Six Web Bubble 1.0 Stocks and Why I’m Watching Them

The best way to get a macro view is to assimilate as much data as possible. I know oil traders who track the number of construction cranes sold worldwide as an input in their crude demand models. And sometimes the best data comes from companies that are leading indicators of the broader economy. That’s why every hedge fund manager follows Fedex and UPS, even if they don’t trade them.

Looking at what certain companies say and how their stock is doing is another way to feel out the market. When the inimitable Jeff Matthews broke down Williams-Sonoma’s earnings call in March 2009, he was exactly right that about the big picture. Here’s what he said, in its entirety:

Tuesday, March 24, 2009

“We Believe We Have Stability”

You wouldn’t expect much out of Williams-Sonoma these days.

What with the evaporation of high-paying Wall Street jobs and the kind of buyer who can afford to spend $635 on a chafing dish—which calls to mind one of the best moments in movie history, from Hot Shots!, no less—not to mention the evaporation of low-paying manufacturing jobs and the disappearance of that so-called “aspirational buyer,” you wouldn’t think there would be much of a market for the kind of foofy, “consumer discretionary” items Williams-Sonoma, and its Pottery Barn affiliate, are famous for.

Yet all good economic cycles must, eventually, end: even the bad ones.

And if this down-cycle is ever going to start to turn back up, it has to first stop going down.

So we were intrigued to hear on the company’s conference call this morning the following from Sharon McCollam, the Williams-Sonoma COO:

What we would say about the current environment is we believe we have stability and we are seeing the October/November trend be our baseline. We see it’s volatile. But that’s what we’re seeing.

Now, whether Williams-Sonoma is an appropriate thermometer to measure the health of the American consumer may be debatable.

But at least the patient’s fever looks like it might—might—have stopped going up.

