The Three Worst Timed-Deals of the Dot-Com Bust (Is 2012 like 1999 or 2001?)

Reading what Mark Zuckerberg had to say last week about Facebook’s purchase of Instagram took me back. 13 years back to 1999.

First here’s what Zuck had to say:

For years, we’ve focused on building the best experience for sharing photos with your friends and family. Now, we’ll be able to work even more closely with the Instagram team to also offer the best experiences for sharing beautiful mobile photos with people based on your interests.

We believe these are different experiences that complement each other. But in order to do this well, we need to be mindful about keeping and building on Instagram’s strengths and features rather than just trying to integrate everything into Facebook.

….

These and many other features are important parts of the Instagram experience and we understand that. We will try to learn from Instagram’s experience to build similar features into our other products. At the same time, we will try to help Instagram continue to grow by using Facebook’s strong engineering team and infrastructure.

And what it took me back to was Yahoo’s announcement that it was buying Broadcast.com

“Broadcast.com’s tremendous first-to-market advantage has made it the leading destination on the Web for audio and video broadcasts, and it will provide significant added value to Yahoo!’s audiences worldwide,” said Tim Koogle, Yahoo!’s chairman and chief executive officer.

“The acquisition of Broadcast.com is a natural extension of our strategy to deliver the ultimate experience to Web users and a powerful advertising and distribution platform for both companies’ content, advertising and business services providers.”

“Broadcast.com has built a scalable digital distribution network designed to deliver streaming audio and video to mass audiences, through any delivery mechanism or access device,” said Mark Cuban, Broadcast.com’s chairman and president.

Todd Wagner, Broadcast.com’s chief executive officer said the deal will help broadcast.com extend its position as the Web’s leading Internet broadcaster.

“Combining our Internet broadcasting expertise with Yahoo!’s position as one of the Web’s leading global branded networks will enable us to extend our multimedia business services to an even larger customer and audience base.”

And I know it’s unthinkable in the after-glow that Facebook would ever shut down Instagram, but go to Broadcast.com today and the $5.7 billion purchase simply redirects you to Yahoo.com.

Scary parallel corporate speak aside there are differences. For one the Broacast deal was ~6 larger than Instagram. And Facebook has a pipeline to digest and monetize the 30 million users it just picked up; Yahoo had no clue what to do with Broadcast.

But when I find myself looking for ways to justify billion dollar deals done for user bases I have to pause and look at the downside protection in my portfolio. No one wants to believe they are part of the herd, so you have to do more than a cursory check on your hedges. You need some and I want you evaluate if you have enough.

The buzzword today is ‘platform’ not ‘portal’ but the lessons from 2000 are still the same. The dot-com bust is well-worn, but the NASDAQ is at 12-year high and I’m starting to hear the exact same kind of rationales I did in the 2000s. Talk to a true-believer of Salesforce.com and you’ll be transported to the era when there was nothing hotter than ‘B2B’.

George Soros likes to quote Chuck Prince, the ousted Citibank CEO, and his infamous line “As long as the music is playing, you’ve got to get up and dance”.

Soros is talking about the behavior of Wall Street and policy makers, but you certainly don’t have to keep swaying to the music. And you can keep tango-ing with most of your portfolio, but it absolutely makes sense to have some downside protection in place before band starts to slow the tempo.

If there’s one point I want you to take-away it’s this:

I think the tech bubble is going to get much larger but no one, not me, not you, not the blaring voices on TV and certainly not the financial alchemists know where we are in the inflation/deflation cycle.

If we are in 1998 and the market has another 100% to run, great. If we are in 1996, even better. But I’m telling you that very, very few people thought the ride was coming to an end in 2000, and then all of a sudden, no one could see anything but doom.

So maybe Facebook will be worth the same as Google on its IPO day.

Or maybe we’ll look back and say that it was ‘obvious’ in April 2012 that we had reached a top because a company that wasn’t even public spent $1 billion to buy a digital photo effects company with 13 employees and zero revenue for twice the valuation it had just 3 days before.

You just cannot know if that shoe drops in the next year or 5 years from now. Or in August 2012.

I am not preaching negativity or pushing a directional bet, but by pure mechanics you are naturally ultra long. So you need to actively search for and put on short bets.

The market and the dealmakers involved can always come up with some kind of a justification for why a deal makes sense. During internet bubble 1.0 it was the invention of new metrics to justify valuations. While the market called ‘B’S on Groupon for inventing an accounting framework, it’s still an $8 billion dollar company. If this is 1997 we have three more years for tech stock valuations to ramp up based on clicks and Klout scores and impressions. But if we are already at 2000 then anything without a real revenue number could sink faster than Groupon’s IPO.

