Two more ways to invest in Facebook before the IPO

Last month I told you Six ways to invest in Facebook before the IPO. Now we’re a month closer and about a week out from that holy day. A company founded in a dorm room less than a decade ago is about to be the biggest American company to ever go public ; UPS went public in 1999 with a $60.2 billion valuation, Facebook looks like it will price just under $100 billion. (Also: Go America, anyone who thinks the dream is dead should read this).

As I told my TradingWithCody.com subscribers I’m surprised Facebook isn’t (at least yet) going aggressive with the price and I’d be a buyer not a seller (or shorter) of Facebook in the $30s. We’re probably a year away from Facebook being a great short but when rich people are forming a line out the door at the Four Seasons for cold danish and the glimmer of a 27-year old CEO, my spidey senses go off.

Before we get to the names I want you the read what my friend James Altucher wrote last December Techcrunch about arranging Facebook sales on the private market. This is the stuff the companies I’m highlighting had to do just to be friends with Zuck & Co:

Facebook shareholders suck. I know this because this past week I tried to help someone sell about 30 million shares of Facebook for $31 a share. These are weird transactions because never before in history has a private company so large ($80 billion in value) had so many random people buying and selling shares of it.

On the one side are these semi-mythical demigods called “co-founders” who hit the jackpot. On the other side are literally kings of some ancient lost kingdoms in Asia that suddenly want to own tens of millions of shares of Facebook before the IPO. In the middle are enough people to fill a small country. There are at least three lawyers (buyer lawyer, seller lawyer, random middle lawyer that keeps popping up and you never know his name but he’s there somehow and nobody knows why). You have 1-3 broker dealers for the buyer, 1-3 for the seller. (See also, “Why Facebook is Worth $100 billion”)

Then you have to figure out a spread. So the seller has to agree to $30, the buyer $31, and the dollar in the middle is split 15 ways. Its 30 million shares so that’s $30 million in the middle and everyone feels this is the transaction of a lifetime and they need to get a piece. And then, all of a sudden, the secretary of the mistress of the random king wants to get at least half of the spread in the middle or will block the whole thing. So everyone needs to get on the phone again. At 11 pm at night on a Saturday. And hagggle out fees.

I introduced the buyer and the seller as a favor but I have no other involvement. But through the course of this I became an expert on everything you can possibly know about Facebook shares. All the prior transactions. Which shares are “Rofer” (i.e. “right of first refusal” for those not in the “Facebook share biz”), which shares are locked up, have they been already sold and resold, we need to see POF (“proof of funds”), we need to see “Proof of shares” (nobody says “POS”, nobody even jokes like that).

Everybody’s already been screwed once, twice, three times, sold, by people who claim to have shares or funds but don’t. They just want to be in the middle (“we’ll find the shares later,” “we’ll find the cash later”). There’s a king somewhere on his toilet thinking about the 1% of Facebook he will soon own. There’s a demigod in San Francisco or Colorado or also in Asia dreaming about all the cash he will be covered with in his gold-plated jacuzzi.

But nobody will move on price. The sellers think Facebook is going to $100 (so why are they selling?). The buyers think “we have all the cash” and won’t budge. And everyone in the middle cries themselves to sleep because they are dreaming of either new houses for all of their grandkids or they assume the deal is off forever. But then new buyers show up and the old buyers disappear. And new sellers show up and the old sellers are gone. And the ongoing conversation continues but nobody knows who is real. Nobody is real. Someone is real. I need proof of funds. Well, I need proof of shares. They’re in escrow. Series A has the same restrictions as Series B. No they don’t.

And then: Can you also introduce me to Mark Zuckerberg?

Hilarious stuff and I hope you’re getting the sense of just how big the Bubble is about to get Before that happens here are two more ways to get Facebook exposure before the wealthy dentists do. And this should be obvious but I’m not recommending either one of these, just telling you who has stuffed their balance sheet with Facebook stock.

1. Hercules Technology Growth Capital Inc (NYSE:HTGC)

One of the strangest birds out there Hercules Technology Growth Capital is functionally a publicly traded middle-market lender with VC equity stakes. Looks like they have a few decent tech exits under their belt, like Sling Media and odd non-tech ones like Annie’s (Disclosure: long Annie’s Homegrown Organic Shells & White Cheddar).

They’ve had three other small-cap exits of late (Cempra, Merrimack Pharamaceuticals and Enphase Energy Inc) with 20.1% of their portfolio in biotech companies. They own stakes in a bunch of tech names I know & like (Box.net, Trulia) and plenty more I’ve never heard of (RichRelevance, TaDa Innovations & defunct ones like TeleFlip).

Publicly traded specialty finance companies are typically dogs (see: KKR Financial Holdings LLC) and we’re only talking about this because of Facebook. In February they closed on 307,500 shares of FB at an average price of $31.08 for a grand total of $9.6 million. I have friends with more than that in their E-trade accounts and it’s only ~1.7% of HTGC’s total market cap but I still think it could pop the stock. And at some point this thing will be great short. For now it has decent liquidity from secondary offerings, some earnings, and as CEO Manuel Henriquez put it, a couple shares of the Boardwalk of Monopoly Money stocks.

2. Firsthand Technology Value Fund Inc (NASDAQ:SVVC)

First Hand Technology Value Fund is pretty easy to understand. Just like GSV Capital Corp they own equity stakes in other companies, they don’t make any widgets or widgets apps themselves. They recently picked up 100K shares of Twitter for $1.8 million. They own 88,841 of Gilt and 125,000 shares of Yelp. And they own 600,000 class B shares of Facebook, around ~12% of assets.

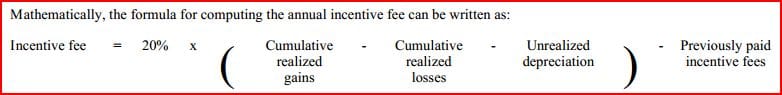

On December 31st 2011 they had 50K Facebook shares and they did 5 separate buys to get to more than 10x that number. The last two earlier this year were at a cost basis of ~$31 (don’t know if that includes the $2500 Facebook transfer agent fee) so it’s not like they are sitting on huge unrealized gains. And management charges hedge fund-level fees. Here’s how they break down their incentive pay (plus their 2% base fee):

So that’s 2-and-20. But since it’s such a tiny company Facebook is around 12% of assets. If you’re just pining for FB exposure, or looking for a quick trade, this one might take off when Facebook inevitably raises it’s IPO range.