The welfare and QE driven market

I’ve often talked about the concepts behind Revolution Investing and why we launched that newsletter in the first place in early 2010. Much of it centers around the idea that the government’s actions, forces and policies are now the biggest drivers of the stock market and (eventually) the broader economy — and not in a good way.

Here’s a quote for the very first Revolution Investing newsletter.

“We call this newsletter ‘Revolution Investing with Cody Willard’ to answer the trillion dollar corporate welfare programs and the new bills for health care and financial regulatory agencies. The new rules in this country that override the economic paradigm we’ve been living under since the 1930s have been ramped up by several orders of magnitude — in just the last two years.”

I’ve talked repeatedly about how we need to expose our capital into the stock markets so that we could be in a position to profit from “the effect of all these new welfare programs for corporate America being a lot more earnings in the near-term than most analysts are expecting.”

We were indeed positioning for all of this long before most every other investor and analyst saw these realities. Remember QE “1,” for example? I mean, what number of QE are we on now? 77? 98? Infinity?

“The stock market’s been in rock-you-steady rally mode for many weeks and also for many quarters since the Fed started its first round of huge quantitative easing (QE1) and the government went on its fourth major stimulus package of the last three years under both Administrations. And what is the Fed doing now and what impact will it have on the markets next year? Well, they’re juicing the money supply with another $600 billion in cash for the economy … So what should we do? Be prepared for another bubble, that’s what. Or several asset bubbles, to be exact.”

You see, the policies of the Federal Reserve and the Republican/Democrat regime have been and continue to move our markets and our economy right in front of our faces:

“All that government help is indeed very likely to help its targets: the same corporations whose profit margins we’re discussing right here right now. I think it’s incumbent upon all of us as patriots to fight this trend of endless corporate-welfare programs with our votes, but as investors, we need to profit from it. That means betting on corporate margins’ continued expansion.”

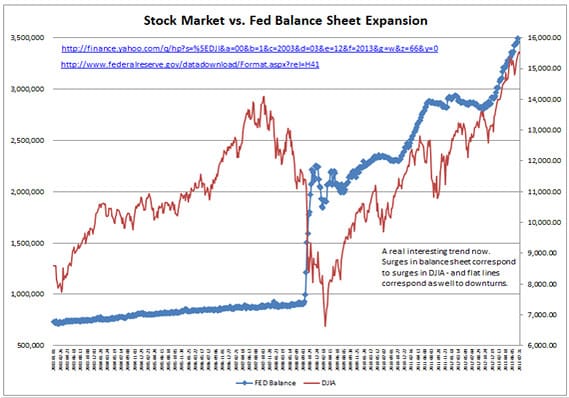

So let’s fast forward (to steal a term from the days when cassettes ruled the world) to today again. I have a chart I want to show you that underscores just how dramatically dead-on all that above analysis has turned out to be.

Source: Fed, Yahoo!, The Burning Platform, Willard Media Ventures

Source: Fed, Yahoo!, The Burning Platform, Willard Media Ventures

What that chart shows us is that since 2010, the government’s intervention and coddling of corporate America has had a direct, measurable, clear and present effect on the stock market — Just as I said would happen.

So where are we now?

The Federales are promising to “taper” their balance sheet expansion and the Republican/Democrat regime is about to start pretending to fight over October’s “debt ceiling” which will likely result in some near-term panics. But I expect we’re going to see yet more of the same from these political/governmental forces that remain fully in charge of where the markets and economy are headed for now.

Remember though, that at some point, the natural forces of the markets and the economy and society and individual choice will come back in a vengeance to rebalance all this horrific imbalance we have to deal with as Revolution Investors in the early 21st century.