The Importance Of Understanding Valuations In A Revolution Investing Framework

We expect to make historic gains in many of our positions as The AI Revolution moves ever more toward Artificial General Intelligence and eventually onward on the spectrum toward Artificial Super Intelligence and as the Robotics and Space Revolutions hit full stride over the next few years too.

"There are times to make money. There are times not to lose money. And if you don't know the difference, you're going to get killed." – Oft attributed to Stanley Druckenmiller

"The first rule of an investment is don't lose money. And the second rule of an investment is don’t forget the first rule." – Warren Buffett

One of our biggest differentiators in our Revolution Investing framework compared to other so-called innovation investors is that we actually do pay attention to valuations. We don't blindly look at P/E (price to earnings) or P/S ratios (price to sales) with no context, as we build 5-, 10- and 15-year financial models for each company we analyze. But we also certainly get context from historic P/E ratios vs today's market, which can help explain how we have been able to avoid any major drawdowns in our funds even as many formerly highflying theme stocks have been crashing 30%, 50% or more in recent weeks.

As I was cleaning out some old files in my office, I came across a book that I'd written in 2011 called "50 Stocks For The App Revolution." In it, I repeated my prediction that billions of people would eventually be interacting with their smartphones (and tablets) trillions of times collectively every day and that investing in the best platforms and applications of The App Revolution would be the most lucrative investment approach.

