Some incredibly important Revolution Investing trends we should pay attention to

How many Greece crisis/EU crisis/Euro crisis/Next-Lehman-Moments can we possibly have before it’s all priced in and then some? More to the point, how many times can the media and the markets possibly freak themselves out over the same slow-motion crisis? And most importantly to us investors, is all this worry about crisis any different than years’ past and should it affect our portfolio strategies? I have been working hard on this report here and I think it’s quite valuable in the trends and data we can use and see here.

Let’s answer all these questions with some historical analysis using an incredible feature that Google has introduced in recent years that allows us to track the frequency that a certain word appears in printed books. It’s an incredibly accurate and incredibly long-dated bunch of data and it answers a lot of the above questions.

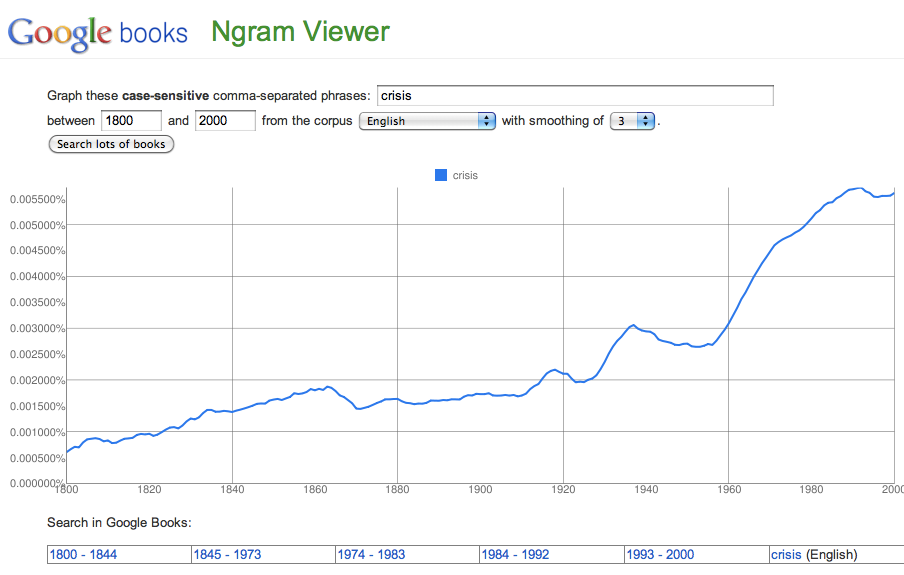

So let’s step back from the current so-called crisis and get some history about the growth of the concern of crisis. Here’s the frequency with which the word “crisis” has appeared in books over the last 200 years:

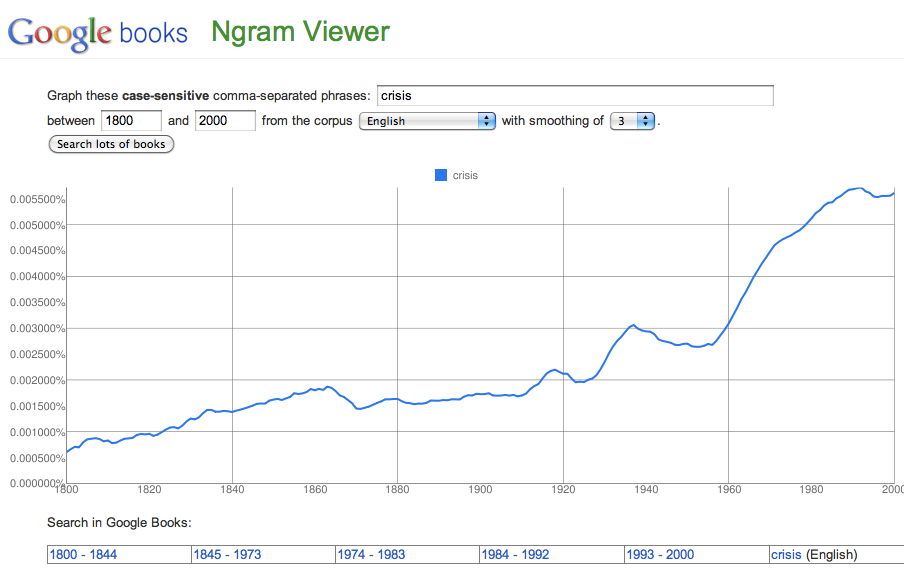

Here’s the frequency of occurrence of the word “crisis” over the last twenty years:

