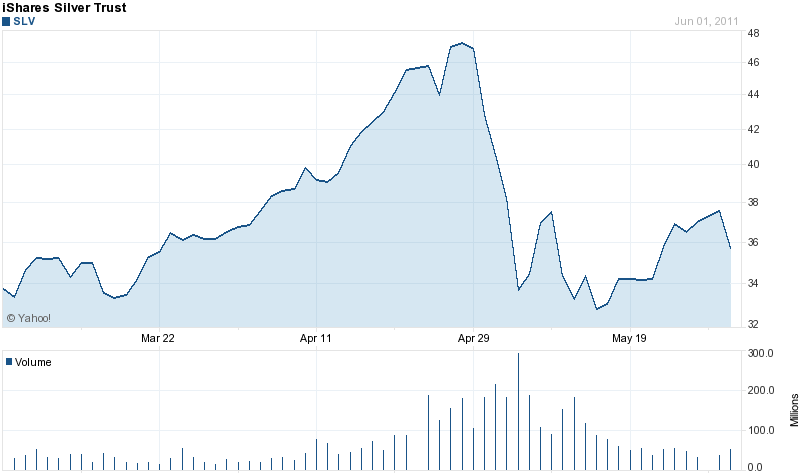

To review, when silver started “dislocating” (see this, this and this) a few weeks ago, it was a flag in my playbook to start building a short position in both silver and in the less volatile, but pretty strongly correlated gold, precious metals. I shorted both the SLV and the GLD ETFs and also bought some puts in both.

Silver subsequently crashed another 20% in just a few days’ time and we covered our short SLV and GLD ETFs and held onto our SLV and GLD puts, which were nicely profitable and which contained a natural stoploss at their respective strike prices, which were (and are) slightly above and slightly below the current quotes for each underlying security.

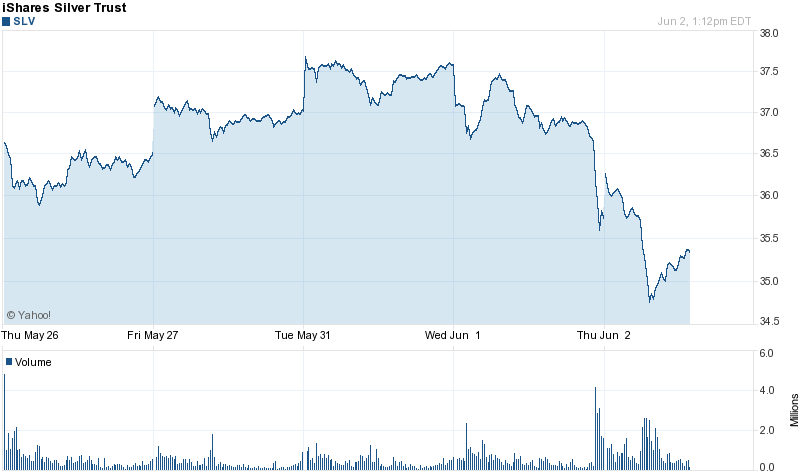

I’ve been holding on to these puts and haven’t added or looked to sell them since, as silver then started trading Steady-Betty in a small range in the mid-$30s. Silver tried to climb back and break through the top of that range at, say, $37 or $38 here in recent days as you can see in the chart below:

Alas, that near break-through was quickly slapped back and the selling yesterday was more intense in silver than in the stock markets where it was rather intense in its own right. And yesterday’s 4% downturn was a big “dislocation” to the downside, along with the crazy intraday action thus far today just might be telling us something about what to expect next:

As I’d noted when I first initiated these SLV and GLD positons, “dislocations” to either the upside or the downside are terrific indicators of mid to long-term topping processes. And in the shorter-term, they are an indication that the volatility, most likely to the downside, is about to return to silver once again too.

I just bought some more SLV puts, spacing myself out over the few months with strike prices and trying to stick to strike prices right around the current $35.50 quote for SLV, say, from $34 to $36. I also shorted a little bit of the actual SLV ETF. I didn’t add to my GLD puts as the premiums there aren’t quite as attractive for those as they are on the SLV puts nor have I re-shorted the GLD ETF. SLV is the much more broken and much more volatile security and that’s the one I’m focused on for now.