Web Bubble 1.0 Stocks: Bluefly

Last week I named some Web Bubble 1.0 stocks and why I’m watching them. Today I want to talk about Bluefly and why I think it could catch a Bubble Bid. Let’s me be clear again: I’m not advocating you get long this or any other of the Web Bubble 1.0 names. I’m using them as indicators to tell me what inning of the bubble game we are in. If any of these falling darlings get scooped up or can change the narrative and get hot again, you’ll know we’re closer to the pop.

If you don’t know Bluefly don’t worry, it’s an ultra microcap at ~$48M. But from 1998-2000 it was worth ~$3 billion (with a b, that’s not a typo). Check out this chart:

After the stock went in to free fall mode, and after some kind of involvement by George Soros and Peter Lynch, Bluefly got stuck in the permanently depressed levels it’s at today. So why am I even talking about Bluefly? Because they’ve started knocking off some of the most innovative and disruptive Web 2.0 companies, and if that ultra transparent gambit works, we are in ultra bubblicious territory.

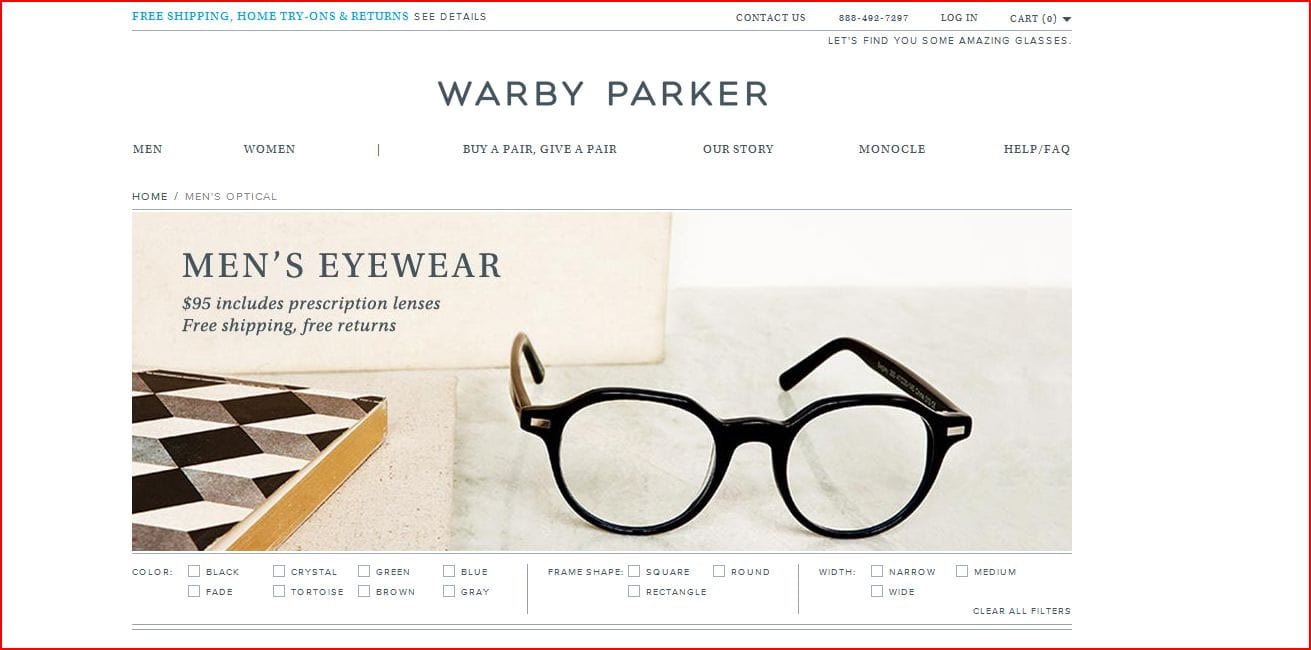

Warby Parker has taken the prescription eyeglass industry by storm, offering direct-to-consumer frames+lenses (and a pair donated to charity) for $95. These are stylish frames at a fraction of what the Luxottica mafia charges, and WP has raised money at a $100M valuation. Here’s a screenshot of the site:

