Throughout this week, I’ll be highlighting these and other charts and outlining the best trades setting up right now for us…

By the look in your eyes you’d think that it was a surprise, But you seem to forget something somebody said, About the bubbles in the sea, and an ocean full of trees. — Neil Young

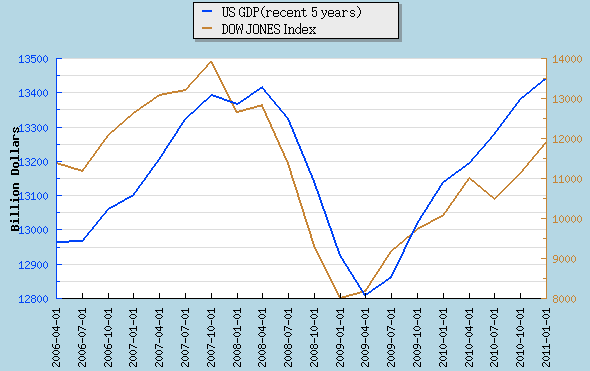

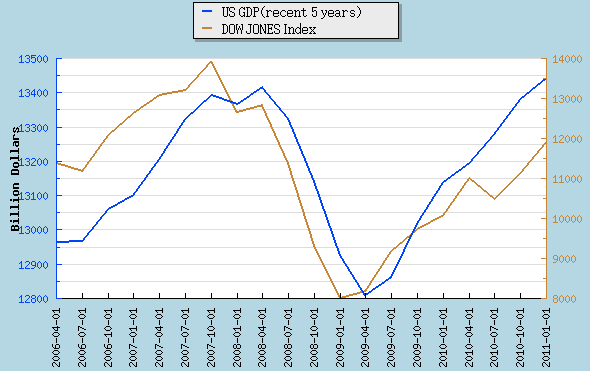

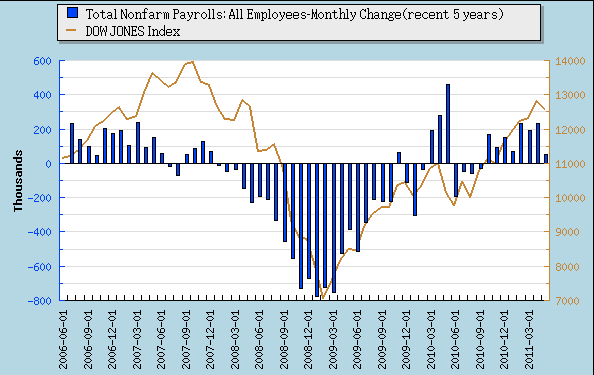

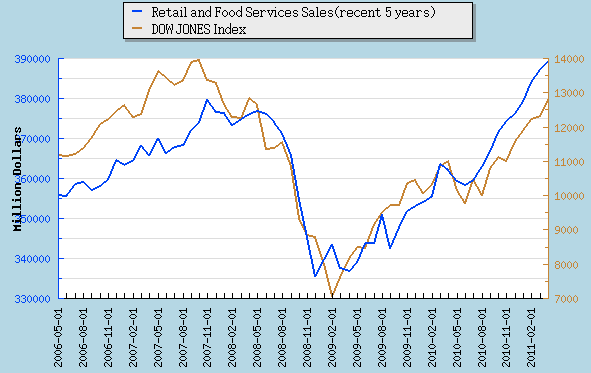

Let’s run through some economic charts my all-star team of research associates put together for us and see how they inform our analysis, theses and positioning. Below we look at the major macroeconomic trends of the last handful of years and layer each one on top of the stock market. First thing you’ll notice is how remarkably correlated the macroeconomic trends are with the stock market.

First off, look at the mirrored charts of recent US GDP and the DJIA:

Source: CL Willard Capital Management, Marketwatch, Yahoo Finance and the US Bureau of Economic Analysis

Next, how about the clear parallels between the labor market that has clearly turned higher but still not creating enough jobs in this nation. Those jobs being funded with new public money at LinkedIn and with huge growth at Apple and its new spaceship headquarters add up to help counter the continued shrinkage in the financial sector such as at Citi and BofA:

Source: CL Willard Capital Management, Marketwatch, Yahoo Finance and the US Dept of Labor

And if you thought those charts were uncannily correlated, how about this one, a picture of retail sales activity and the broader stock market over the last few years. The Gap, Staples and Home Depot marketplaces are in rebound mode:

Source: CL Willard Capital Management, Marketwatch, Yahoo Finance and the US Dept of Commerce

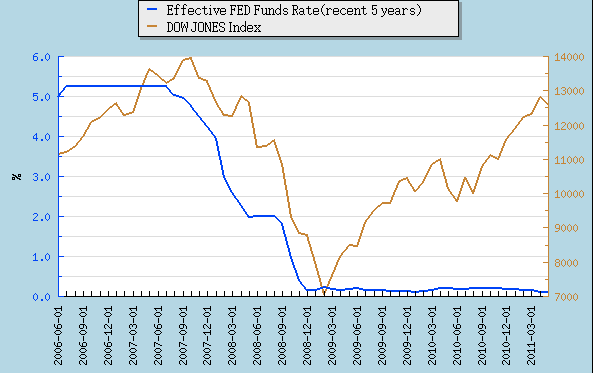

Finally take a look at this chart and you can see that the Fed’s far behind all these charts with their still unprecedented easy monetary policies. Put simply — this following chart is how bubbles get blown and it’s a large part of why I’m betting so big on a coming bigger-than-ever tech stock bubble:

Source: CL Willard Capital Management, Marketwatch, Yahoo Finance and the Fed Reserve

Like I’ve been saying for a while now, I’m fully expecting to see a huge new tech stock bubble that I will call the “echo tech-o bubble” and we’re right now about 20-30% of how big it will eventually be before this monetary and stock market cycle turn. Throughout this week on TradingWithCody.com, I’ll be highlighting these and other charts and outlining the best trading opportunities setting up right now for us.

Don’t forget about what somebody said about bubbles in the sea and an ocean full of trees.

At time of publication, Willard, author of Revolution Investing and Trading With Cody, was net long Apple though positions can change at any time. None of the information in this column constitutes a recommendation by Willard of any particular security or trading strategy is suitable for any specific person.