New short name

Markets are in rally mode, up 1%, making them about even on the year, which is what they were last week and twelve months ago too. We’ll see more pitches come our way and the only way to continue our vast ourpeformance is to be very different in our approach than just about everybody else. Speaking of more pitches, here’s another stock that I’m going to start shorting today — PNC. I’m going to start with just some short common, maybe about 1/10th as much as I eventually want to be exposed short to. Patient tranche buying is key to our success and let’s keep with it.

If you’re fatigued by a year of markets ruled by politicians, gyrating in both directions, you’re in good company. The 2-and-20 crowd, the hedge fund managers who are supposed to inure their limited partners from the pain of volatility, are having one of their worst years on record; the HFRI Fund Weighted Composite Index is having its 2nd worst year ever, only the third negative one on record.

But let’s not let’s pack up shop just yet, this week I want to briefly review our short position in Wells FargoWFC +1.92% and add a new financial name to our book.

Back in July I repositioned our portfolio, replacing our XLF short (that’s the widely used financial ETF) with a more targeted short in Wells Fargo. I wrote:

“WFC is proportionately more heavily exposed to residential real estate than the rest. It also appears to me that this company has been as aggressive in engaging in under-reserving for loan losses as anybody in the industry since the government bailed these guys out and started allowing such unrestrained flexibility in how these companies recognize the reality of their asset values.”

All of which is still true. At a $146 B market cap Wells Fargo is the very definition of too-big-to-fail, bigger than J.P. Morgan ($126 B) and the combined value of Citigroup & American Express ($134 B). And the legal issues and multi-hundred-million dollar settlements Bank of America has been saddled with haven’t come Wells Fargo’s way just yet, but there’s no reason why they’d be untouchable from the irresponsible lending of the boom years.

Remember as with our Lender Processing Services LPS -0.34% short you want to put on the position before the narrative switches to negative. We want to take a stand before the talking heads who have no skin in the game start reading off talking points typed up by a TV producer’s intern, slamming Wells Fargo as if they’ve known the whole time.

That being said WFC does get treated differently by investors than every other bank out there. Maybe it’s Warren Buffett’s repeated praise (and ever increasing equity position) of Wells Fargo, maybe it’s that investors believe the purchase of Wachovia-Golden West was done at a great price or maybe everyone is just lazy and just repeats and amplifies the consensus that WFC is somehow special. Whatever the case may be, WFC’s stock has barely budged down since June and has even slightly out performed the S&P 500SPX +0.82% . I’m staying short the name, staying patient, but adding another TBTF golem that will be less bulletproof to short-term problems.

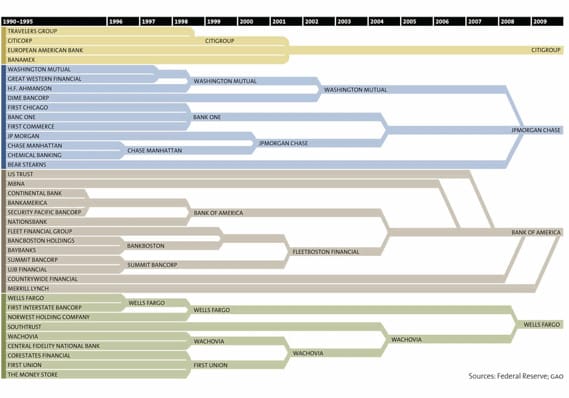

PNC Financial Services PNC +0.97% is the newest big-boy-bank on the block, now the 5th largest by deposits and branches, according to the FDIC . The bank has been growing as of late just like banks did in the 90s, gobbling up smaller regional banking chains, rebranding them with their colors, and telling Wall Street the acquisition is accretive to the current fiscal year. Check out the excellent chart Mother Jones put together from Federal Reserve & GAO data:

Click on chart to expand.

Terrifying right? If you think the industry-approved Dodd-Frank will reverse a two-decade trend of consolidation leaving consumers with only a handful of choices, I’ve got a bridge in outer-borough New York City you should take a look at.

Consider the track record of the Fed failing to recognize that the risks to the financial system were growing ever more concentrated and correlated, and PNC comes in focus as a natural short. Last week the Fed approved PNC’s acquisition of the Royal Bank of Canada’s assets in the southeast, which catapaulted PNC from 7th to 5th place in the sprint to become the largest TBTF bank. RBC is handing over ~420 branches from Virgina to Florida for $3.6B (97% of book value) after a disastrous run, and retrenching to the northeast markets it knows better.

Here’s the kicker though and the catalyst for getting short PNC: they barely have enough money to do the deal. In an 18-page decision by the Fed approving the purchase, the central bank in its infinite wisdom accepted that PNC is stretching its balance sheet to expand its deposit base (which the Justice Department separately claims will not decrease competition) but that financial alchemy will smooth it all out.

(Federal Reserve press release:http://www.federalreserve.gov/newsevents/press/orders/order20111223.pdf )

According to Helicopter Ben’s wizards, after the acquisition, when PNC holds $201B or 2.2% of all deposits in America, it will be able to carry the increased costs by selling $1.0 B in noncumulative preffered stock, another $1.25 debt and other “cash resources” it has on hand. Nevermind that PNC (along with Wells Fargo) was one of the last banks to be let out of TARP—a decision that the inspector general of TARP now says was done because of favoritism and before the banks were on solid footing. (Source:http://www.sigtarp.gov/reports/audit/2011/Exiting_TARP_Repayments_by_the_Largest_Financial_Institutions.pdf).

And here’s the most galling acknowledgement from the Fed, spelled out clearly for all those who actually read what our government says:

“Although capital ratios would decline upon consummation, PNC and PNC Bank would have capital ratios well above the established regulatory minimums. In addition, PNC has been performing capital stress testing since the second quarter of 2009.”

Heard it before, didn’t believe it then, don’t believe it now. This is exactly the kind of deal that should be blocked outright by an alphabet soup of agencies (DOJ, FDIC, OCC). But until regulators step up and do their job, we’ll have to fend for ourselves, shorting the new crop of TBTF banks before everyone else realizes that the bankers are getting money for nothing all over again.