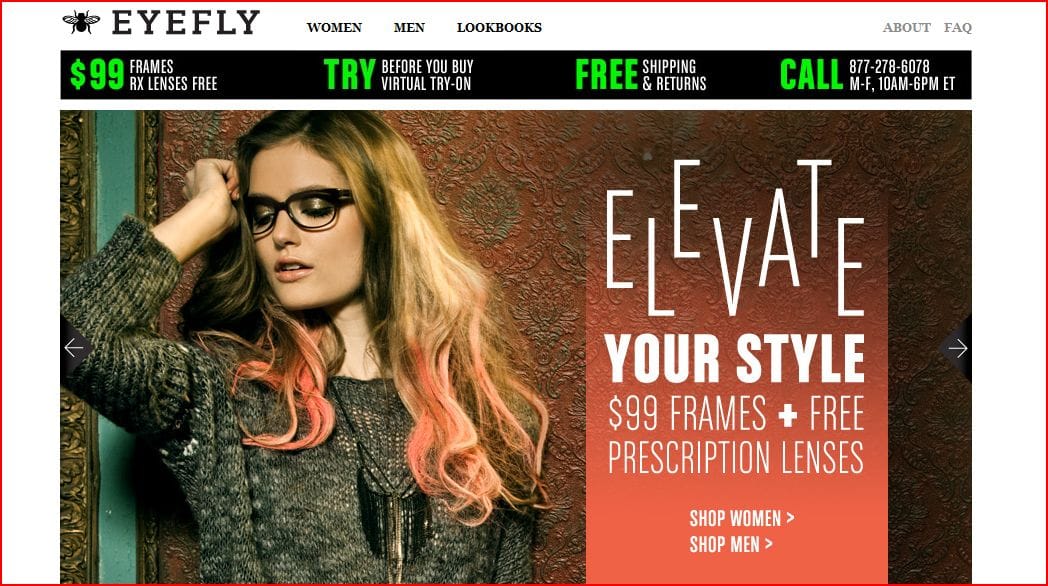

So Bluefly knocked it off the concept and called it Eyefly. Here’s that site:

Right now they own 52% of Eyefly and some prescription lab owns the rest. If you want to decipher the shady particulars of that it’s on page F6 of the 10k. But the knockoff site that I think could get them some real attention is Bell & Clive, their attempt at flash sales.

