Remember the pain of the bottoms while we’re at new highs

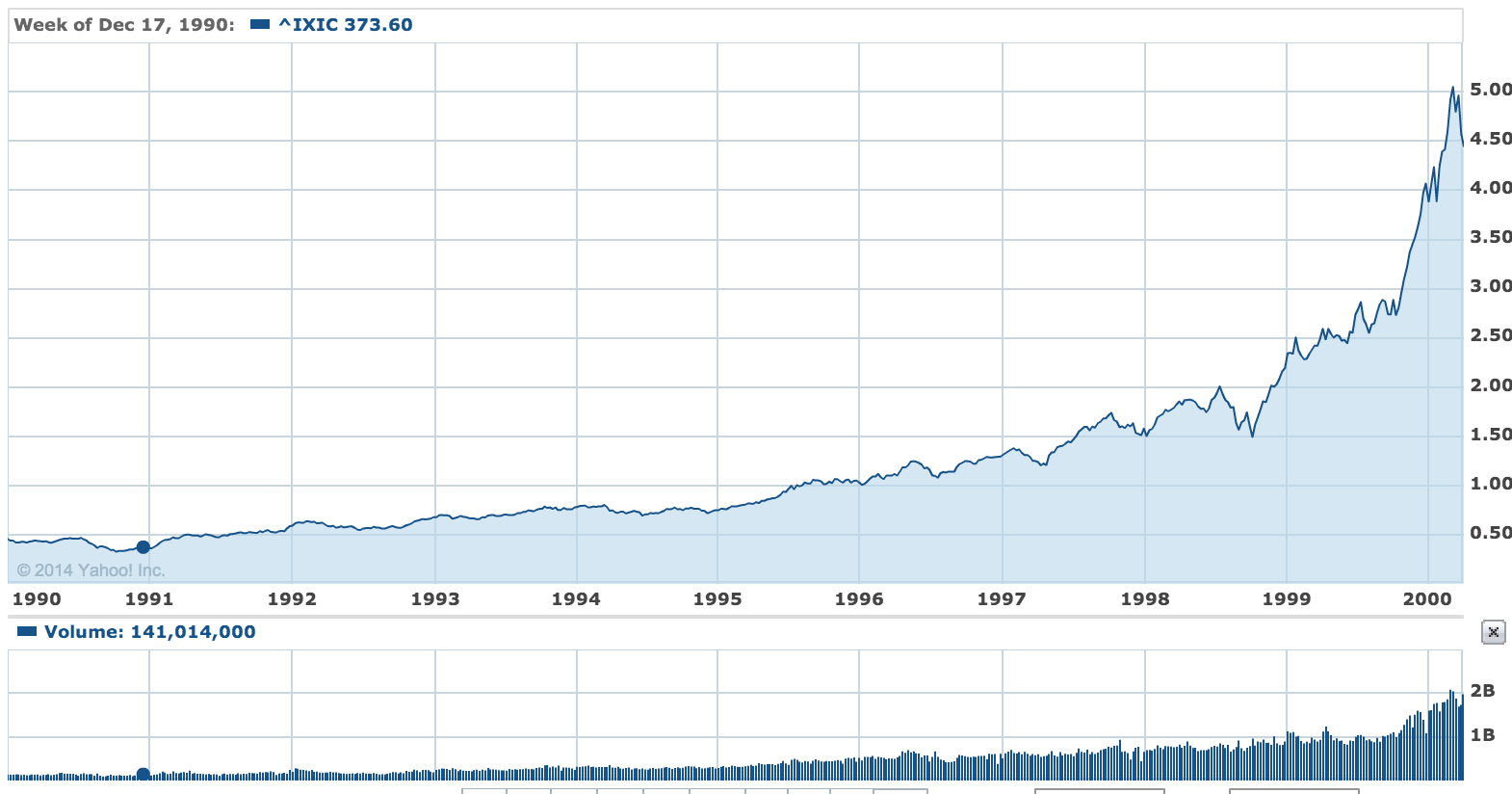

I’m going to use the Nasdaq to drill home some important concepts about why we buy weakness and trim new highs.

The Nasdaq is at a 14-year high. It’s within 10% of the dot-com tech bubble peak of 2000, as well as being up 300% since the 2002 post-dot-com tech bubble crash.

It’s up 150% in the last five years, rising at a rather steady 20% annual rate since the 2009 bottom. Go back to the March 2009 bottom, and its up nearly 250%.

From its bottom in Operation Desert Storm bottom in 1990 to its March 2000 peak, the Nasdaq went up 1400%. From its 1992 bottom to its 1996 peak, it rose 150%.

From its 2002 bottom to its 2008 peak, it rose 180%.

How far could we fall if this ongoing bubble-blowing bull market finally crashes?

From the 2000 dot-com tech bubble peak to its 2002 nadir, the Nasdaq fell nearly 80%.

From its 2007 peak to its 2009 nadir, the Nasdaq fell more than 50%.

So what are the lessons of the above analysis?

Taking a long view of the Nasdaq, and more importantly, the companies that comprise the Nasdaq which is known as a tech-heavy index for a reason, buying on crashes and trimming on big rallies has been the most profitable way to ride the overall climb higher as it has been and continues to be a wildly volatile index full of even more wildly volatile stocks.

Underpinning the overall climb higher is earnings growth. Microsoft, Apple, Google, Oracle, and so many other formerly small-cap tech stocks have generated tens or hundreds of billions of dollars in earnings for their shareholders over the last twenty-odd years.

The rallies in the Nasdaq have lasted for many years at a time, with five to eight year bubble-blowing bull market trends not uncommon. We are currently in year five of this ongoing bubble-blowing bull market. Could it last another three years? Sure. Could it go another couple years after that even? Doubtful, but not impossible. History rhymes, it doesn’t repeat.

The post-bubble-blowing bull markets usually followed up by two year-long crashes that range from 50% to 80% in their severity. Should we be preparing for that kind of a crash right now? We don’t have to try to nail every top and every bottom as we ride these cycles in the markets and the economy.

That’s why I suggest trimming down a bit of your overall net long positioning and making sure you’ve got a bit more cash and other assets besides stocks, tech stocks and any other sector in the market included, to a level that you’ll be able to have some flexibility when the next crash comes. We try to have our cake and eat it too, by holding onto our many long positions overall, but trimming each of them down and selling the entire position of names that you’ve not got the utmost confidence in.

Remember the pain of the bottoms while we’re at new highs.