Our Models Prove It: AI Is Already The American Economy's Superman

There is a lot of FUD (fear, uncertainty, and doubt) surrounding The AI Revolution and the American economy more broadly right now. The many bearish macro themes dominating headlines these days – including tariffs, end of U.S. hegemony, collapsing dollar, recession, DOGE cuts, etc. – has resulted in a big pullback in U.S. equities. Even though things have sort of popped/stabilized over the last week or so, the Mag 7 are still down slightly over 20% from their highs last December:

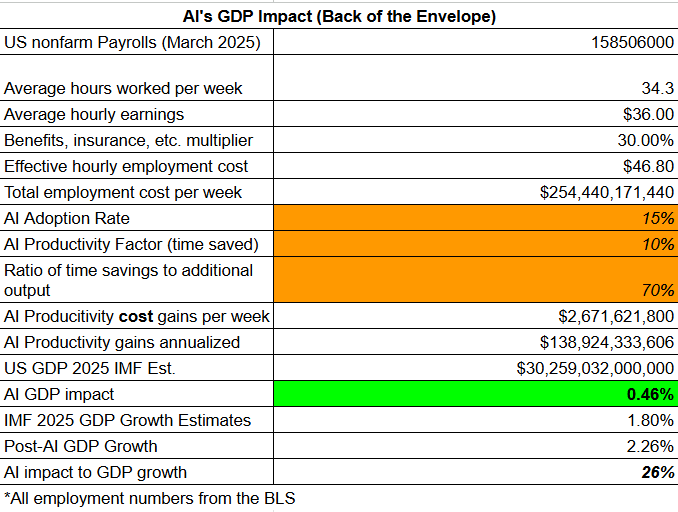

But despite these macro/geopolitical fears, we think AI is a big tailwind to economic growth in 2025, and will actually move the needle in terms of overall GDP growth this year. As we explain below, we think AI has the potential to be a 0.46%-0.93% kicker to U.S. GDP growth in 2025, which is currently estimated at a meager 1.8% by the IMF. Moreover, the IMF estimate is already down from where it was earlier this year, and most Wall Street analysts raised recession odds this year to around 50% as the markets were crashing in April, meaning most of them are probably whispering about an outright recession this year. But our research indicates – and the Q1 earnings reports so far seem to back up – continued strength in corporate earnings throughout the year as AI only gets better and adoption continues to go up. We also expect our portfolio of AI and Robotics Revolution stocks to lead the march higher as well.

As the trade war and macroeconomic headlines have gripped most institutional investors, most people seem to be forgetting that The AI Revolution is happening in earnest right now. To many, AI is just some mystical idea that has the potential to change the future, but they are forgetting that it's actually having a meaningful impact on the economy today. And while some economists and Wall Street analysts have modeled out AI's potential long-term impact, basically none of them think it can move the needle for the broader economy in the next year or two.

Those economists and analysts are forgetting that AI – in its present form – is already tremendously helpful for many tasks and is showing signs of boosting productivity for American workers, most notably in the services sector. This is important because the U.S. is a services-based economy, with around 80% of U.S. GDP coming from the services sector (another fact that everyone seems to be forgetting right now with all the fretting about tariffs). Accordingly, even a marginal impact on productivity for services workers can have a big impact on overall economic output. According to our model, AI is starting to move the economic needle.

As you can see above, our original base case simplified version of the model shows that AI could have a 0.46% impact on U.S. GDP growth, which is significant given the current IMF forecasts (1.8%), meaning our estimated AI boost to the economy would in a 26% boost to consensus estimates.

We arrive at this estimate by calculating the total U.S. employment cost using official Bureau of Labor Statistics (BLS) numbers for total workforce, average hours worked, average hourly earnings, and benefits multiplier. We then take that number and apply our subjective inputs for AI Adoption Rate (the percentage of U.S. workers using AI daily), AI Productivity Factor (the percentage of time saved by AI adopters), and the Reallocation Factor (the ratio of time saved using AI that the workers put back into productive use (as opposed to leisure)).

