Some more analysis on Apple Suppliers

I’m working my butt off today!

It’s been about two weeks since I published my Apple supplier book. The response has been phenomenal and we thank everyone who bought the book or subscribed to Revolution Investing and sent along their kind words.

To keep the dialogue going for those of you deciding entry points and allocation for each of the 10 stocks, or for anyone still on the fence about buying Apple suppliers, I’d like to highlight this Bloomberg article about Elpida.

Can’t state it any better than Jun Yang and Naoko Fujimura do in the first three grafs (emphasis mine):

For a bankrupt company, Elpida Memory Inc. (6665) is getting a lot of attention as the subject of a billion-dollar chess game among the biggest technology companies.

They don’t necessarily covet Elpida’s debt, workforce or even most of its business. They just want the part of its business that makes chips for Apple Inc.’s mobile devices –and, even more, they want to make sure their competitors don’t get that.

SK Hynix Inc. (000660), the world’s second-largest memory-chip maker, said March 30 it’s bidding for Tokyo-based Elpida. Private-equity firm TPG Capital also plans a bid, a person familiar with the matter said on April 6. Toshiba Corp. (6502) may join Hynix, and Micron Technology Inc. (MU) may also try to buy the company’s assets, Japanese media including the Nikkei newspaper have reported.

So there you have it. A company with valuable IP (very valuable in fact, Elpida has some really interesting little trees that could become redwoods) is made even more valuable by its relationship with Apple. Even Cupertino frenemy Samsung wants Elpida. I think Sandisk may even throw its hat in the ring.

