This Ain't Your Grandfather's Bubble

Although this bubble might not make sense at first glance, we think there is a relatively simple explanation for what is happening: the appetite for risk has gone up dramatically.

Robert Oppenheimer to Student: "What do you know about quantum mechanics?"

Student: "I have a grasp on the basics."

Oppenheimer: "You're doing it wrong. Is light made up of particles or waves? Quantum mechanics says it's both. How can it be both?"

Student: "It can't."

Oppenheimer: "It can't, but it is. It's paradoxical and yet it works."

-- From Oppenheimer (2023).

We're living through one of the most interesting, and perhaps even paradoxical markets in recent memory. Much of the common knowledge and prevailing wisdom that has guided investors and held true for most stock market cycles in living memory isn't working. Although this bubble might not make sense at first glance, we think there is a relatively simple explanation for what is happening: the appetite for risk has gone up dramatically.

Let's start with the economic backdrop. Early in 2022, the Fed started raising interest rates to combat the worst inflation the US has seen in fifty years. Notably, this dramatic rise in interest rates in such a short time (500 basis points in about 16 months) came after the longest period of near 0% interest rates in history (essentially 15 years of 0% rates following the 2008 financial crisis). According to every economics textbook ever written, such a rapid and significant interest rate shock should have caused a recession and falling asset prices.

But it didn't. In fact, economic growth continued at a steady pace, employment held steady, and asset prices rose significantly starting in 2023. How could we have rapidly rising rates and rising stock prices? "It's paradoxical and yet it works" as Oppenheimer would say.

Another sort of paradox we've seen is the massive divergence amongst the performance of stocks within the market, even though the indices are at or near all-time highs.

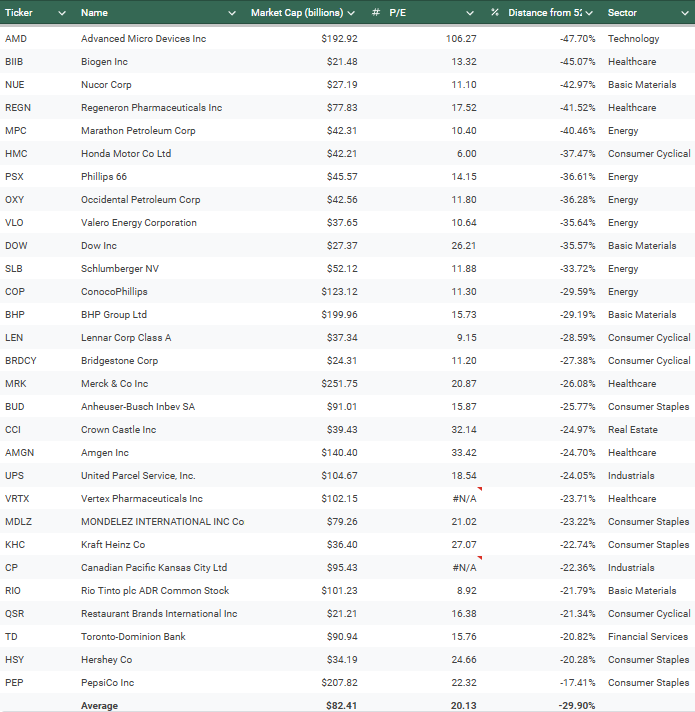

To illustrate this point, I ran a screen on stocks that hit new 52-week lows yesterday:

As you can see, the pain is severe for many of these large cap, what many would consider "blue chip," names. Moreover, nearly every sector is represented here, with technology being mostly absent except for AMD (which had a heck of great year until everyone realized how hard it was going to be for AMD to catch NVDA).

What's surprising looking at this list of names is that many of these are generally considered good barometers of how the US economy is doing. UPS, for example, is closely tracked as an indicator of how e-commerce is doing, and e-commerce is probably the best indicator of the health of the consumer. We also have staples like Hershey, Pepsi, Kraft Heinz, Mondelez, and Anheuser-Busch performing very poorly, while again, the consumer is supposedly doing just fine. The energy business is also in a slump, with names across the supply chain (from producers to service companies to refiners) all putting in 52-week lows.

So how are all of these blue chip, mainstream, economic-bellwether companies at 52-week lows while the indices – which also supposedly represent the economy – are at all-time highs? Once again, "it's paradoxical and yet it works."