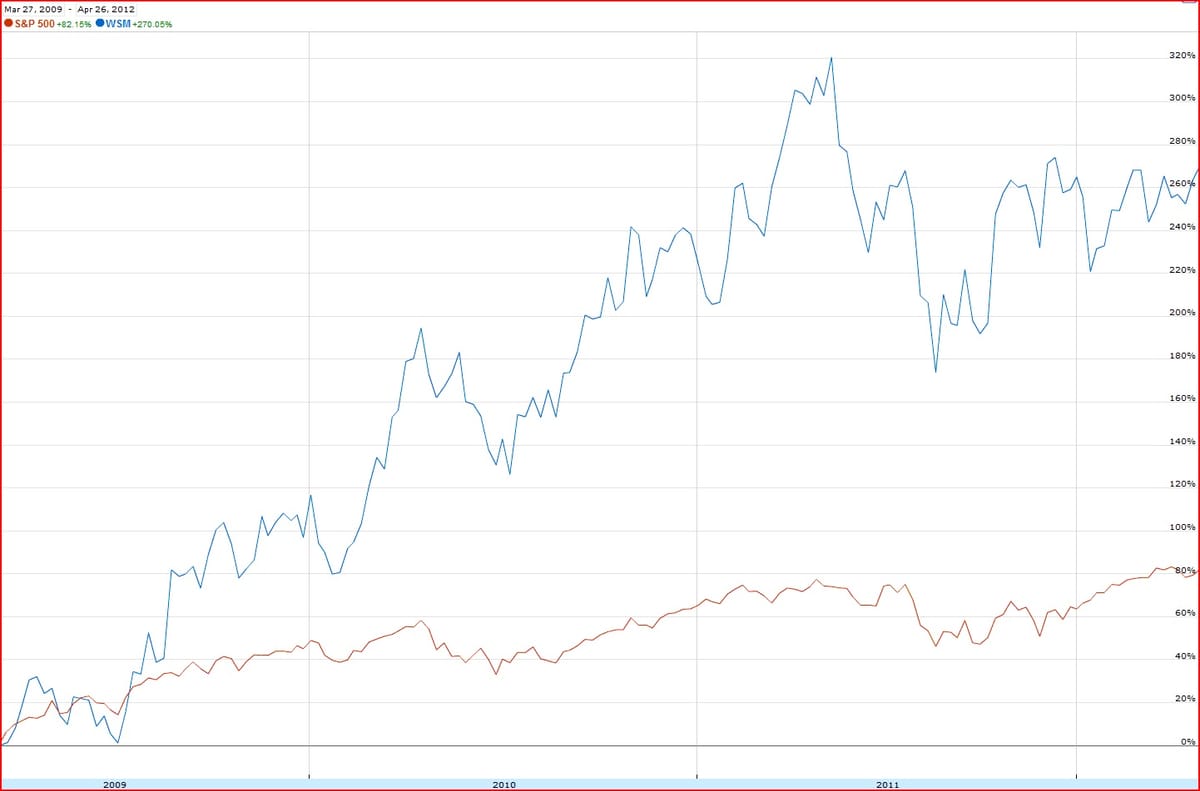

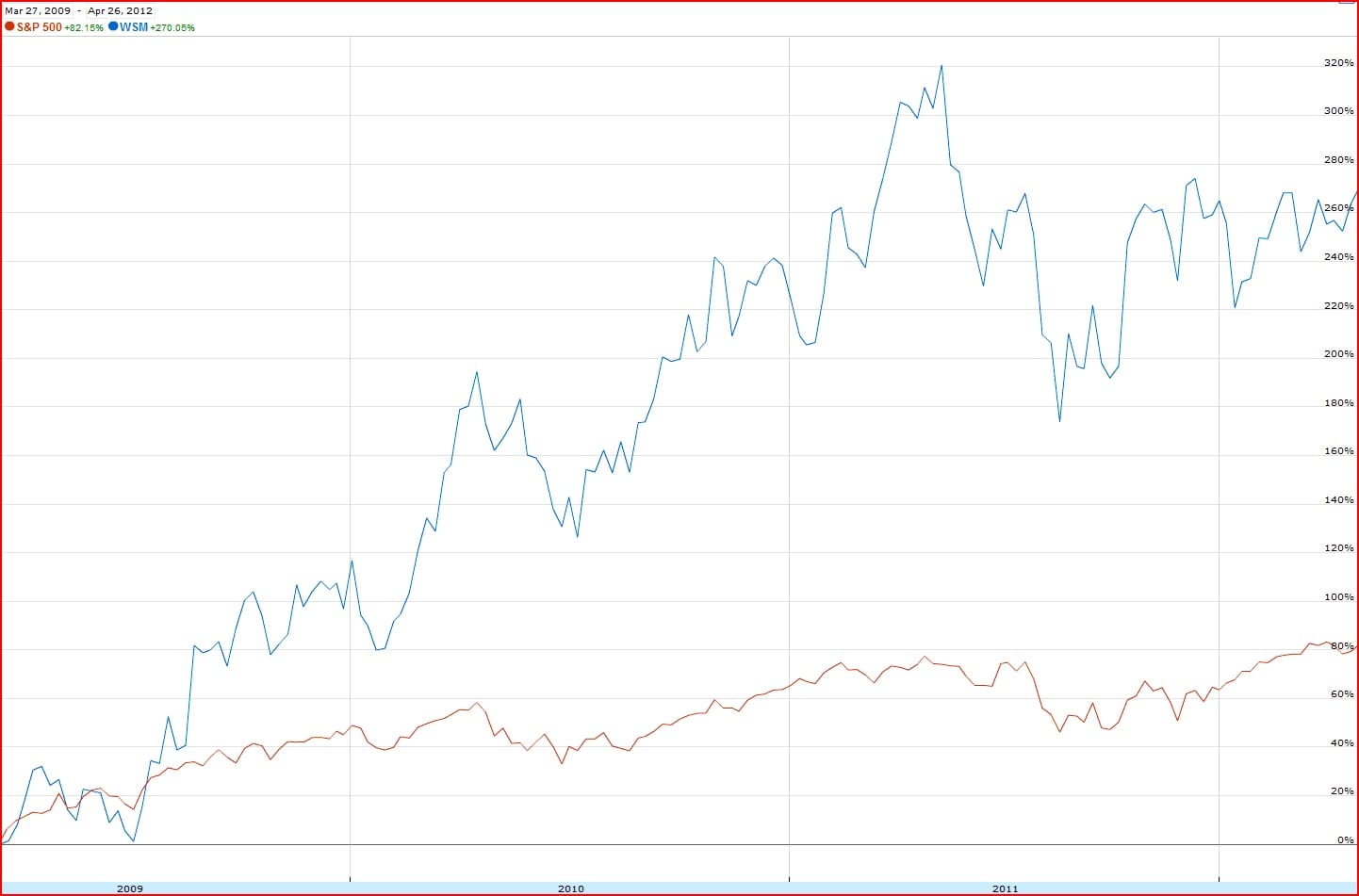

Jeff didn’t know we had already touched the bottom on March 9th but look at the enormous numbers S&P and Williams-Sonoma have done since:

(click on image to enlarge)

(click on image to enlarge)

I’ve linked to Jeff’s original post above. The comments were so dead-wrong in retrospect its hilarious (you should be reading JeffMatthewsIsNotMakingThisUp, by the way). It’s one of the best calls I’ve seen in my years of trading (and Jeff made the absolute best call I’ve ever seen but we’ll save that for another time).

So today I want to let you know about a new piece of data I’m looking with an eye towards Web Bubble 2.0: the stock prices of companies from Web Bubble 1.0.. Over the next couple weeks I’ll be breaking down why I’m watching each one, and why I think they could catch some bubble mo-mo. Let’s be clear, I’m not buying, shorting or recommending you do anything with any of these other than track them. Think of these stocks as a thermometer on just how hot the bubble is getting. Facebook’s IPO should push up the multiples of anything company that can cast itself as ‘social’. And it may even inspire scavenging and rollups of already public internet companies that have long been left for dead. There have already been micro-cap buyouts like that of Answers.com.

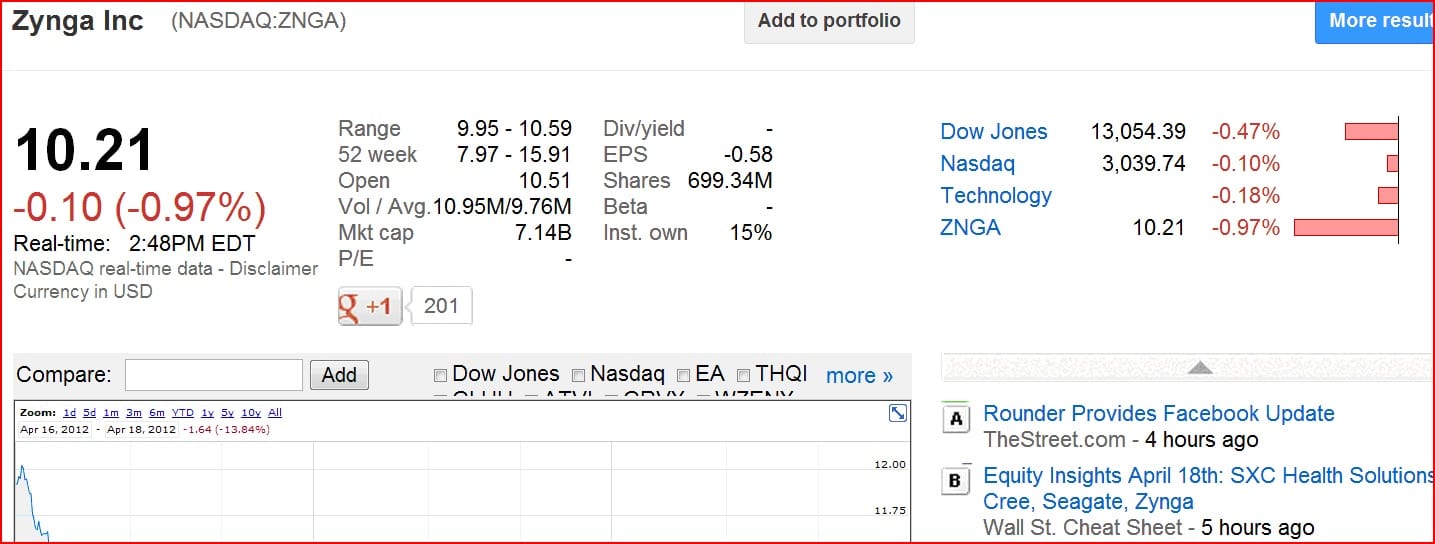

Before we get to the names I want to remind of just how heated the web frenzy was twelve years ago—and mention a shady stock promoter technique I haven’t seen in a while. There was an time when putting out any kind of press release with a mention of ‘dot-com’ could pop a stock 50%+. It got so ridiculous that companies would announce ‘partnerships’ that were little more than reseller agreements and see their market cap double. And that garbage is back in a slightly different way. While looking at Zynga’s chart on Google Finance recently, this is what I saw:

(click on image to enlarge)

(click on image to enlarge)

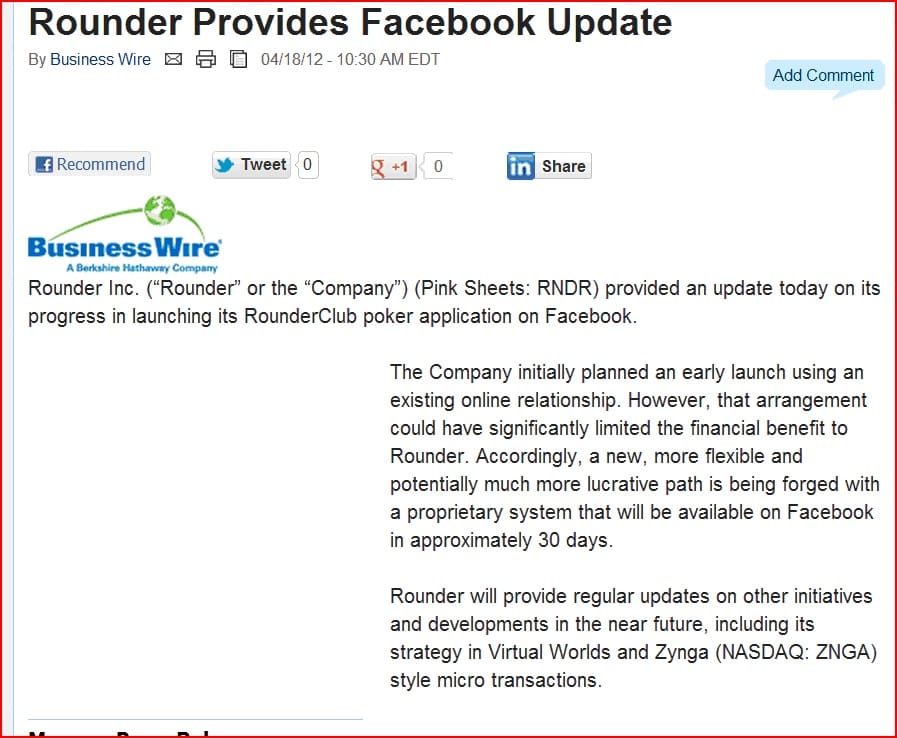

The ‘A’ result in the news about Zynga smelled of penny stock promoter nonsense. Clicking through revealed this press release from Berkshire Hathaway’s Business Wire, republished by TheStreet.com:

(click on image to enlarge)

(click on image to enlarge)

Rounder’s ‘Facebook update’? They are making a Facebook poker app. That is something anyone with an internet connection can do for free. And they worked in they’re knocking off Zynga’s virtual goods system, to game prime placement from Google.

Now this isn’t particularly consequential on its own. The stock, which popped 16%, has a market cap of under $1.5 million. But if you see similar sorts of press releases from already public companies like the ones I’m highlighting, and it starts to really juice their stock price, that will be a great indicator that we’re right back where we were 13 years ago. In the meantime, I’m buying the stocks of companies that supply Apple as a play on the bubble.