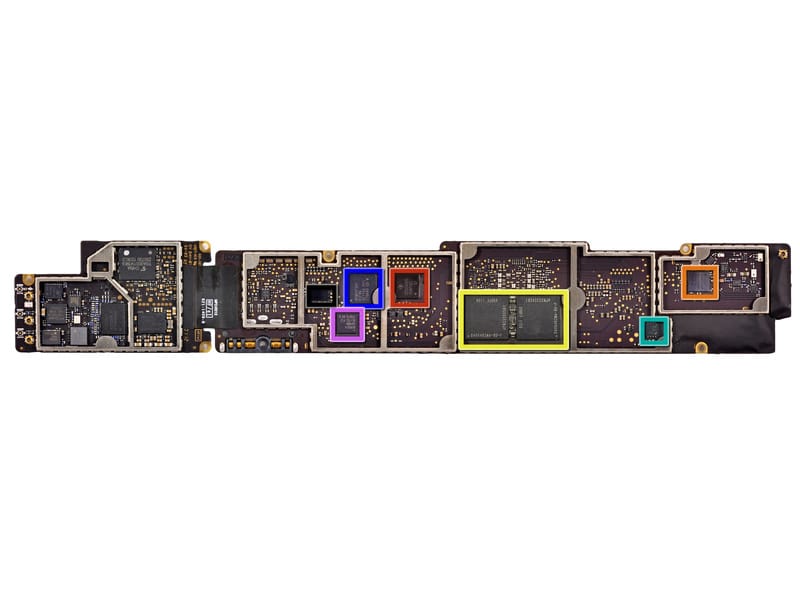

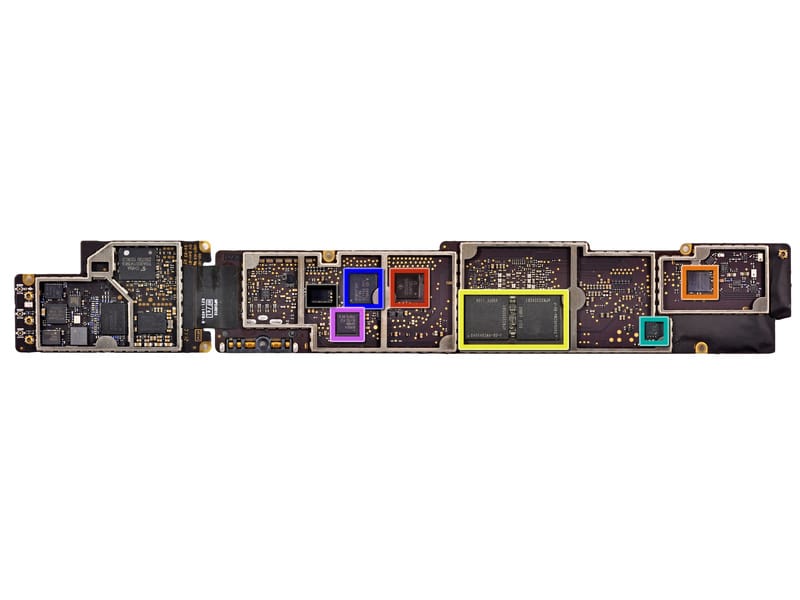

The yellow in the picture below is the Elpida component that iFixit found in the new ipad (I hope Gartner (NYSE:IT) is paying attention to ifixit, they are quickly becoming the go-to tech intelligence source)

Source: Elpida website

My thesis about Apple’s suppliers all along has been two-fold.

1.) Apple has run so much and will head north of $1000 soon, that anything associated with Apple will get a premium in the market,

2.) Apple is the most robust and liquid company out there and when they buy a component, their check always clears (side bet: Apple’s critical mass and power over their consumers and suppliers means they will launch some kind of a payments platform in the next 5 years).

This is why I’ve highlighted the best-in-breed Apple suppliers in the book and purposefully skipped some names. Companies like Broadcom are killers in their own right that will continue to sell to lots of customers besides Apple but have also figured out how to stay critical to Apple’s plans.

I’ll leave you with an analogy to another supplier-buyer relationship, that of Wal-Mart to 5-Hour Energy.

If you haven’t seen those little energy shot bottles you’re likely dead or don’t live in America. For those in the latter category, 5-Hour Energy pioneered a new category of energy booster, a couple ounce potion rather than a whole can of Red Bull.

Wal-Mart is famous for squeezing its suppliers—sometimes to the point of death. They’ve forced Energizer to sell them discount private-label no-brand batteries that are the same as Energizer branded ones—and display right next to each other. They’ve pushed suppliers to move overseas and shut their factories in America, and when they refuse, dumped them and switched to a Chinese company willing to make the same pillow for 10% less, pushing a 50 year old company into bankruptcy

Negotiating with Wal-Mart and winning a supply contract is a legendarily excruciating process. You sit down in sparse room the size of a college-library study nook and say a number at which you can make 25% margins and pay your workers and yourself.

Then Wal-Mart executives cut that number in half.

But as Clare O’Connor points out in her excellent Forbes piece, when a product like 5-Hour Energy becomes a must-have for its shoppers, Bentonville plays ball. Wal-Mart knows that at the margins, some people will be pushed away from entering their stores if they know they can’t grab 5-hour Energy really quickly when they do their regular shopping. So today the energy shot has the choicest placement any vendor can hope for—-every single checkout out aisle at every single Wal-Mart in the entire country.

Do you think that 5-Hour Energy cares about getting squeezed on margins by Wal-Mart on that 15% of their topline? Heck no! They are in the Wal-Mart ecosystem and are exceedingly unlikely to get squeezed out. Making the 80-90 cents they likely get per shot is enough———because it happens at every single town in the country, every single hour of the day, in virtual perpetuity. And 5-Hour Energy can get their fatter margins elsewhere. Other billion dollar vendors like Casey’s General Store (NASDAQ: CASY) have much less pricing power and buyers like ultra-hipster Organic Planet on Bedford Avenue on Williamsburg have none..

The idea is to get long Apple suppliers that have cracked the code about what Apple wants and can sell them on new components, over multiple igenerations of iphones and ipad and itv’s and maybe even icars someday. Those are the 10 companies I’ve picked and the ones I’m paying extra special attention to and want you to keep an eye on.