This position will end up being much too big in relation…

Stepping up and getting aggressive into the teeth of a steady decline late last week was, as I wrote at the time, “scary” and “very hard” to do. Remember how it felt back then:

Okay, I’m stepping up and buying and I’m getting more aggressive about my approach this time. Specifically, I have stepped up this afternoon and have bought some Riverbed calls and some Cisco calls. I know it’s scary out there right now and it’s very hard to pull the trigger on purchases. Especially to step up right now when these stocks have been beaten down as badly as they have been and it seems like they won’t ever come back to life again. I’m not drawing a line in the sand, but I did buy calls and not common both of these names and I did buy mostly slightly-out-of-the-money calls that will expire in six months’ time rather than eighteen or twenty-four months’ time. That is, I bought Riverbed January 2012 calls with strike prices between $35 and $40. And I bought Cisco January 2012 calls with strike prices up to $17.50. Both of these purchases today are very high risk/high reward because of the closer expiration dates and the higher strike prices, but they give me lots of leverage and I used just a tiny bit of capital to get what could be very big upside if the world’s economies and the stocks that reflect don’t collapse in front of our faces.

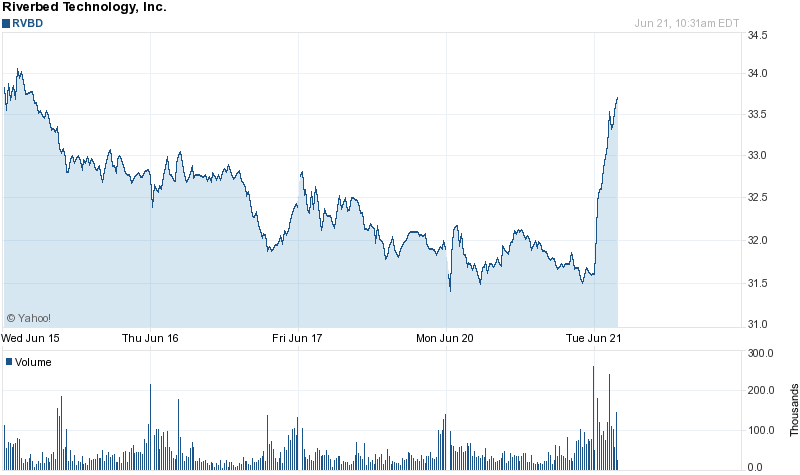

As outlined in the next post, that made Riverbed my largest position. And today, Riverbed gets a big relief rally. With no Rivebed or industry news to drive today’s pop, take a look at what a “big relief rally” looks like:

We’ve now got some big gains in Riverbed once again, as those calls from last week, being slightly-out-of-the-money and now being closer-to-in-the-money along with being dated only a few months out all of which makes them more risky than other kinds of calls we could have bought here, in particular have popped today. This position will end up being much too big in relation to the overall portfolio because of the outsized leverage on any upside from here in the approach I’ve taken, so I’ll be looking at how best to trim down this position if it does find legs and can rally further in coming days and weeks. We’ll see (and as Andrew Lanyi, my first boss on Wall Street would say, “knock on wood”).

Huge gains in the portfolio early today (“knock on wood” again) and after having stepped up the buying aggression last week and yesterday, I’m not making any trades yet today.