What's ironic is that most of the companies in the list above which are hitting 52-week lows are profitable (27 out of the 29 listed), and they have an average P/E of 20 on a trailing-twelve-month (TTM) basis. This is about 50% less than that of the S&P 500 with its TTM P/E ratio of 30.

While the market is willing to sell those blue chip names at a 50% discount to the market, it continues to find the most ridiculous, overhyped, and overvalued names to bid higher. Here are some of the best performers in the American stock market over the last four weeks:

Obviously, this list is made up of nearly entirely of unprofitable, speculative, small-cap tech stocks. Note that only one company on this list (Himax) has any earnings over the last twelve months. The vast majority of these stocks are "story" or "theme" stocks – where investors are betting on an idea like quantum computing (QMCO, RGTI, QBTS, QUBT), artificial intelligence (HSAI, SOUN, CRDO, NVTS), space (DXYZ), flying cars (ACHR), robotics (SERV), and crypto (BTDR) – while generally throwing fundamentals to the wind.

Why would investors pay billions of dollars in market cap for companies with no revenue, no earnings, no assets, and shoddy management, and yet give away blue chips? It's paradoxical but it works.

As a final mention of the upside-down world that we live in, consider crypto. As we mentioned in our deep dive published on December 3rd, the speculative craziness in the crypto community has reached new heights. Tens of thousands of new meme coins are printed every day out of thin air, and ordinary people are losing millions to scammers, fraudsters, and criminals on sites like pump.fun. Several new memecoins like Pudgy Penguins (PENGU) go viral every day, while many other memecoins never make the headlines. But whether a memecoin achieves temporary success or not, the end result is always the same (PENGU is already down 65% from its high, on its way to being down 99% at some point we can say assuredly).

So the bubble we are living in is clearly not as widespread as some of the bubbles of the past (think 2000, 2007, or 2021) where every single asset and every stock was at or near all-time highs in tandem with the indices.

But does the fact that we see this divergence mean we are actually living in some sort of paradox? Interestingly, a paradox is defined as (according to Google) "a seemingly absurd or self-contradictory statement or proposition that when investigated or explained may prove to be well founded or true."

When we start investigating the dynamics of this bubble, we think there may be a somewhat simple explanation for what is happening. To put it plainly, we think what we have witnessed is simply a sharp rise is the appetite for risk.

When we look under the hood, what's powered the indices and this bubble in the most speculative assets is the steady and strong performance of large-cap tech stocks (most of which we have owned for many years like TSLA, NVDA, GOOG, AAPL, AMZN, IBIT, META, etc.). Below is a list of large-cap stocks that hit new 52-week highs this week (I didn't use today's list as there weren't many new 52-week highs today following Wednesday's big selloff):

Clearly, tech – especially megacap tech – has dominated the markets once more this year. Basically, 2/3 of the new 52-week highs hit this week by the largest companies by market cap were tech stocks (by the way, I reclassify stocks like Tesla and Robinhood as members of the "technology" sector even though technically they are considered "consumer discretionary" and "financial," respectively). These high flyers are up an average of 70% from their 52-week lows and are trading at an average TTM P/E of 47 (amongst those that have an "E"), which is a 56% premium to the market multiple.

As the biggest tech names continue to drive big performance, it drives up the market's attitude for risky assets. This phenomenon occurs when investors seek to invest in the riskiest of assets, because they view those assets as having the highest probability of generating the highest returns (after witnessing what's happened with other tech stocks like those mentioned above).

In conjunction with seeking the highest returns, investors also feel confident that their bets on those risky assets will actually work out because they have seen risk assets (like megacap tech stocks) continue to work for a prolonged period of time. In some ways, to many onlookers, it looks like the assets that are traditionally seen as "risky" have become "safe" as demonstrated by their strong outperformance of traditional safe assets like cash, bonds, and low-P/E stocks.

This rush to risk (opposite of the traditional "flight to safety" we see in bear markets (remember we always flip it!)), is almost entirely the result of the performance of megacap tech. It's caused people to blindly buy up unprofitable stocks and worthless crypto, or sometimes even stocks with no revenue, not because they believe in the fundamentals of those companies or tokens, but because they want risk, they need risk. In markets like this, the more risk, the better the performance (at least for a time). Tech stocks are generally viewed as more risky than staples or utilities, so people decide to buy other risky stocks and assets hoping they will go up as well.