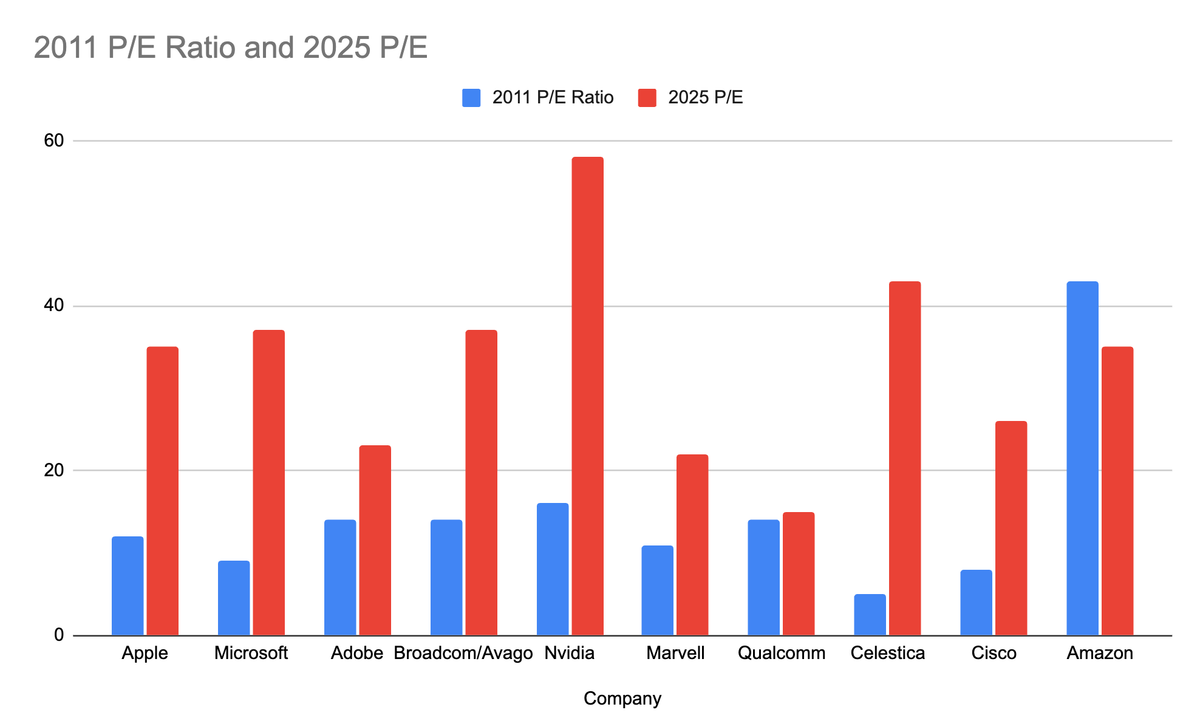

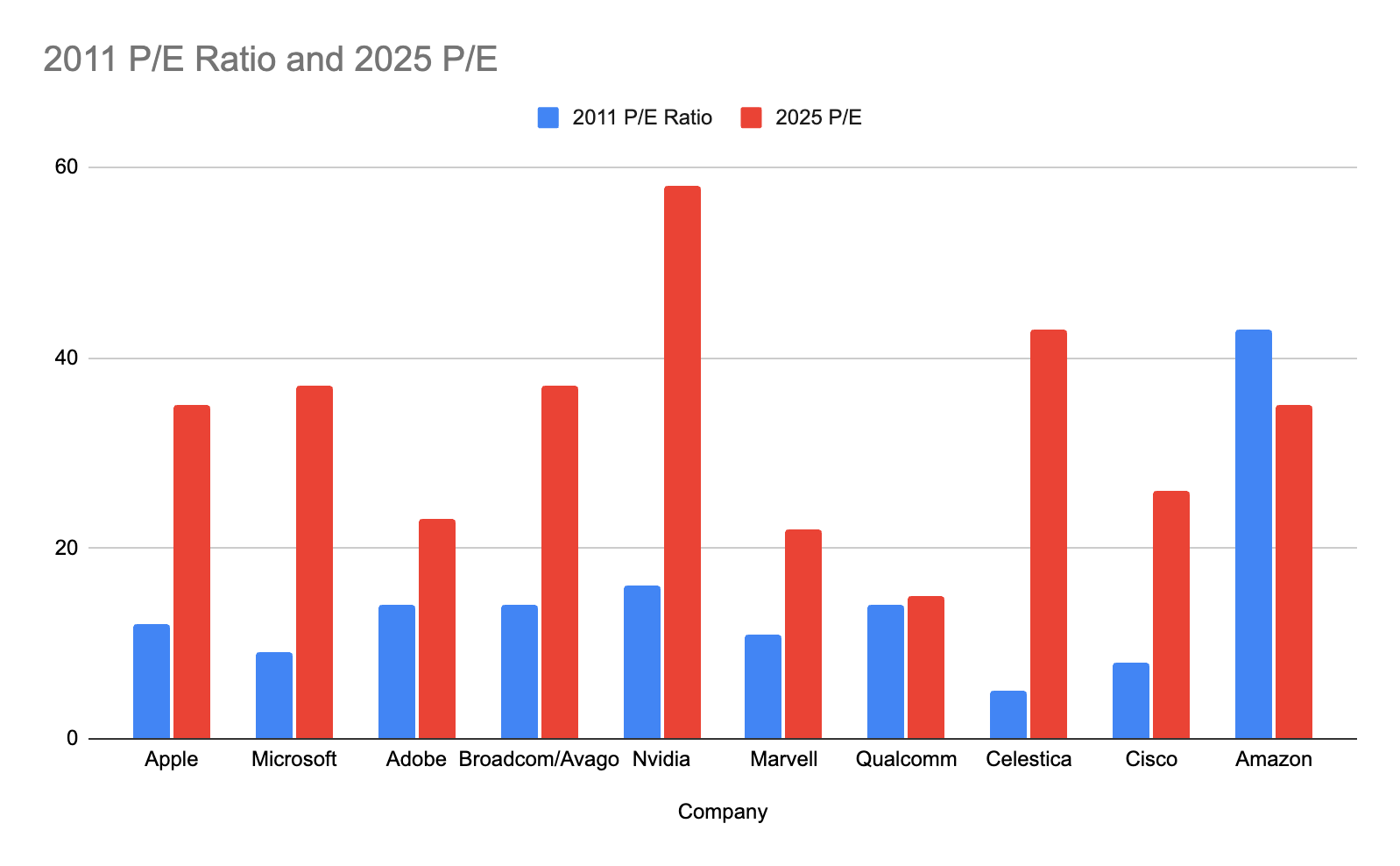

Among the fundamental analysis I did for each of the 50 stocks in the book were the P/E ratios that they were trading at in 2011. When I saw the P/E ratios they were trading at back then, I almost fell out of my chair. Here are some examples of just how low tech stock P/E ratios were back in 2011 vs today :

You can see how much higher the P/E ratio for each tech stock is today compared to back in 2011 as every company except for Amazon has a higher ratio today. To give a little more context to these numbers, let's show consensus revenue growth for each of these tech stocks back in 2011 vs today too:

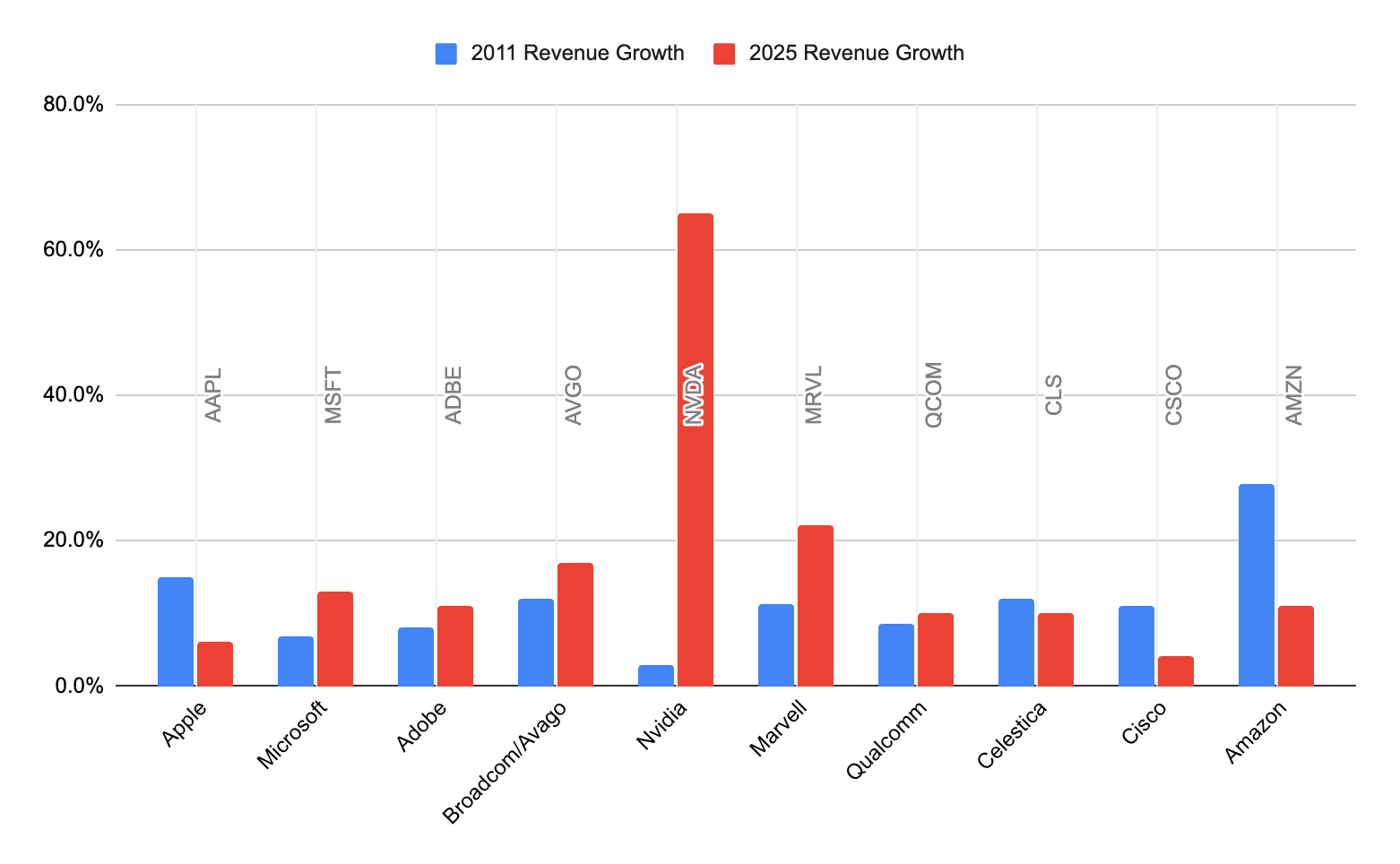

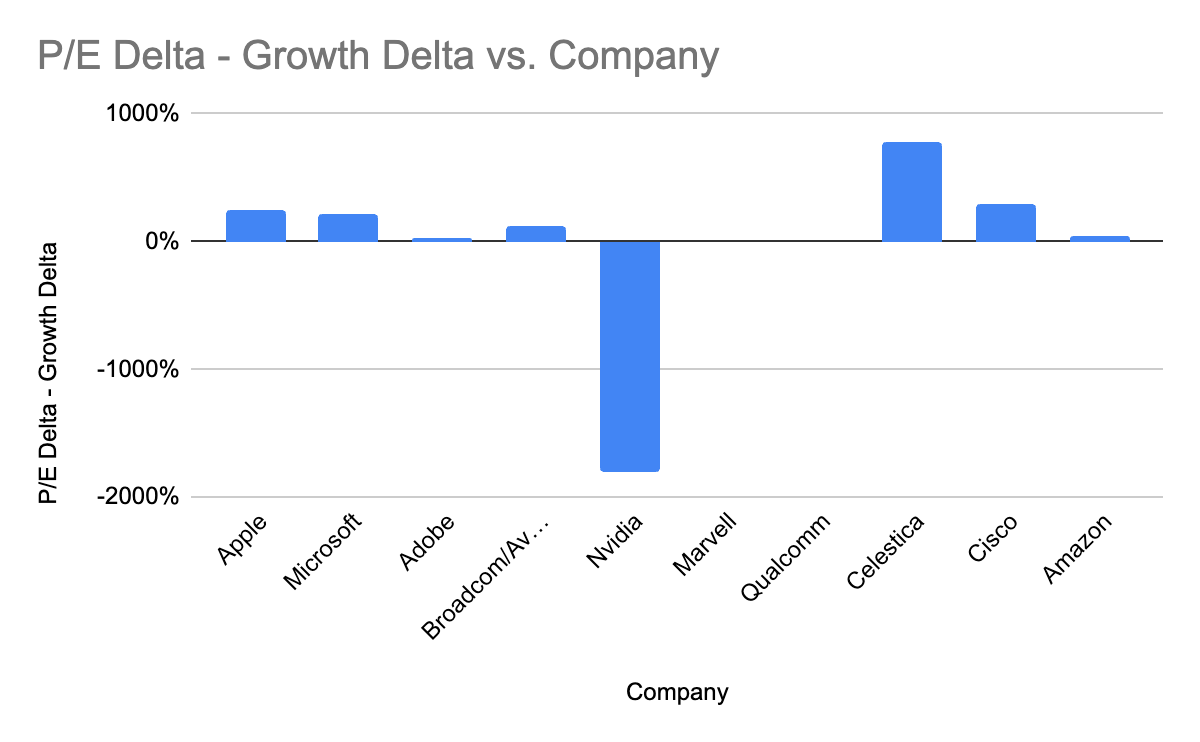

You can also see that most of the companies in this sample (6 out of 10, to be exact) are growing faster today than they were back in 2011, but for every company except for Nvidia, their revenue is not exactly exploding relative to the increase in their P/E ratios. We can subtract the growth in the P/E from the growth in the revenue to see this outsized discrepancy:

Again, every company but Nvidia has seen large gains in its P/E compared to the change in their revenue growth rates.