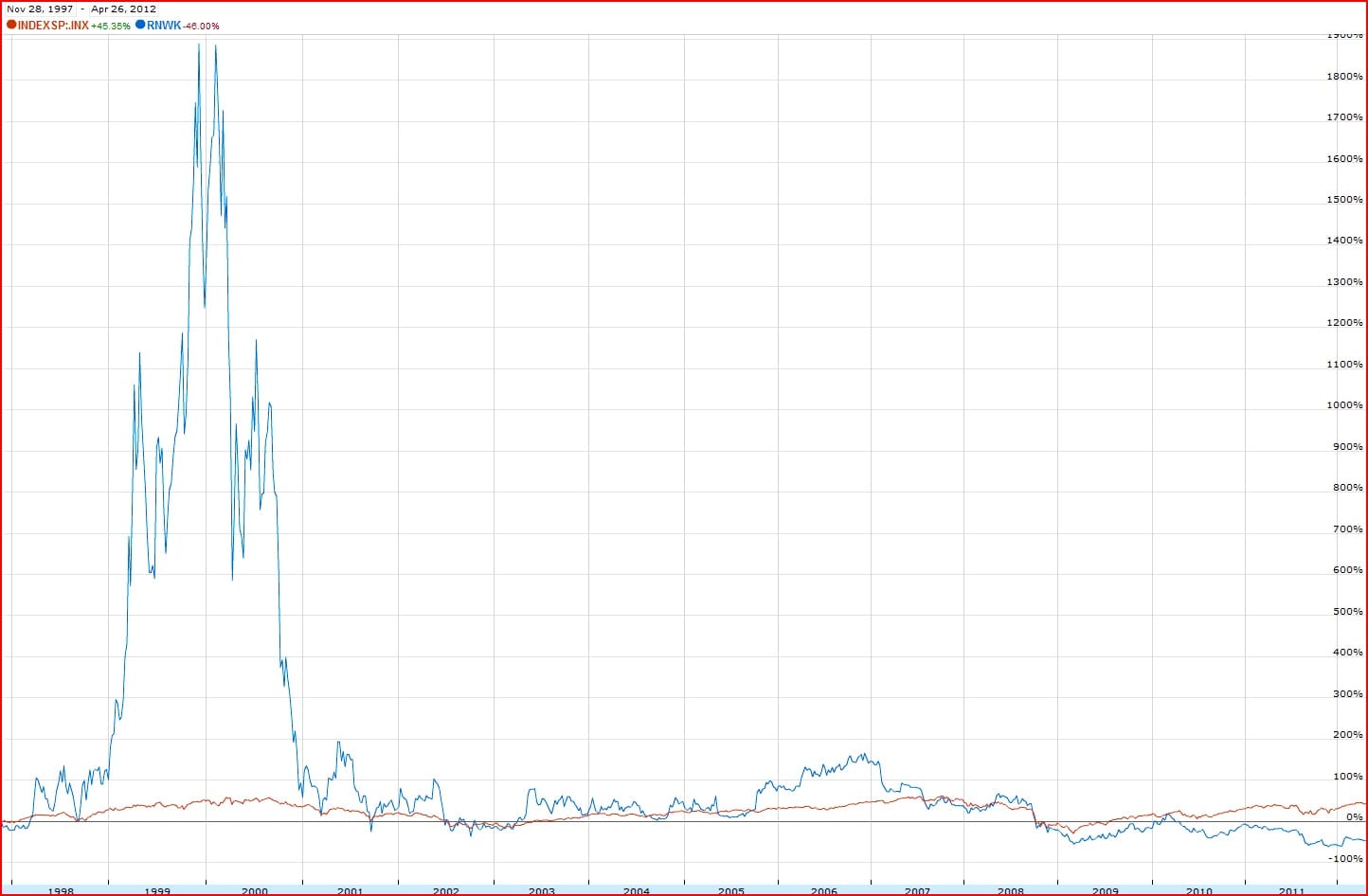

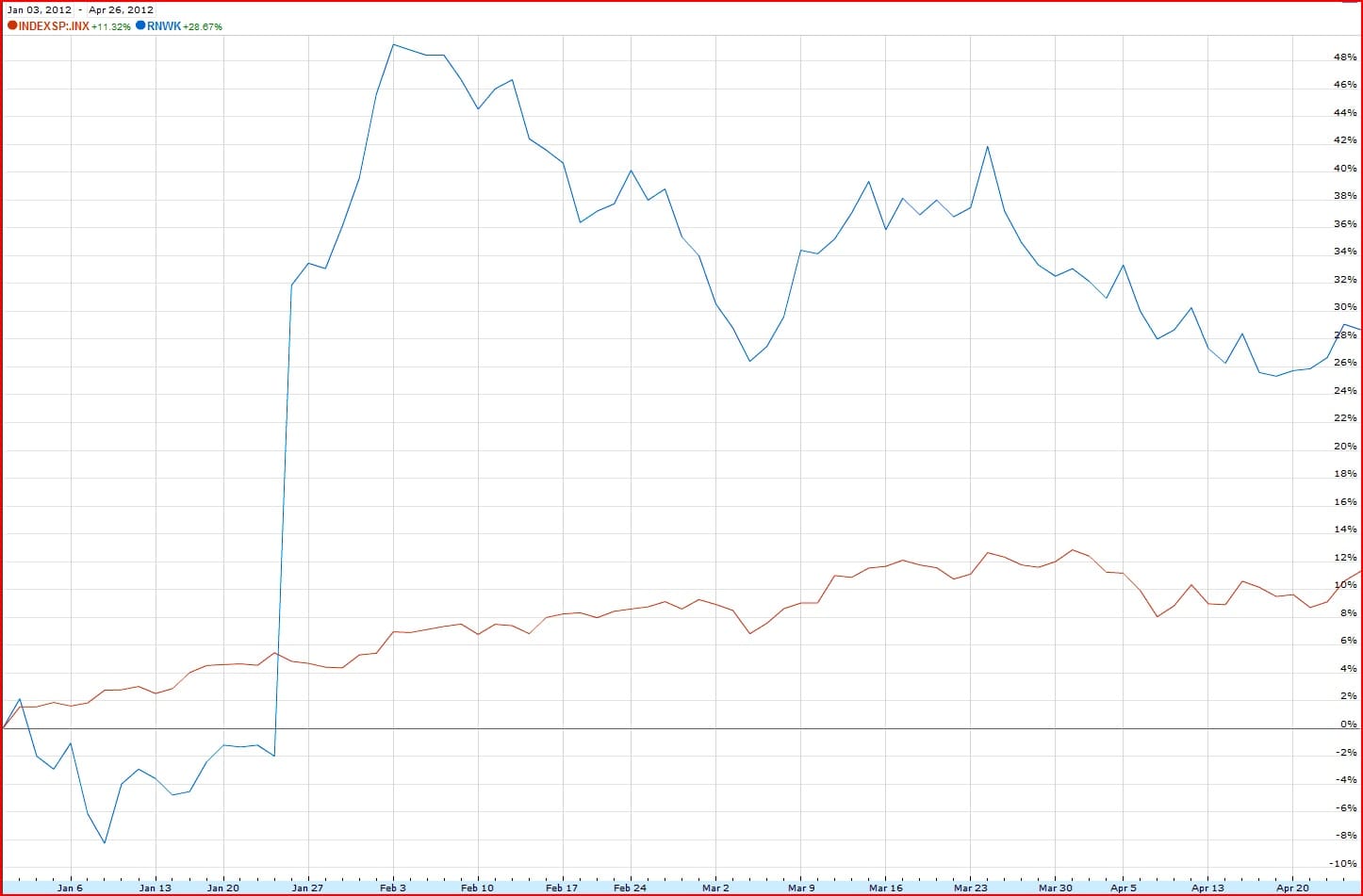

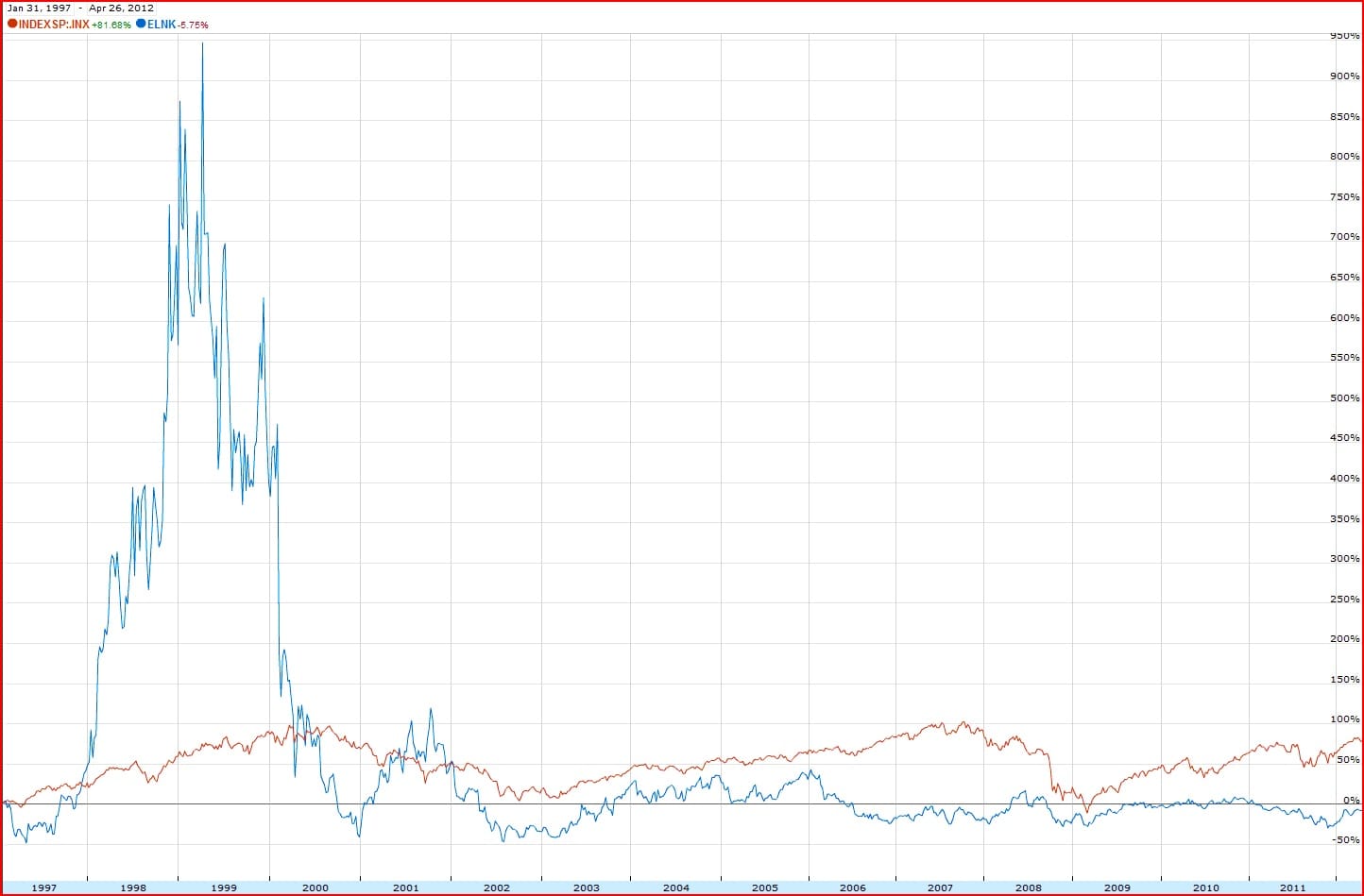

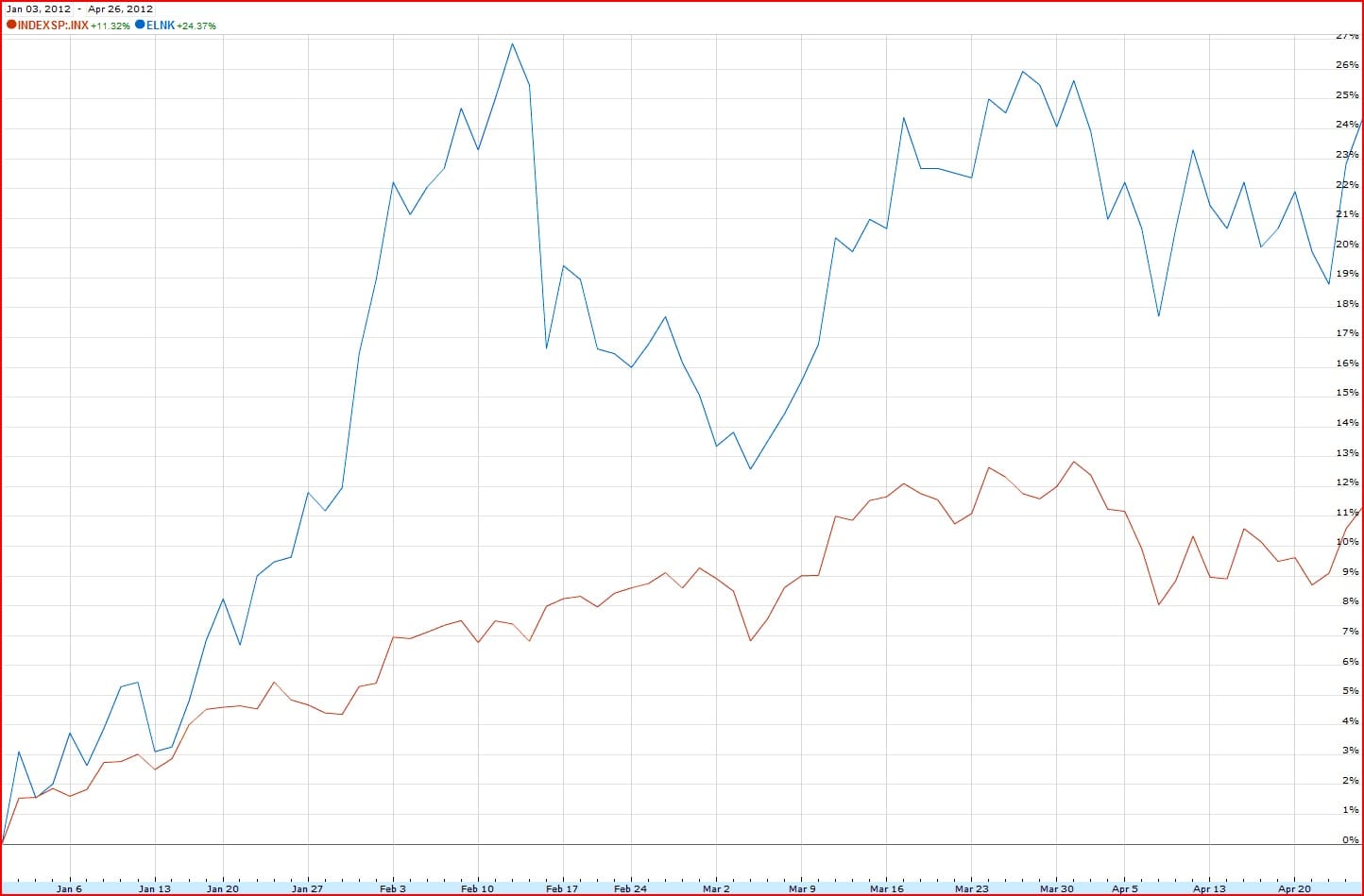

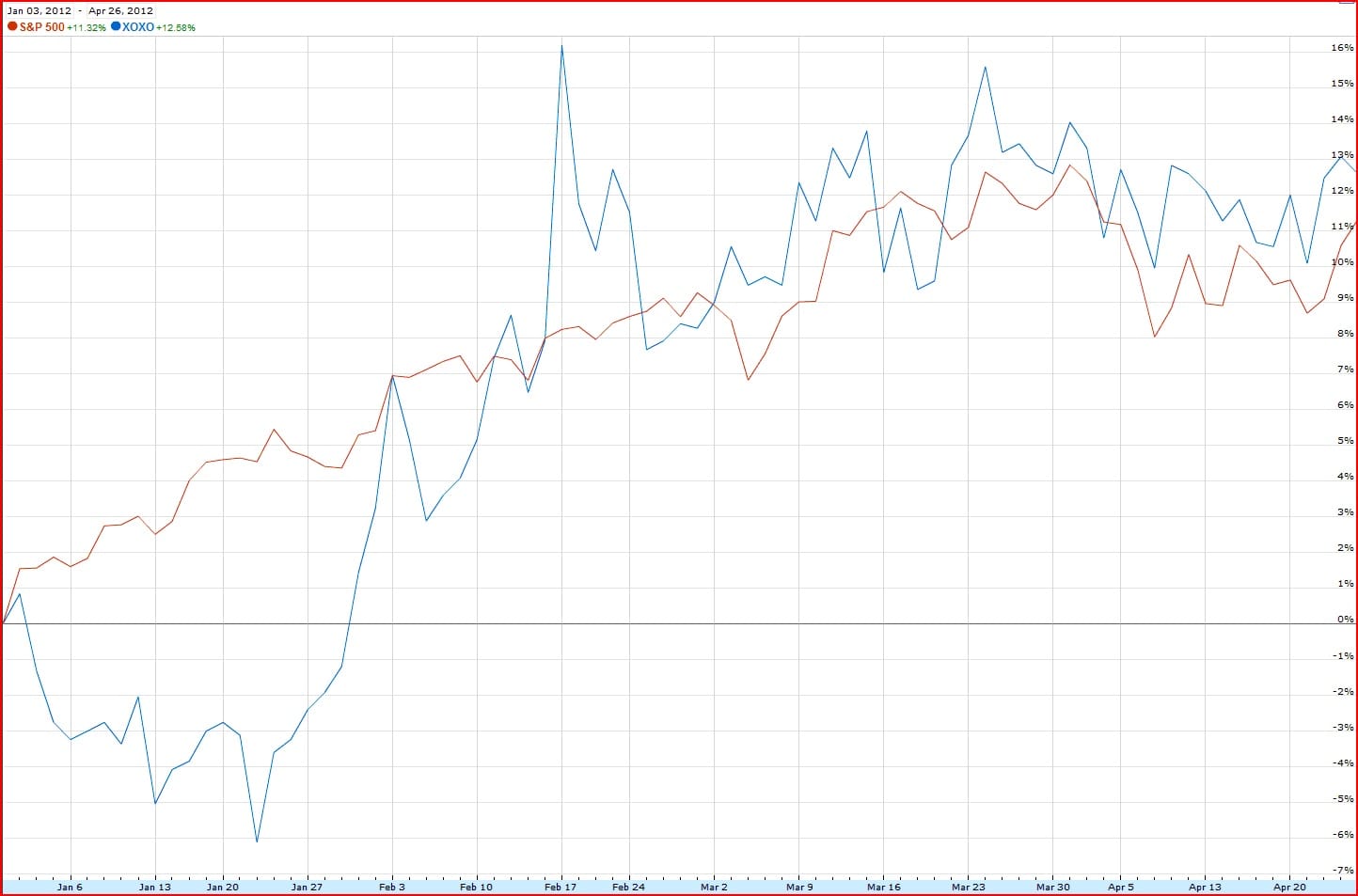

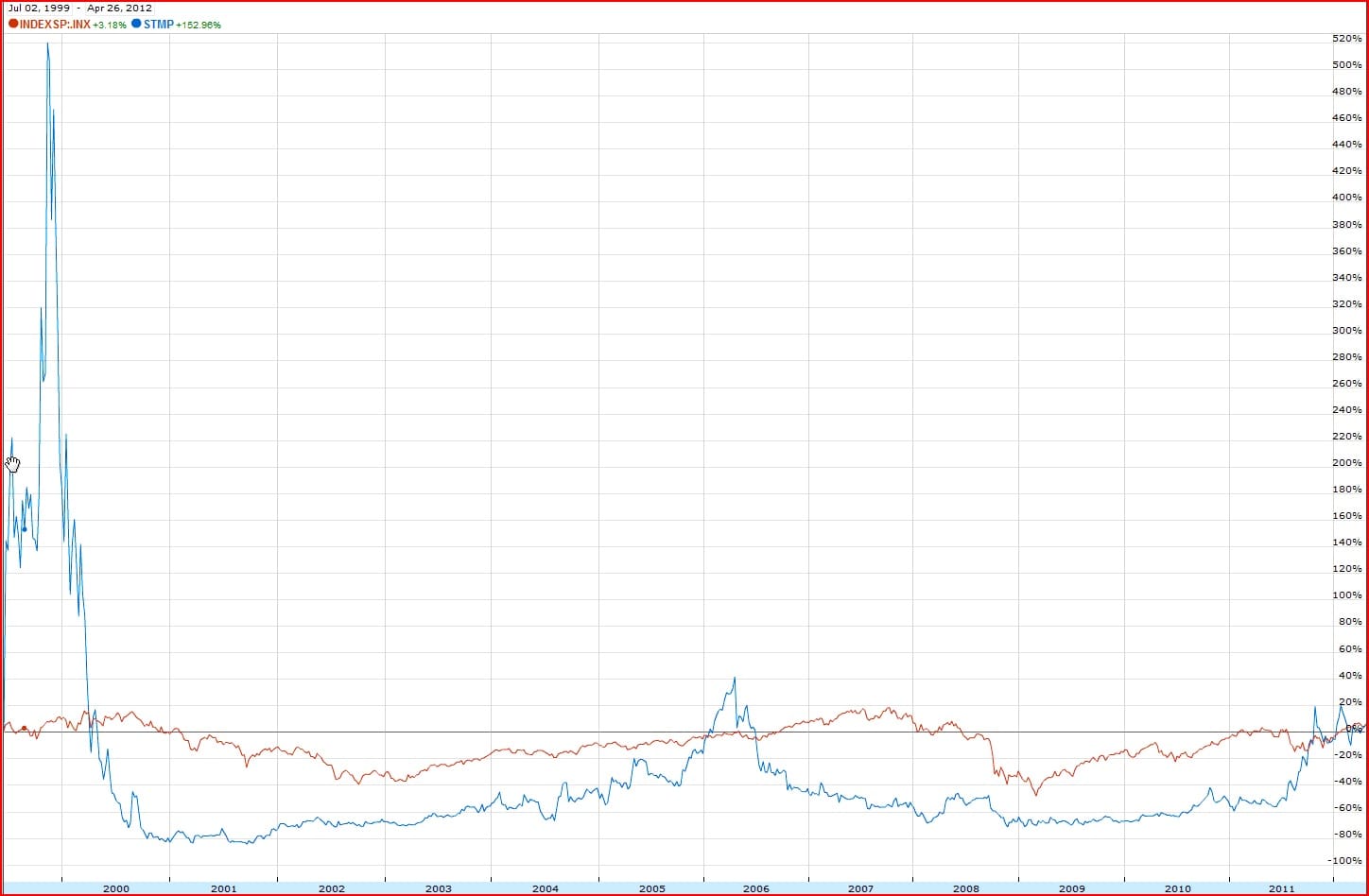

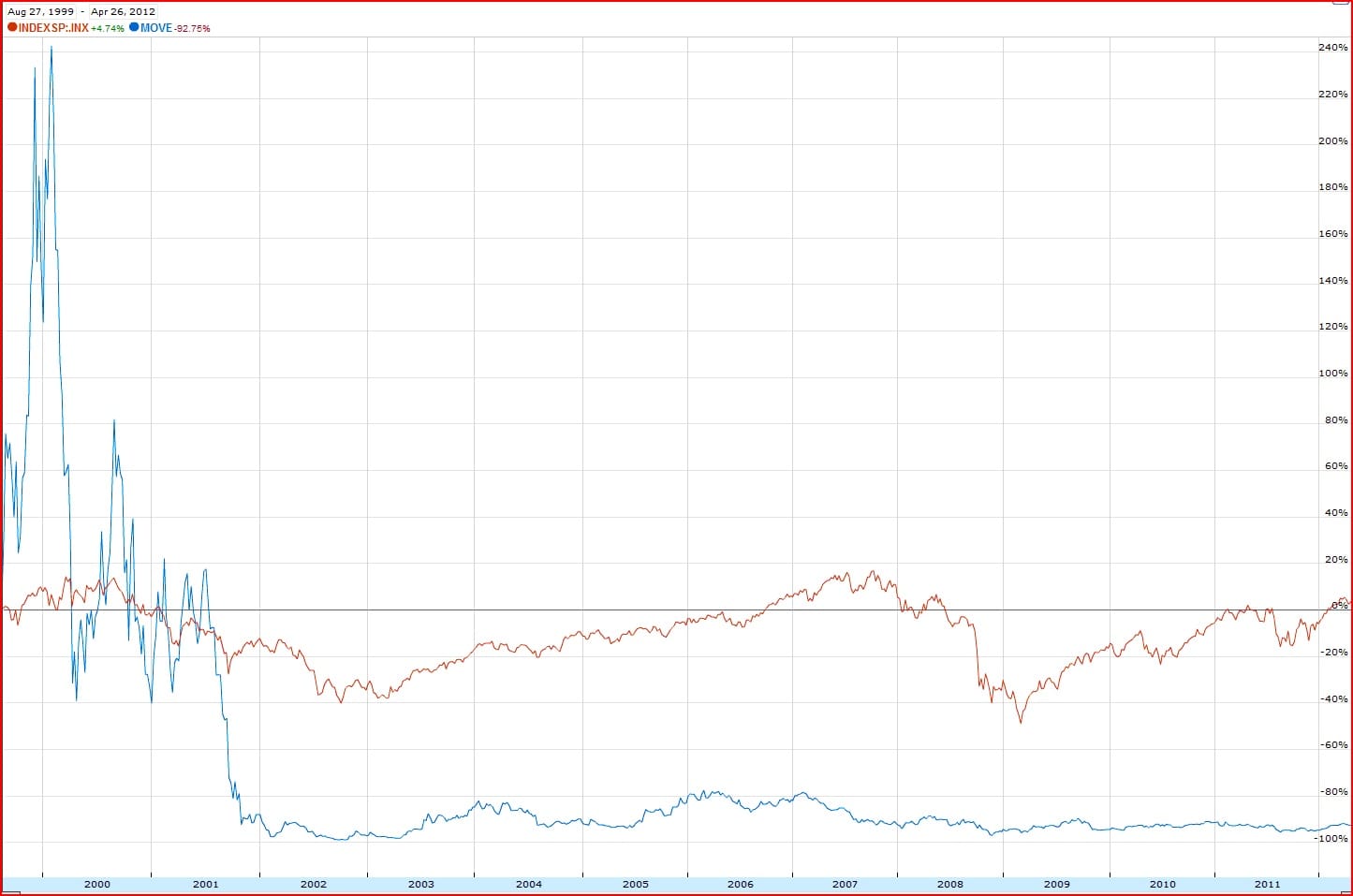

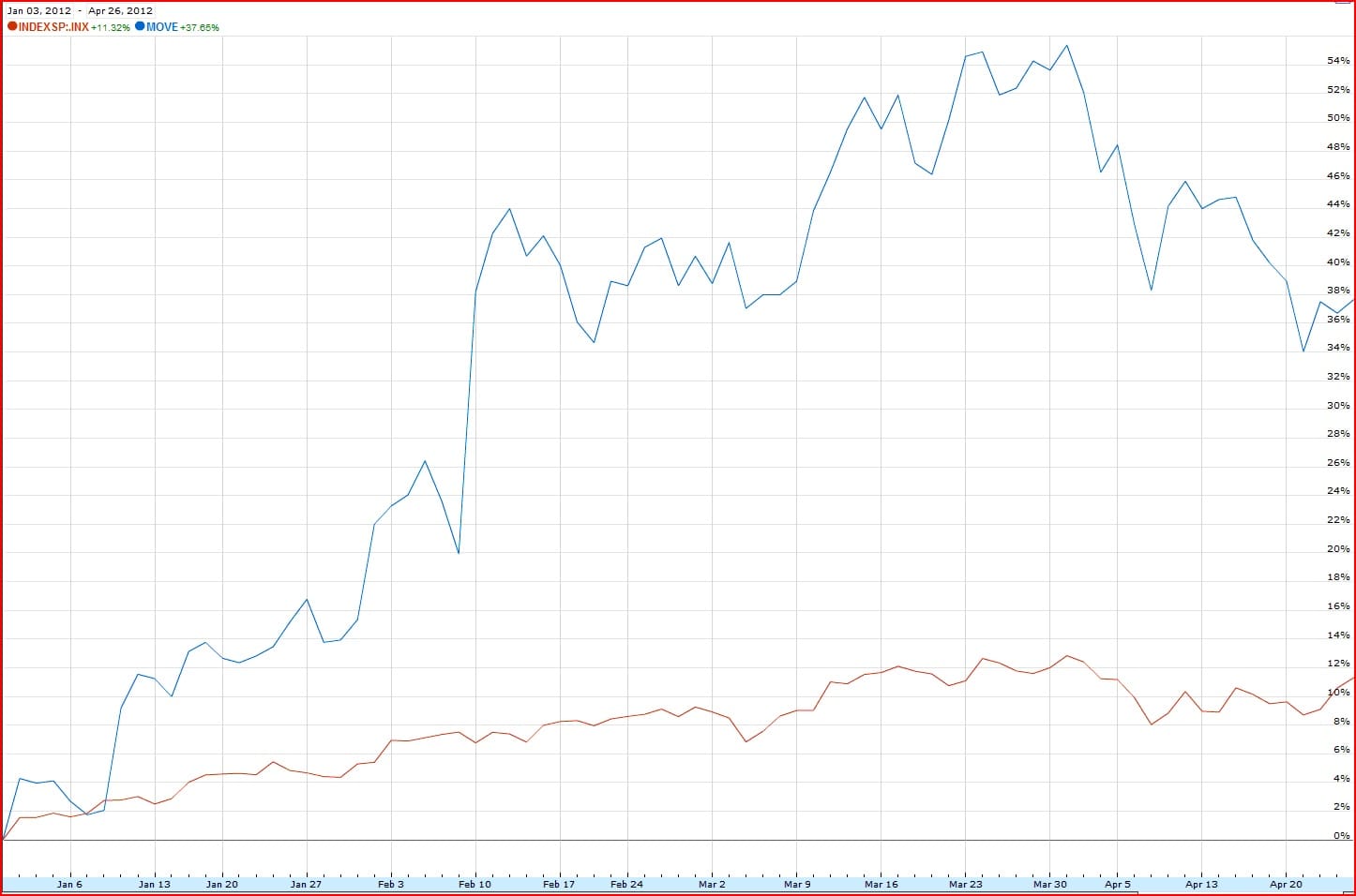