Notably, as the market's appetite for risk goes up, its appetite for low-risk assets actually goes down. It's not like both risky and relatively safe stocks both perform well in this type of a bubble. There is only so much capital to go around, and people literally sell their Kraft Heinz, UPS, or Phillips 66 stock to buy profitless quantum computing stocks and the like.

I was in Las Vegas recently, and perhaps a gambling analogy will illustrate shifting risk appetites best. A craps table presents many odds, from even money (e.g. the "Pass Line") to 30:1 (e.g. snake eyes (which is two ones)). At the beginning of a player's roll, most of the other players at the table will be fairly conservative. Many will bet the pass line (or perhaps "don't pass"), but there generally won't be too much money scattered on the table right at the outset of a new roller. Once the player rolls and a number is "on," you'll start to see the chips being placed across the board. If the player gets lucky and doesn't "crap out" (i.e. roll a 7) after a few rolls of the dice, the chips really start flying. Every time the table sees the player roll and he/she doesn't crap out, that gets them feeling good about their luck. If you've been to a casino, you've probably seen massive crowds around craps tables with everyone cheering and high-fiving because a player has "hot hands" and is "on a roll."

So what do the other players eventually do? No one wants to be the guy sitting there with a table-minimum bet on the damn pass line when you've got a hot shooter. Pretty soon, everybody starts craving risk. They want to bet snake eyes (two ones), they want to bet on boxcars (two sixes), or they'll start betting "The Field." If those bets hit, they'll often "let it ride," because they want more and more money at risk since the roller has hot hands.

But, eventually we all know that the streak will end and the player will crap out. When that happens, essentially all of the money on the table gets wiped (with a couple of exceptions). A new shooter comes along, and everyone will usually be a little more cautious to bet this time around.

The stock market is in one of those places where we've got a shooter with hot hands. In this analogy, the Magnificent 10 – as we now call them (we include TSM, Broadcom, and bitcoin nowadays) – are our shooters. And these shooters didn't just pick up the dice yesterday, they've been rolling without crapping out for basically two years now, driving massive returns for investors and generating trillions in market cap.

For many investors who were on the sidelines or perhaps even made a little money in the markets over the last couple of years, they are looking for new ways to risk their money to try and benefit from these hot shooters. Many people sold their tech stocks in 2022 when the Nasdaq was down 33% and stocks like Tesla and Meta were down as much as 75% in the year. Now that those stocks have strongly outperformed for two years, those same people that sold are feeling the FOMO.

Nevertheless, it is important to remember that the Mag 10 (and many other tech stocks) have actually seen rapidly improving fundamentals since the 2022 bear market (Meta's EPS was up 76% in 2023 and up another 44% over the last twelve months). The AI Revolution is real and it has powered the extremely strong performance of the true AI companies like most of those in the Mag 10. That's why we will remain invested in our Revolutionary portfolio despite our almost-bearish outlook on much of the broader market.

But if other investors missed on out on investing in the Mag 10 over the last two years, where do they turn now? They buy memecoins, unprofitable startup tech stocks, "theme" stocks, and sometimes even companies bound for bankruptcy. They sure as heck don't want to own boring old Phillips 66, UPS, or Kraft Heinz. That's like only betting the pass line when you have a hot shooter.

We've seen this type of speculative fervor before, and we'll surely see it again. We don't know that this is the top, and the Mag 10 could still have many rolls in them before they ever crap out. The thing is though, that eventually it will happen (meaning we'll get some type of pullback that washes out the worst companies), and you don't want to be the one standing there with your entire bankroll on snake eyes (like unprofitable high flyers or memecoins) when that 7 finally hits the table and your heart sinks as the dealer slowly pulls all of your beautiful chips that you worked so hard for to his side of the table, and adds them to the house's already massive stack.

We're not predicting some type of market-wide mega crash or anything. And we're going to continue betting on our favorite longs which continue to perform well. But consider this a warning that we are not interested in messing with almost all of these speculative high-flyers of late. In fact, we have been shorting some of those names in addition to our crypto shorts that we mentioned last month.

This bubble actually isn't a paradox, even though its different than the ones we've seen in the past. And to be clear, it could get more extreme before it eventually unwinds. For that reason, we never make too big of moves, and we never bet it all on one roll of the dice. Steady as she goes.