When Cody and I built our initial model above, we used our best estimates to come up with the subjective inputs, and we were both surprised to see that using what we viewed as reasonable estimates, AI could have a material impact on the broader economy this year.

For context, most Wall Street firms and economists have essentially zero impact from AI modeled into their 2025 GDP growth forecasts. Even though Goldman Sachs purports to have a more optimistic outlook on AI than some of the other institutions, the bank chose to leave its GDP forecasts unchanged for 2025 and 2026 after its research indicated AI's net impact on U.S. GDP in those years was negligible (only 0.10% per year at best). And notably, over the next ten years, Goldman thinks that AI might accelerate GDP growth to a meager 2.3% annually relative to their 1.9% baseline growth rate.

After we realized the disparity between our view of AI's economic impact compared to the Street's, we decided it was worthwhile to dig deeper and see if we could build out a more detailed model proving up our assumptions, and then back that up with real data.

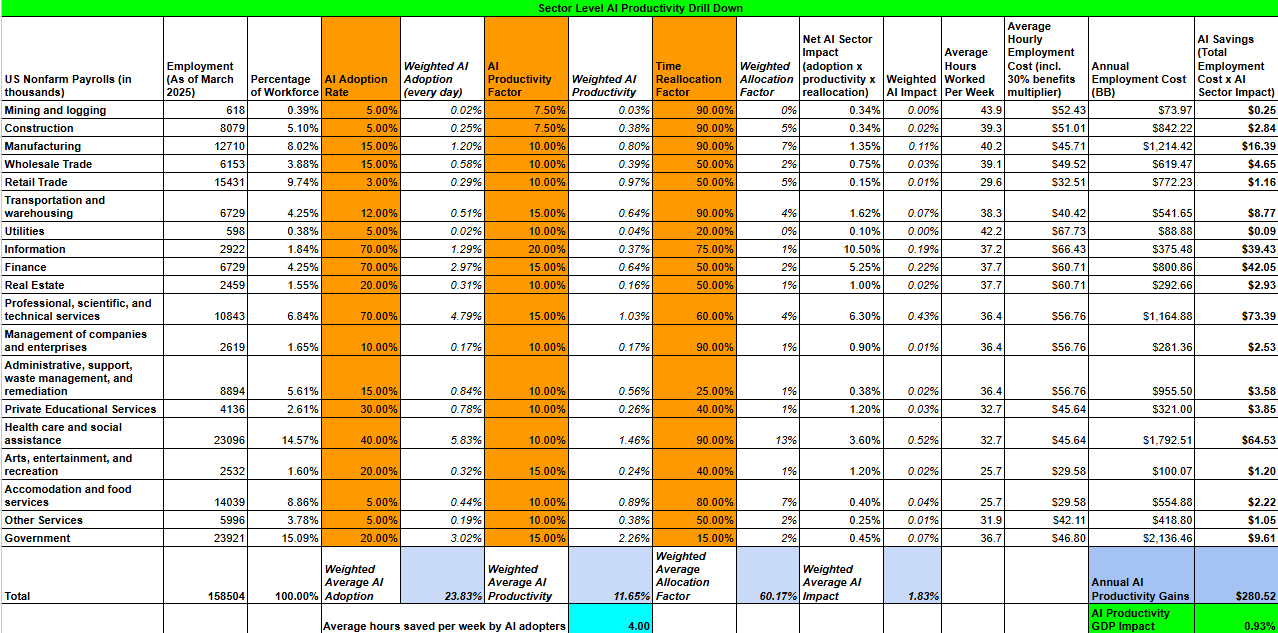

So we broke down the total U.S. workforce using official BLS data for March 2025 by sector, and then applied our three subjective factors to each sector of the economy. We also used the official hours worked and hourly wages for each sector according to the BLS. It makes sense to do this sector-level analysis because the adoption of AI and its productivity impact are not uniform across the economy, and certain sectors, of course, earn higher wages than others (professional versus retail services, for instance).