So here are 3 of the worst buyouts from dot-com boom 1.0 and the exact words used to justify some truly enormous numbers. Hindsight may be 20-20 but knowing that means your portfolio should be at least 90-10 (long-short) right now:

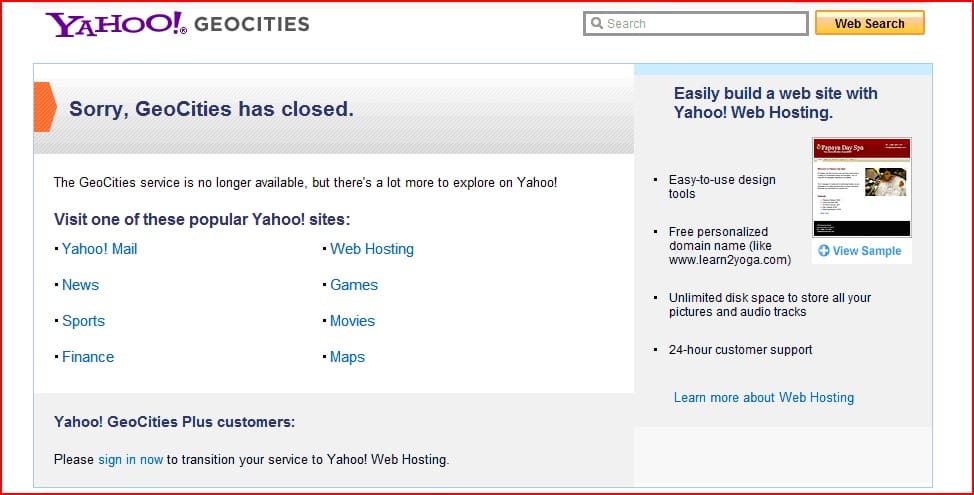

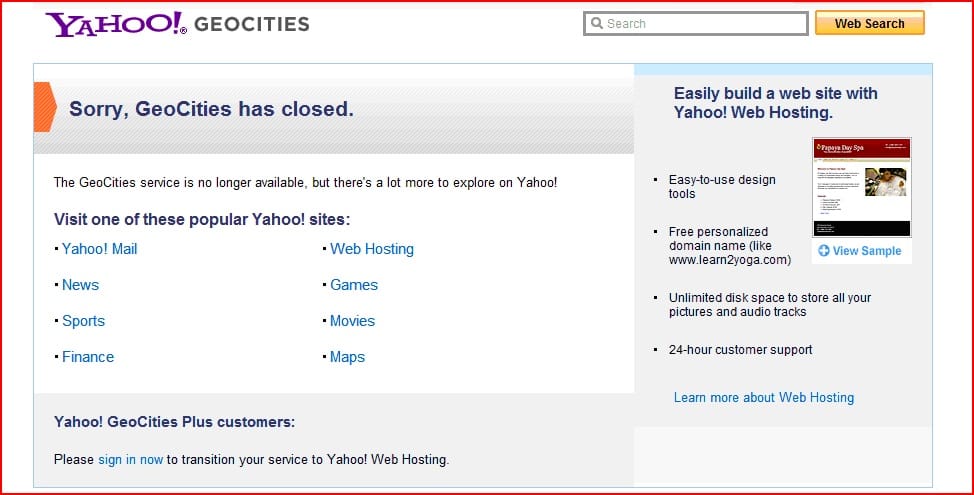

1. Yahoo buys Geocities (1999)

Yahoo’s always good to beat up so let’s start there. If you navigate to Geocities.com today you’ll get this awesome page:

Seems like a shame considering that Yahoo paid $3.7 billion (a 56% premium) for the personal website maker just two months before they got hungry again and gobbled up Broadcast.com. Yahoo waited till 2009 to pull the plug on Geocities, keeping only the Japanese site alive.

But there was a time when a ‘portal’ like Yahoo ‘needed’ to offer every service imaginable to sop up the world’s internet users before someone else did. Here’s what they said at the time:

While other major Internet players seem to be forming alliances with high-speed access companies, Yahoo moved to extend its reach as a pure Internet brand name.

“GeoCities has defined and popularized community on the Web,” Yahoo president Jeff Mallett said in an interview with CNET News.com. “And wow, as a bonus, it added, looking at December figures, an incremental 10 points of unduplicated reach to the Yahoo network. We’ll take that.”

“Part of our growth strategy will be organic growth,” said Mallett. “But we will also try to keep ourselves as one of the ‘big three’ branded companies with an acquisition strategy.”

Yahoo’s monstrous stock valuation is likely to help the company in its bid to acquire other firms.

“You bet,” said Mallett. “That’s one of the great things about [high valuation].”

Go back and read that last part one more time. Yahoo’s president was all but saying that Yahoo stock was overvalued and he’d use that overvalued currency to roll up assets. Tough to see what went wrong.

Here’s how stock should be used in an acquisition: as sparingly as possible, reserved for only the highest quality buyouts that you couldn’t get without offering an equity portion.

Here’s what Yahoo’s stock has done in the 14 years since the Geocities purchase:

Really ugly overall right? But just 11 months from the Geocities deal, Yahoo hit its all time high. Which was tust before it’s inexorable decline. Are you willing to bet whether the market is Yahoo in September 1999 or April 2000? You just cannot know so its better to have some kind of downside protection than to be a Yahoo employee in 2000 with all their money in company options.