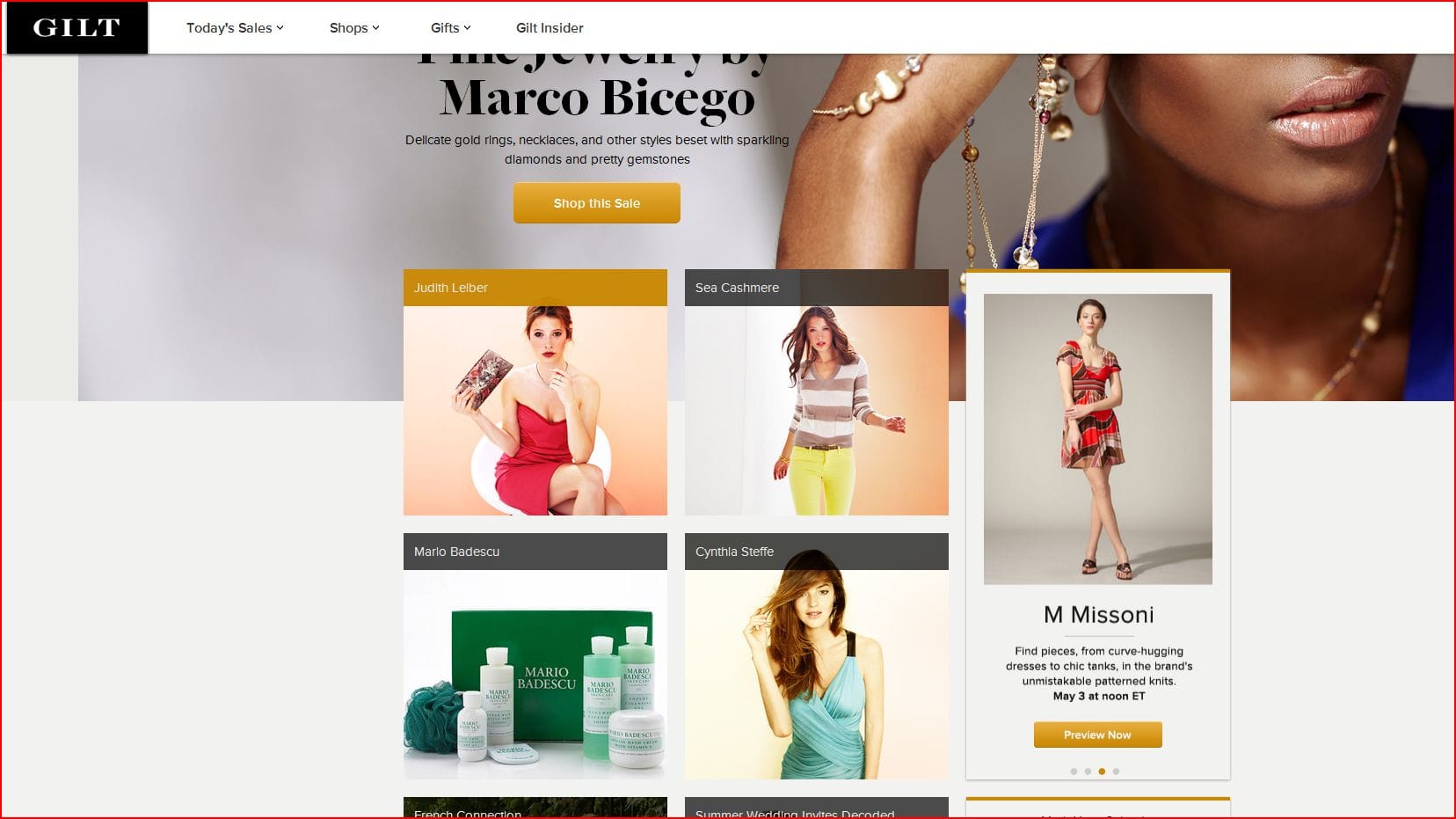

The biggest flash sale pioneers, Ventee Privee and Gilt, are private but have multibillion dollar valuations (depending which day you checking SecondMarket or Sharespost of Liquidnet). Nordstorm just spent $180M to buy a flash sale site. For those of you lucky enough to have never accompanied a girlfriend to a New York City sample sale, Gilt brings that experience to you digitally, minus the hair pulling (I’ve seen some things). Here’s what you’d see on a typical visit to Gilt:

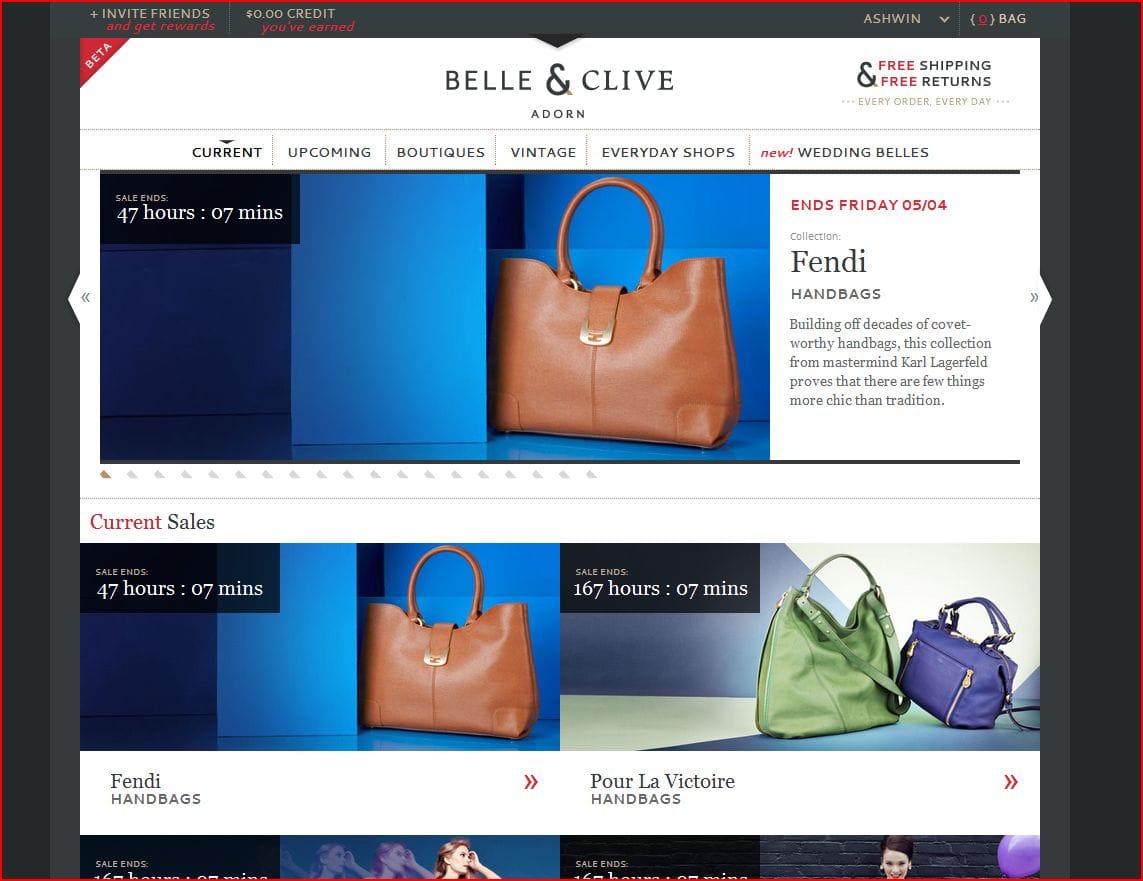

And here’s Bluefly’s knockoff:

Same concept, the sale is time limited to spur demand and impulse buys. I don’t know if Bluefly can make this work but they do have relationships with designers like Christian Louboutin that have been hesitant to sell on sites like Amazon’s Zappos. And right now Bell & Clive is selling Fendi, Prada, Zegna, Gucci and Bottega Venetta.

So maybe that works and the stock gets bid up if they pitch themselves as a Neiman Marcus level flash sale site. Maybe they get a bid 1/12h the size of Gilt, which would be double where they are today. I don’t know and I’m not buying the stock. What I do know is that if that line of reasoning plays out, I’ll be cutting my exposure to the bubble, not adding.