Our much more detailed model, shown below (and available here), shows that AI's potential impact on GDP is around 0.93%, much higher than our original estimate. This is because studies show that certain sectors (like IT, professional services, and finance) are much higher AI adopters, and AI is also more useful to those sectors than to other sectors (like retail trade and construction). In other words, there is a very high correlation between AI's productivity factor and its adoption rate (around 0.94 correlation according to data collected by the St. Louis Fed). Moreover, because the sectors of the economy most impacted by AI are also the highest wage earners in the economy (again, IT, professionals, and finance), the impact on the economy is actually much greater than our original model showed.

If AI's productivity impact actually contributes close to 0.93% to GDP growth this year, that would put overall U.S. GDP growth at 2.73%, or 51.6% higher than the IMF forecast for this year, or perhaps keep Wall Street's now-consensus recession forecast from happening.

We also cross-checked our model with real-world surveys to ensure that we were in the right ballpark in terms of the assumptions we made. As of late 2024, surveys from McKinsey and the St. Louis Fed show that generative AI has quickly become embedded in the work routines of a growing share of U.S. workers. While only 9% of workers use generative AI daily and 14% at least once a week, those who do rely on it heavily—with over half of daily users reporting using it for more than an hour a day. Among all workers who used AI in the past week (roughly 22%), between 6% and 25% of their total work hours were assisted by generative AI. Even when accounting for the full workforce, including non-users, the data suggests that 1.3% to 5.4% of all work hours across the U.S. are now AI-assisted.

Measured productivity gains are material as well. Survey data from November 2024 indicates that generative AI users saved an average of 5.4% of their work time, equivalent to 2.2 hours per week for a 40-hour worker. Spread across the entire labor force—including nonusers—this translates to a 1.4% total time savings.

We were encouraged to see that the results of our sector-level model were roughly in line with the actual survey data. For example, our model reflects that AI is resulting in productivity savings equal to roughly 1.8% of the total hours worked, only slightly higher than the St. Louis Fed's research at 1.4%. Moreover, our adoption rates and estimated productivity factors are within the range of possibilities even if they are somewhat on the higher side of survey data. But it's important to note that our estimates are for the full year 2025, and the surveys were done late in 2024, and given AI's rapid pace of improvement, we think it is reasonable to see these numbers continue to climb slightly throughout the year.