2. JDS Uniphase buys SDL (2000)

If you thought Yahoo’s chart was ugly you might want to look away, this one might turn you to stone.

And yes, everyone who was alive and trading 12 years ago knows that optical equipment makers have never recovered their boom time share prices. But my point is one about the enthusiasm JDSU had for its $41 billion mega-merger with SDL just before the bottom fell out. Only a month after buying E-TEK Dynamics for $15 billion, JDSU’s flacks were in rarefo rm with the SDL press release. For some reason, it’s still on their corporate website:

Jozef Straus, JDS Uniphase Co-Chairman and CEO commented, “I am thrilled and excited about this merger and to have the opportunity to work closely together with Don Scifres and his team. JDS Uniphase and SDL share a common vision to provide customers with the most innovative and technologically advanced products that enhance their ability to deliver next-generation optical systems.”

Don Scifres, SDL Chairman, President and CEO added, “This combination brings together world class technical and manufacturing teams that promise to deliver best-in-class products at increased volumes for today’s systems while developing solutions for tomorrow. We also expect to enable the migration from today’s hybrid integration and module level products to tomorrow’s truly integrated system on a chip.”

I’ve been analyzing tech companies for most of my adult life and if you can tell me what that last highlighted part means I have a $20 bill with your name on it.

SDL had revenues of $300 million when JDSU bought it. Which means JDSU paid ~136x revenues. For comparison Facebook is likely coming public at a $150B market cap, which would be ~40x revenues. So if you agree the JDSU-SDL merger was absurd, but like Facebook for the long-term, the sweet spot of where you should bail out, or at least cut your bubble exposure, is somewhere in between. Again, you can’t know where that is, but you can know you’re trading habits and how easily you’ll get shaken out of a trade. Will you re-evaluate your Facebook stock daily, worrying about gyrations and the fact that Farmville is 12% of sales? I’d say it’s better to have some short exposure, effectively arbitrage your holding period, and let your bubble picks be.

3. @Home Corp buys Excite (1999)

If you’re too young to remember Excite this might not do anything but for the old-timers out there I know you can recall seeing this logo:

Even more exciting (ok, you knew it was coming) is this info graphic from a January 1999 article describing the implications of @Home Corp’s $6.7 billion deal for Excite:

I’ll let 99’ CNNfn (which is itself an erstwhile internet era company) explain what ‘Portal Partners’ means:

Web portals are becoming more important as companies strive to become the “first stop” for people online.

As the Web grows, users are faced with a baffling array of new Web page offerings. These Internet companies believe users will welcome a jump-off point with links, both old and new, to sites related to their individual tastes.

In addition, many portals hope to become centers for Internet commerce, a potentially lucrative enterprise as more people begin to shop online.

Portal companies with strong brand-name recognition like Excite have been in particular demand and George Bell, chief executive officer of Excite, said his firm had more suitors than he could count.

So the portals on the left would partner with content and distribution partners on the right, and they would disrupt commerce and advertising as we knew it.

Certainly @Home CEO Tom Jermoluk was excited (okay, last time) to expand his ISP into web portals. He remarked at the time:

“The synergies of the companies are terrific,” said Tom Jermoluk, CEO of @Home, in an interview with CNNfn. “I think shareholders will look at that together and say ‘one and one makes 10 here.'”

Got that? The Internet means new math. Shades of Groupon, a marketing company, ignoring marketing expense numbers.

Discussing the premium @Home was paying for Excite Mr. Jermoluk said:

“I think that’s a very reasonable number in terms of these deals. I think we got it for a fair price. There’s not that many people out there that have built a portal with 20 million-plus reach in terms of unique users. They’re a precious commodity.”

I bet he thought that was a reasonable price to pay; negotiating the deal triggered a $21 million dollar payout.

For a while everything seemed to be on schedule. Losses were widening but it was all part of the plan! By October revenues had doubled, daily page views were up 10% to 89 million, and there were 220K more subscribers. The combined company Excite@Home (see what they did there?) saw its stock jump 98%.

Two Octobers later Excite@Home filed for bankruptcy with $1 billion of debts. Its ISP business was bought by AT&T and the vaunted portal was kicked around for years before landing at Barry Diller’s IAC.

And Mr. Jermoluk? He parachuted out in 2000 to a partnership position at Kleiner Perkins. Then he built condos in Miami. Now he has a WordPress blog.

The big issue I want you to get is that the smartest people, paid the most money, inside these companies and looking the financials daily, kept doing dumb acquisitions and spending shareholder funds right up to the end. This isn’t a good government rant, it’s a good sense warning. I do believe some things are fundamentally different this time around. Companies take longer to go public. Revenues matter. And the deal sizes haven’t reached stratospheric levels. Yet.

But human nature is constant and at some point in the near future we’ll see huge multiple expansion and lots of deals that won’t make sense very soon after the fact. If I had to guess I’d say we’re two years out from that point. But it pays and makes sense to put on hedges that 2012 is 2001, not 1998.