Position round up

Amazon’s topline is light and the stock is down 10% after hours. I’ve missed two earnings trades in a row (Sandisk last week and now Amazon this week) and I’m extremely disappointed about that. I will step back and re-evaluate and step up my game.

In the meantime, we rounded up and added to all my recent analysis on most of our positions. Here it is:

We’re right in the middle of earnings season, and it’s the right moment to catch our breath and take stock of some of the less talked about, but no less important, positions in the Revolution Portfolio. In the the last couple weeks we’ve introduced a new financial short, PNC Financial Services PNC -0.09% , a new education short, Apollo Group Inc. APOL -1.43% and gotten long an old friend in tech, F5 Networks Inc. FFIV -0.23% (which for those keeping score, popped 20% on earnings just after we recommended it here).

So no new meat this week, but with Europe still futzing about and Facebook’s many-dozen-billion IPO on the horizon, we’ll have plenty to gnaw on pretty soon.

DBA

The PowerShares DB Agriculture Fund DBA +0.68% is now the smallest long in the portfolio. Remember, this isn’t a trading ETF for us as it is for many hedge funds; this is the cheapest way to get long the long-term, ever-increasing demand for agricultural products of all kinds.

After a brutal and supervolatile fourth quarter, commodities managers cut their bullish bets, sometimes tossing out positions built the whole year in a matter of days. But there are signs that commodities could catch a bid as hedge (or at least cross-hedge) against inflation. The CFTC said in its Jan. 24 Commitment of Traders report that bullish positions jumped 13% as the Fed promised to keep the zero interest-rate policy in place through 2014. This ETF will get hit in a global slowdown, and that’s when we’ll look to put on cheap, long-term bets.

SLV (didn’t know what you thought about this one, so I wrote what I think!)

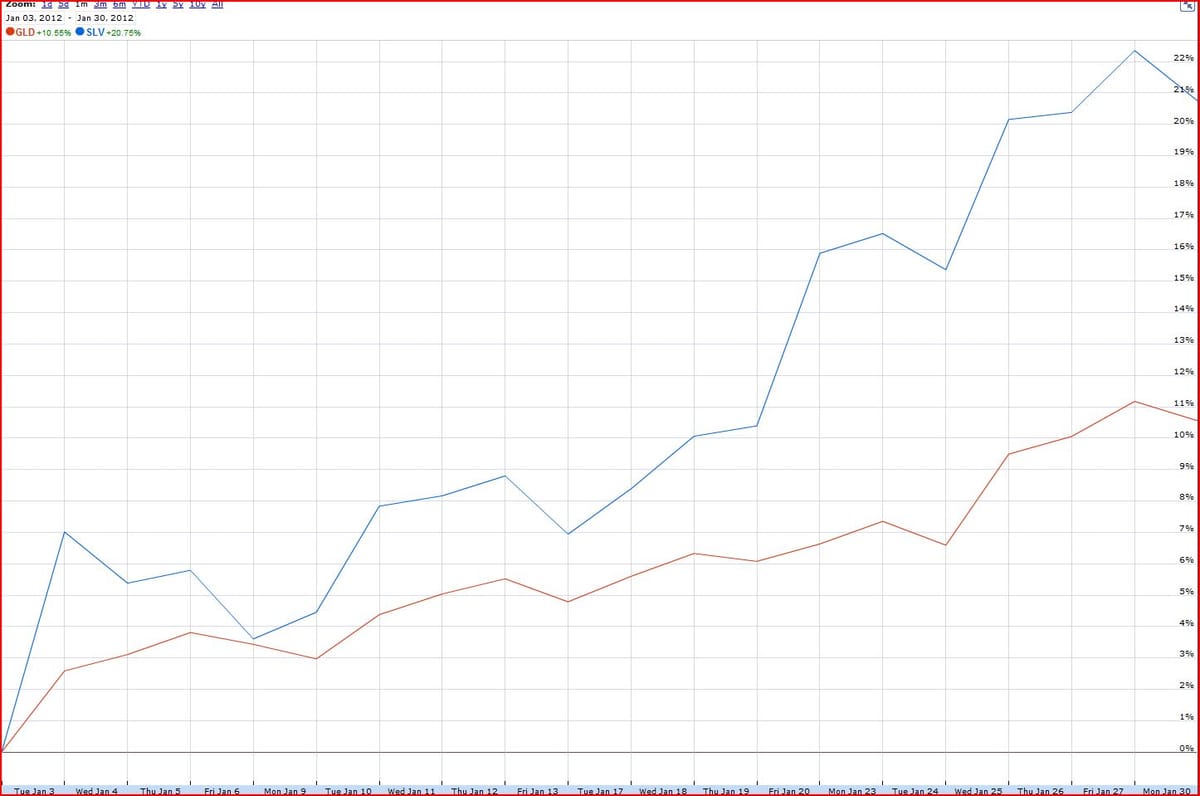

From the smallest long to our smallest short. As you can see from the chart below, iShares Silver Trust SLV -0.80% has been outpacing the SPDR Gold Trust GLD +0.58% as a cheaper alternative for the metals crowd, as they try to hedge debasing by central banks.

For the time being, this is going to be ruled by macro news, and everything that nations are doing to bail out failed states is inflationary. In the very short term, we may add to this short because in a real flight to safety, the dollar should strengthen, taking down any speculative hedge denominated in greenbacks, namely SLV.

Nuance

Even though no one in the know will admit it, least of all famously tight-lipped Apple Inc.AAPL +0.70% , Nuance Communications Inc.’s NUAN +0.25% software is clearly somehow part of the iPhone 4S Siri functionality. Apple stole the show at CES again without showing up, and everyone and their mother considers it a fait accompli that Steve Jobs’s pronouncement that he cracked TV means one with voice commands is coming. We’ll see.