Two things I want you to notice: the S&P was a better bet vs IPO for all save one name, and YTD all but one is beating the broader markets.

Bluefly, Inc. (NASDAQ:BFLY)

All-time chart vs S&P 500

(click on image to enlarge)

(click on image to enlarge)

Year-to-date chart vs S&P 500

(click on image to enlarge)

(click on image to enlarge)

RealNetworks Inc (NASDAQ:RNWK)

All-time chart vs S&P 500

(click on image to enlarge)

(click on image to enlarge)

Year-to-date chart vs S&P 500

(click on image to enlarge)

(click on image to enlarge)

EarthLink, Inc. (NASDAQ:ELNK)

All-time chart vs S&P 500

(click on image to enlarge)

(click on image to enlarge)

Year-to-date chart vs S&P 500

(click on image to enlarge)

(click on image to enlarge)

XO Group Inc (NYSE:XOXO)

All-time chart vs S&P 500

(click on image to enlarge)

(click on image to enlarge)

Year-to-date chart vs S&P 500

(click on image to enlarge)

(click on image to enlarge)

Stamps.com Inc. (NASDAQ:STMP)

All-time chart vs S&P 500

(click on image to enlarge)

(click on image to enlarge)

Year-to-date chart vs S&P 500

(click on image to enlarge)

(click on image to enlarge)

Move Inc. (NASDAQ:MOVE)

All-time chart vs S&P 500

(click on image to enlarge)

(click on image to enlarge)

Year-to-date chart vs S&P 500

(click on image to enlarge)

(click on image to enlarge)