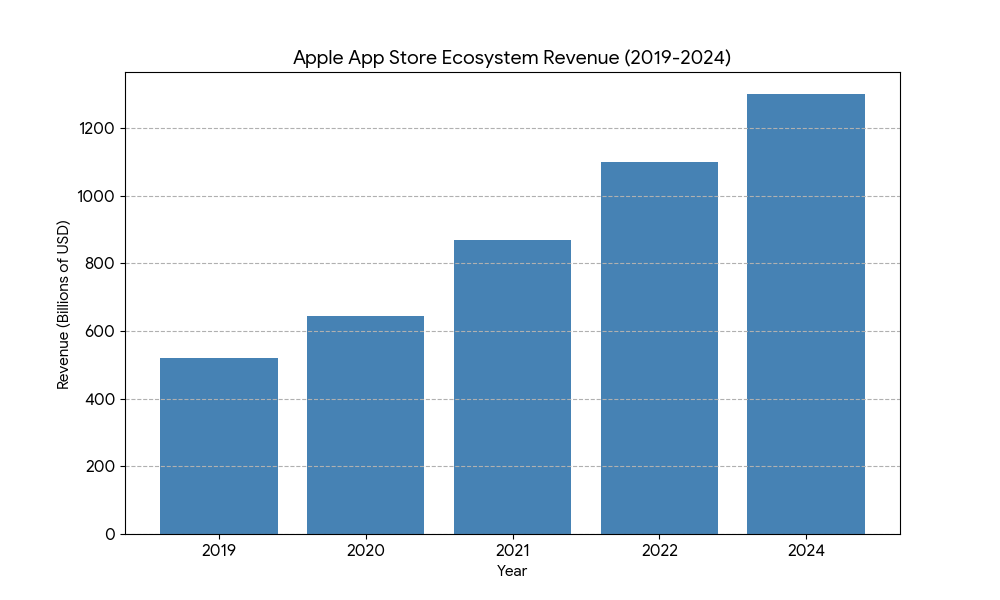

While these valuations certainly are high by historical standards, that doesn't mean we're necessarily running for the hills either. Many of the tech-naysayers and Luddites and short sellers have for years complained about high valuations, and for years these stocks have kept working. One of the main reasons that these higher valuations are justified is that these large tech companies are larger, more profitable, and more monopolistic than any set of companies that have ever existed on planet Earth. Sure, Apple isn't growing as fast as it was in 2011, but the Apple Ecosystem is orders of magnitude larger and its platform now processes about $1.3 trillion in revenue through the App Store. Such durable, recurring, high-margin revenue is something the world has never seen. The company is almost untouchable (key word: almost), and thus it probably deserves a higher valuation than it did back in 2011 when it was still hard at work trying to grow that ecosystem.

And if you've been reading or listening to how we're investing in the three most important Tech Revolutions of the 21st century (AI, Robotics and Space), you know that we expect these Revolutions to keep going and we expect more of our companies to become more Apple-like with their dominant monopoly platform positions, and thus we are willing to pay up (slightly) for their profits. Moreover, these Revolutions will mostly keep the US and global economies growing both near-term and long-term, and we are pretty fully invested in what we consider to be the best AI, Robotics and Space stocks that will propel that economic growth. But the reason we can justify owning these companies with slightly elevated P/Es is in large part because our 5-, 10- and 15-year financial models show us that the companies we own are quite cheap looking out over the years as they capture and create so much value for shareholders.

On the other hand, you know that we're quite cautious and even bearish on many of the hype-ful, promotional smaller-cap theme stocks as most such companies are wildly overvalued at best and doomed to head to zero at worst. And when we say wildly overvalued, we're talking about companies trading at 30, 60, or even 100x their revenues (and in many cases, they have zero revenue). These are obviously venture capital type investments, but when there are this many trading and the stock prices are continually going up, that's not a sign of a healthy market.

And it's actually quite normal, of course, that many of these startups and theme stocks will actually fail. A Harvard Law School study found that only 55% of small-cap companies remained publicly listed five years after their Initial Public Offering (IPO). This suggests that nearly half of small-cap IPOs fail to maintain their public listing within five years. And if we know that if we're paying 50x sales (not earnings!) for smaller cap theme stocks, even in the three most important Tech Revolutions of the 21st century, you're most likely to lose a lot of money when many of those companies fail to live up to their potential, even if the stock doesn't necessarily go to zero over the next five years.

So we spend a lot of time and energy making sure that we can not only justify the valuations that we are paying for the stocks in our portfolios today, but that we actually find these valuations quite compelling even as the average P/E ratio in the broader market (and especially in small cap theme stocks) is quite historically extended. Not to mention, as I always tell Bryce: Winners win. We stick with our winners. And we avoid needless risks just as we avoid FOMO, we avoid YOLO trades and we avoid greed. We are not venture capitalists, and we do not intend on chasing every shiny object that happens to be involved with a Revolution we are invested in.

Nevertheless, we expect to make historic gains in many of our positions as The AI Revolution moves ever more towards Artificial General Intelligence and eventually onward on the spectrum towards Artificial Super Intelligence and as the Robotics and Space Revolutions hit full stride over the next few years too. There are still amazing opportunities for investors in the public markets today, but the appetite for risk at these levels seems extended to us, and one of our jobs as investors is to "not lose money."

To the moon (but as safely as possible!). Also, we'll do the Live Q&A Chat on Wednesday, August 27th at 12:00pm ET in the Discord Channel or you can email your questions to support@tradingwithcody.com.