Venezuela, CES 2026, The Space Space, Memory Mania, and Much More

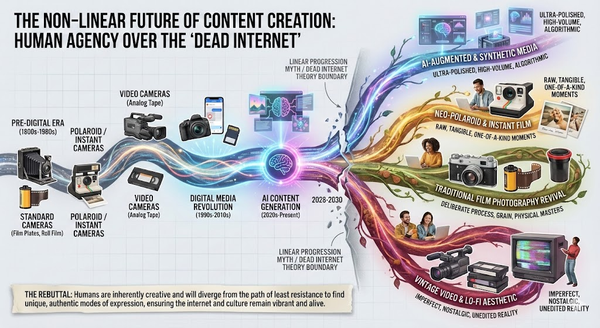

Meta and the Future of Content

Our 2026 Predictions

A Cautious Note On The Non-AI Bubble

Datacenter Jitters, Burry's Bear Bashes, SpaceX IPO, and Much More

Vegas Thoughts (Not Sure They're Deep lol)

2026 Predictions, SpaceX IPO, US vs. China, Tesla FSD and Much More

SpaceX Might IPO at $1.5 Trillion. Rock on.

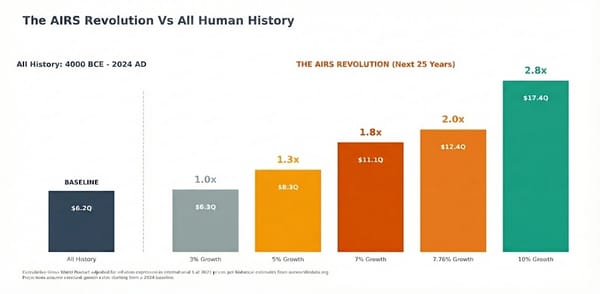

I keep telling you that there's never been a better time or place to be a Revolution Investor than right here, right now.

MUST READ: Humanity’s Next 25 Years Will Dwarf All History

Fight the Fed, Quantum vs Crypto, GOOG Outlook, SpaceX, and Much More

Elon Is A Revolution Investor (And We're Still So Early With AI)