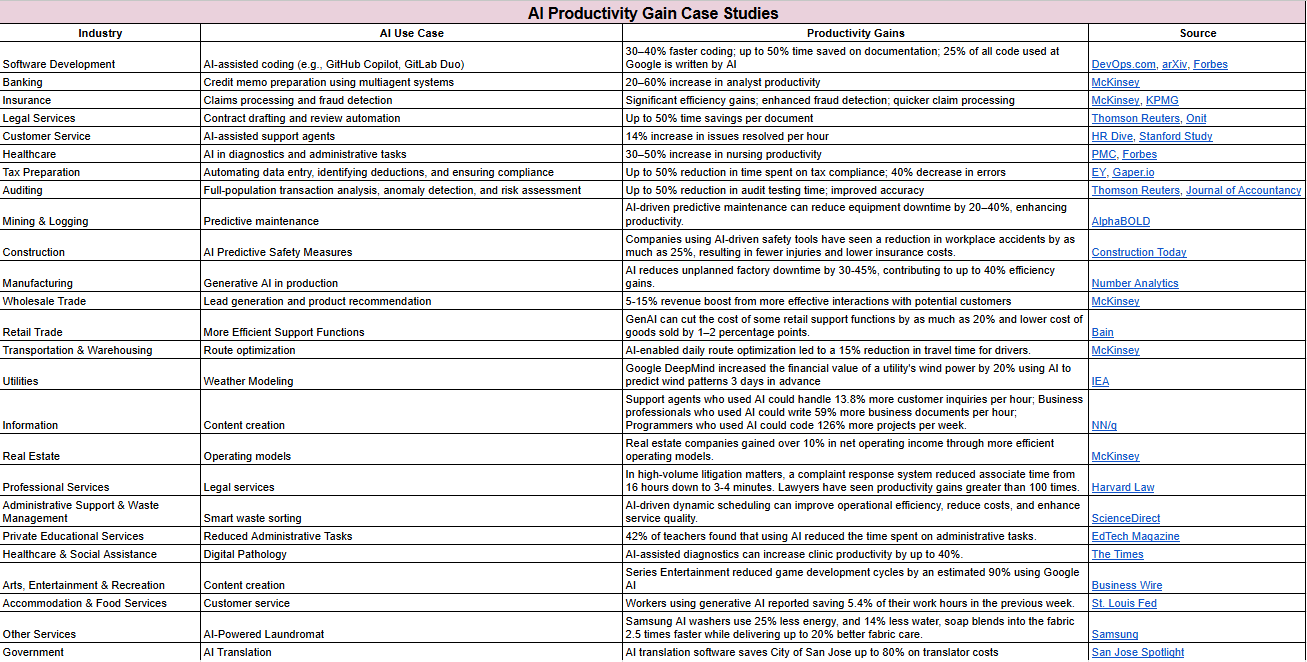

Finally, we checked our assumptions against individual case studies to ensure we were in the right ballpark for each sector. It was remarkable reading these case studies (some of which are already two years old) and seeing how AI is already making a big impact on productivity for discrete tasks within certain sectors. In nearly every sector of the economy, research has shown that AI is making at least some impact on worker productivity, but in many cases, the efficiency gains for individual tasks are tremendous (for example, some lawyers report being up to 100x(!) more productive already). The full table with all of the case studies we reviewed is shown below and available here, but here are a few notable ones to call out:

- AI produces 30–40% faster coding, and 50% time saved on code documentation; further, 25% of all code used at Google is written by AI.

- A study from Harvard Law School found that AI reduced associates' time dealing with client complaints in high-volume litigation by 99.6%.

- A recent report estimates that voice-to-text transcription will result in work time savings of 17% for doctors and 51% for registered nurses.

- According to EY, using AI has reduced the time spent on tax compliance by up to 50 percent by the Big Four accounting firm.

In conclusion, we think Wall Street and a lot of the people fretting about macroeconomic conditions are potentially not accounting for one of the biggest macro forces going right now: AI. As our models show and the data proves out, AI is already having a sizeable impact on the United States' services-based economy.

Accordingly, we think AI is a big tailwind for growth in 2025, and we think it may help offset any headwinds created by current trade uncertainty. Critically, we think trade uncertainty will actually accelerate the adoption of AI, as enterprises look for more ways to control costs and boost productivity. Not to mention to benefit from AI in a post-Trump-Tariff-Tiff world when their competitors are not. We expect to continue to see earnings grow for the S&P 500 throughout the year as AI efficiency keeps becoming ever more material to corporate earnings. In our view, this is already starting to show up as Q1 earnings and Q2 guidance have come in fairly strong despite unprecedented levels of trade, geopolitical, and macro uncertainty. We're not saying a recession won't happen as the macro uncertainty out there is very real, but at this point, the hard data indicates that the recession isn't here yet, and our work confirms that AI is part of the reason for that.

Therefore, we remain very bullish on our AI Revolution stocks, including Nvidia, Google, Amazon, Tesla, Meta, GitLab, CoreWeave, and the other stocks in the portfolio, which include the key enablers and beneficiaries of AI. And in terms of the trade tensions and pressures to redomesticate the supply chain, we would call out Tesla, AutoDesk, Texas Instruments, and Amazon (yes, even Amazon despite the many foreign-sourced products sold on its site) as winners here given there existing focus on domestic manufacturing and automation.

Also, we will do the Live Q&A Chat on Wednesday (April 30th) at 12:00pm ET in the Discord Channel or you can email your questions to support@tradingwithcody.com.