But I’m not complaining about a stock up 13% for the year to day. I sold one-third of my Nuance calls that I bought at 45 cents and were up 10x.

Cypress

A subscriber in the weekly TradingWithCody.com chat on Jan. 11 asked if it was time to up our position. Here’s how it went:

Q: What about CY Cody, is it time to add?

A: I think Cypress Semiconductor Corp. CY -0.98% might have some inventory in the supply chain that’s being drawn down a bit, which could limit the upside from this quarter. That said, if the company sees that inventory down heading into next quarter, it could mean some upside guidance. Longer term, I’m starting to see the chip vendors try to integrate some of Cypress sensor-motion technologies into their chips, which is worrisome and something that I’m staying on top of.

Bottom line: No rush here especially because the long-term store might be changing. Motion-sensor technologies are red hot right now, and besides the established chip makers, there are more than a few start-ups getting funded at big valuations to tackle the idea. Short term, Cypress guided below what analysts were expecting, about $200 million in first-quarter revenue vs. the $228 million the Street estimates. Staying in the portfolio — for now.

Visteon

I do think auto sales are reverting back to a mean that is probably 15% to 20% higher than the total sales of the industry in 2010 … but some of that already has been priced in. I continue to think that Visteon Corp. VC -0.50% is a much better/safer play on the auto industry than Ford Motor Co. F +0.57% would be, because of Ford’s banking business being so bad. (Alliteration at last!)

Autos may even show some global growth next year and VC, as a major auto supplier, would be a good beneficiary of that.

Microsoft (Nokia payment: a drop-in-the-bucket rounding error)

Softee’s tough in the near term. The stock MSFT -0.20% is just so loathed by the big money managers who don’t own it and has been such a long-term holding of those who do own it, that it really will take some surprising success from Windows Mobile and the Nokia Corp. NOK -0.20% partnership to drive MSFT into the $30s.

It came out that Microsoft Corp. paid Nokia $250 million, or one and a half days of revenue, to use the platform in its phones. While it’s accepted practice to scoff at Redmond, I think the software giant could pick apart the carcass that is Research In Motion Ltd. RIMM -2.36% and grab some pretty nice enterprise market share.

I plan on holding the MSFT position I own for a while, and don’t know when or if I’ll add to it.

Live Nation

If you’re a fan of the Boss like I am (OK, if you don’t like Bruce Springsteen I don’t want to know about it), then you have to be a little disheartened that one of the gods of rock ’n roll still has to deal with the clowns at Ticketmaster, a unit of Live Nation Entertainment Inc. LYV +0.49%

After loyal fans were frozen out from buying tickets to Bruce’s upcoming gigs, the company was forced to admit that scalpers totally know how to game its system. Just last year in federal court, the case of a scalper using Bulgarian hackers (really) to cheat their way to $25 million in gains at the fans’ expense was another black eye for LYV. With hugely popular festivals like Coachella and selling out consecutive weekends in two hours at hundreds of dollars a ticket without Ticketmaster, Live Nation’s middleman days are numbered.

Hopefully the next time the Boss plays the Garden State, he’ll bypass these fools. LYV is our secondest smallest short after falling 27% last year; holding onto it for now, but it’s an ever-shrinking part of the portfolio.

Autodesk

After announcing a couple acquisitions, analyst upgrades and reaffirming 2012 guidance, Autodesk Inc. ADSK +0.14% shares are on an absolute tear this year. With the Dow Jones Industrial Average DJIA -0.13% and S&P 500 Index SPX -0.04% showing 3% to 4% gains, ADSK is up better than 18% on virtually no news. No net debt and $1.34 billion in cash (or 44% of assets) means that Autodesk is primed to take advantage of turmoil in the industrial world from the euro zone.

I expect ADSK to pick up more companies/partnerships on the cheap and I think the market is starting to pay attention. Hold and love.

Fusion-io

Then there’s Fusion-io Inc. FIO -3.82% This indeed has been one of the most wildly volatile stocks that you’ll ever own, as I’d predicted when we’d first bought some. You guys know that I was buying more common and calls all the way down to the low $20s, and then nibbled on it some more as it started rebounding into the mid-$20s, then watched as it crossed $30 a share, which made it up nearly 50% from its quarterly lows. I trimmed some of the position as the calls and the common had gotten so big relative to the rest of the portfolio.

That’s basic portfolio balancing, and it’s important. Too many money managers let winners run and don’t trim back when they become an overweight part of their book

Our prudence paid off: FIO was down 15% after the report and it’s now flat at about where it was a few weeks ago, and still up 25% from where it was a few weeks before that, and still up nearly double from where it was a few weeks before then — but still down 25% from its peak. Like I said, this one’s volatile. As I’d explained last quarter, there’s little difference between paying $25 or $30 for a stock that could possibly earn, say, $5 per share per year in a few years’ time but that might only earn 50 cents per share per year in a few years’ time.

Point being that nothing changed my analysis or my stance in last night’s report, and I likely will be buying back the calls we’d trimmed before the report in coming days. Not today though, letting it settle in again.

SanDisk

As for SanDisk Corp. SNDK -0.95% , mea culpa. The stock was down 10% the morning after earnings, even though the company beat estimates because it also guided a little bit lower for this quarter. (The morning after can be rough.)

Nothing to worry about longer term for SanDisk investors, but the calls we bought took a big hit. I’m going to hold my SanDisk longs steady. We still have huge gains from our purchases when it was in the $30s that more than offset any paper losses. Still not happy about losing money and making that mistake in front of you though.