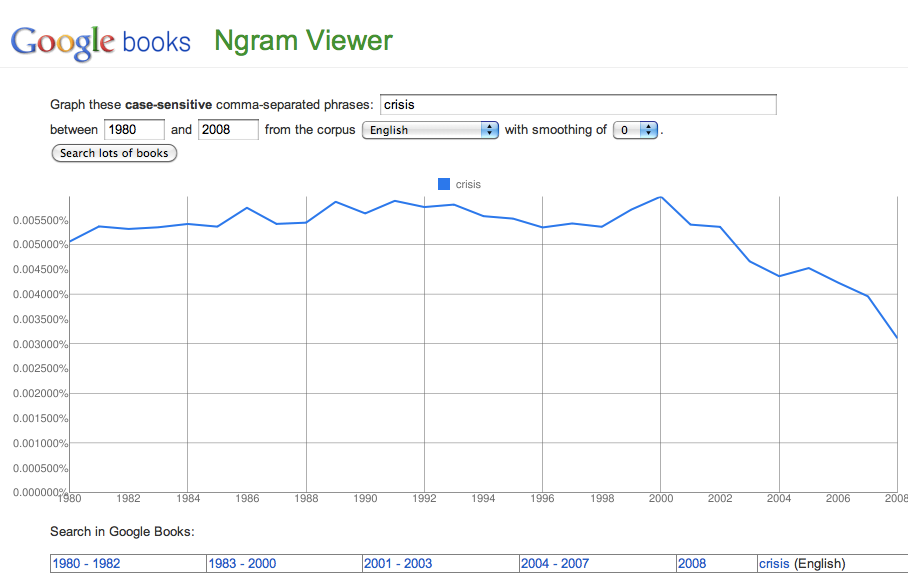

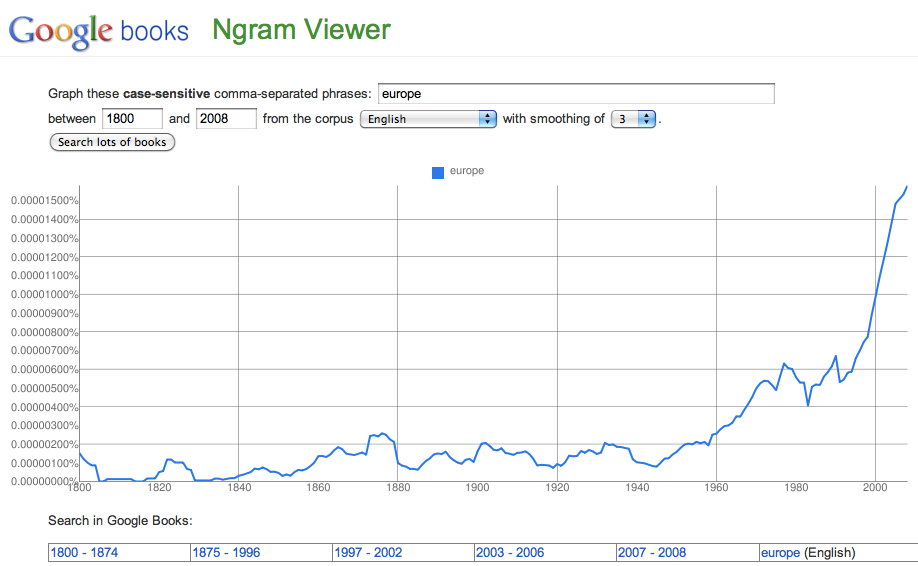

Do you see how society has increasingly worried over “crisis” for the last 200 years steady? And that for the last twenty years there’s been little change or even a decrease in that frequency of worry over “crisis” in our published literature?Let’s compare the trends of the word “crisis” in our books with a bit of a control word, such as “Europe”. Here’s the frequency with which the word “Europe” has appeared in books over the last 200 years:

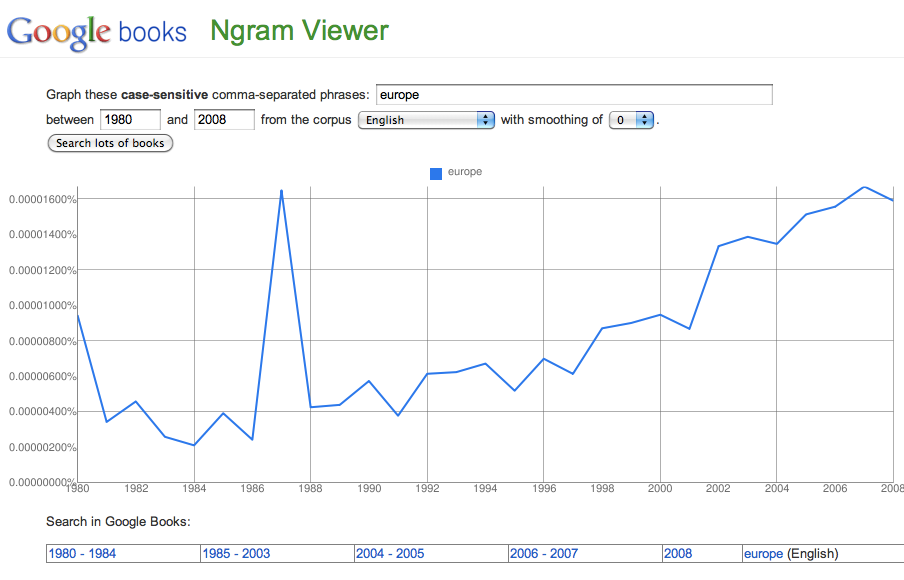

Here’s the frequency of occurrence of the word “Europe” over the last twenty years:

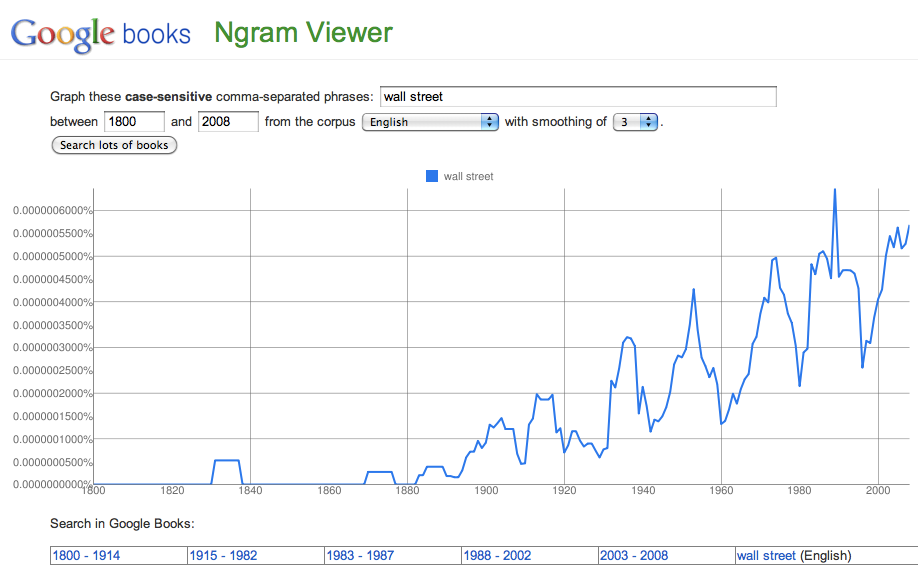

That “Europe” word has shown steady growth in our culture’s books for the last 200 years and that growth really took off back in 2000 when the EU and Euro were kicking in. And our stock markets and economy were topping.How about the words “Wall Street” showing up in our literature? The last 200 years:

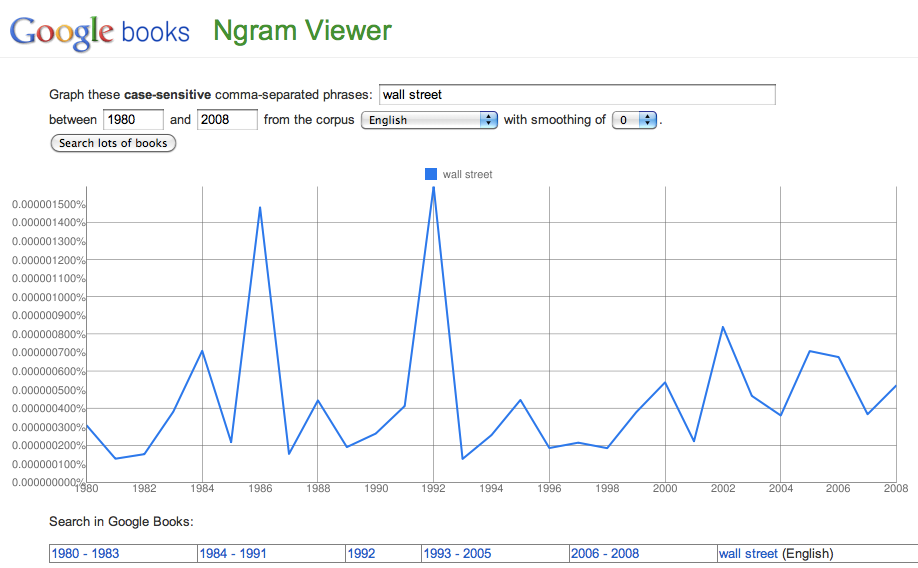

The last 20 years:

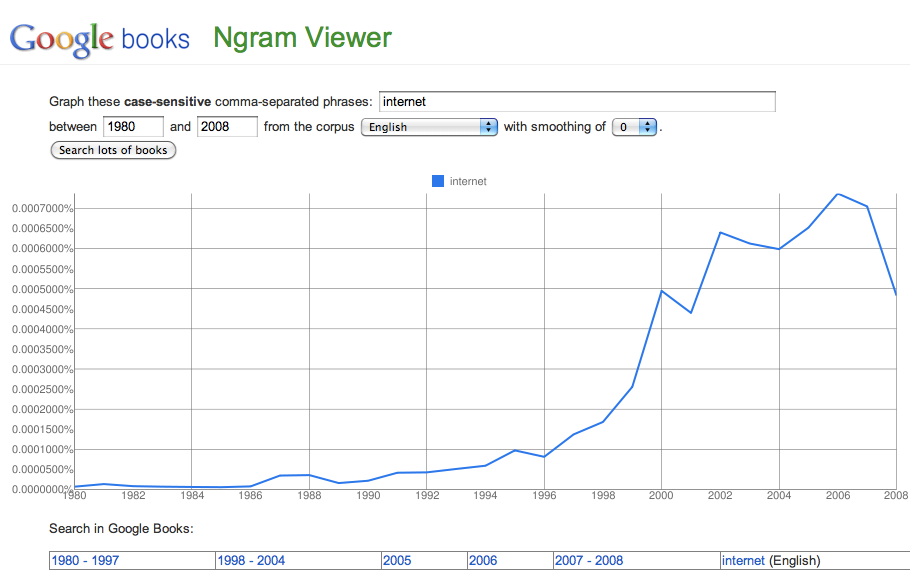

Interesting how volatile both of those charts of “Wall Street” are and how the last 20 years has been so steady despite the dot-com bubble and other crazy times, huh?Want to know some word trends that are looking like they’re very early in their own growth phases? Here’s the word “Internet” and its frequency of appearance in published books over the last couple decades:

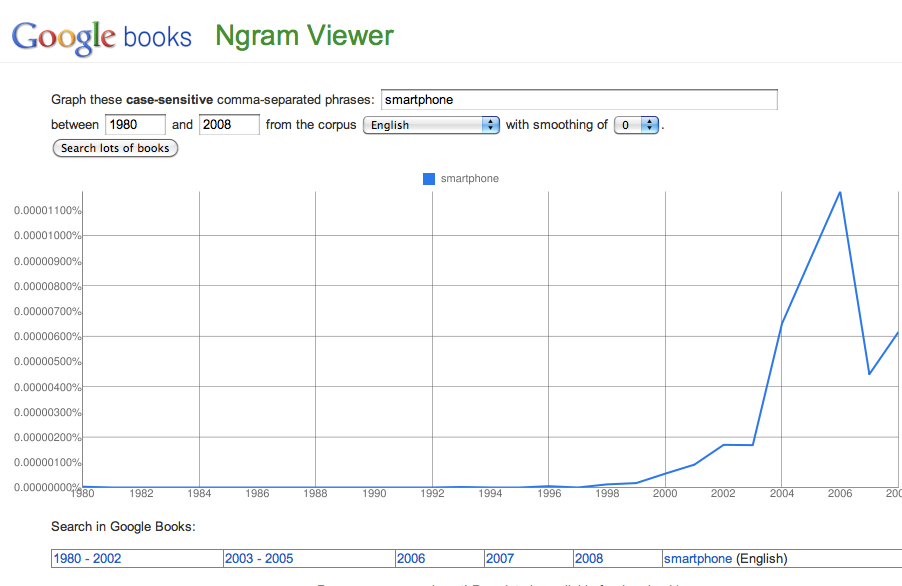

And here’s “Smartphone”:

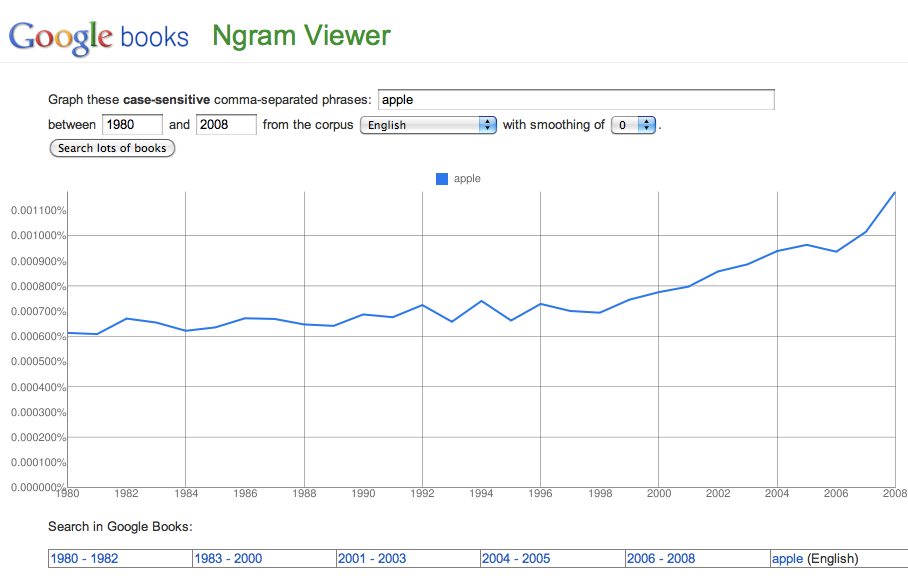

How about just “Apple”:

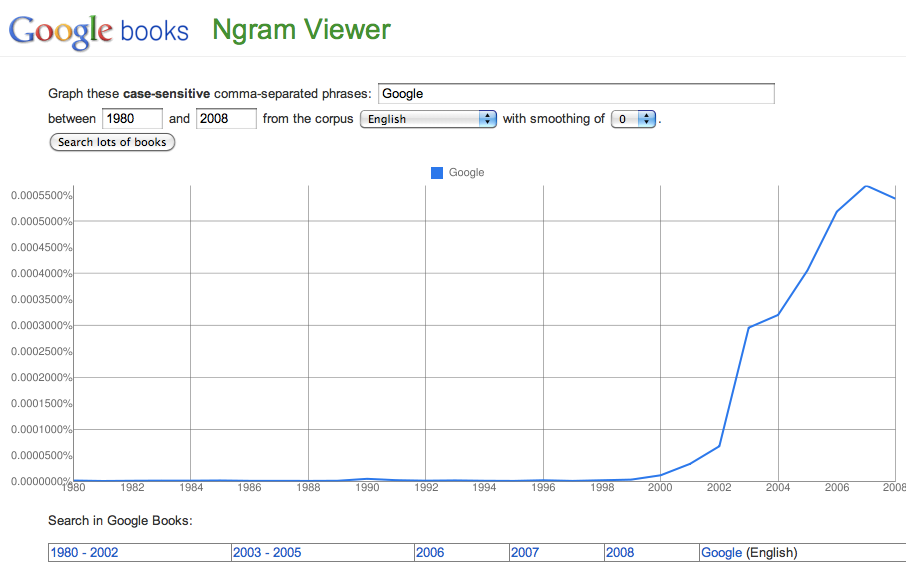

And Google:

Let’s circle back and answer the original questions I posed to start off this newsletter then:How many Greece crisis/EU crisis/Euro crisis/Next-Lehman-Moments can we possibly have before it’s all priced in and then some? A lot! Maybe more than we’ve seen so far, despite the seeming ridiculousness of the redundancy of these current so-called crises.More to the point, how many times can the media and the markets possibly freak themselves out over the same slow-motion crisis? More than it takes to price it in, which means there’s more freak out from the markets and media to come. There always is, see?And most importantly to us investors, is all this worry about crisis any different than years’ past and should it affect our portfolio strategies? Not really. Let’s stick with our Revolution Investing longs and shorts and ride these Revolutionary Trends that we are set up for!And if you’re enjoying and profiting from your subscription to TradingWithCody.com, please be sure to forward this or one other of these posts to your friends and colleagues telling them to join you as a subscriber by visiting our site.Thanks and see you tomorrow.